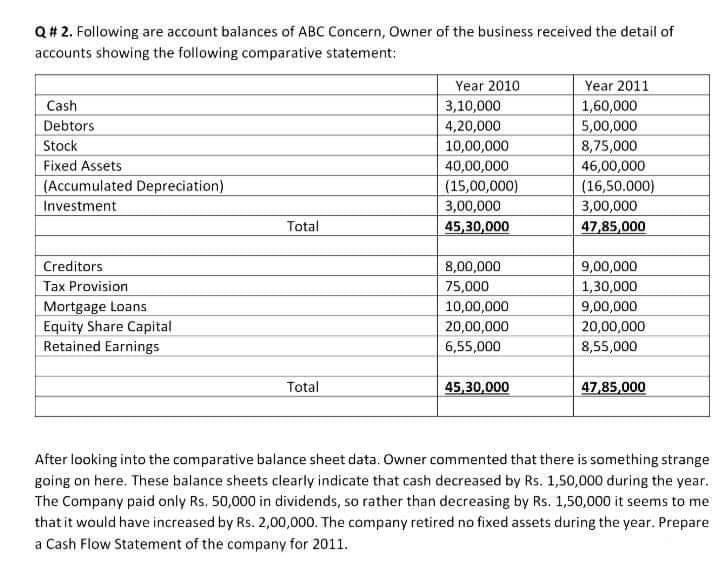

Q# 2. Following are account balances of ABC Concern, Owner of the business received the detail of accounts showing the following comparative statement: Year 2010 3,10,000 Year 2011 1,60,000 5,00,000 Cash Debtors 4,20,000 Stock 10,00,000 40,00,000 (15,00,000) 3,00,000 8,75,000 Fixed Assets (Accumulated Depreciation) 46,00,000 (16,50.000) Investment 3,00,000 Total 45,30,000 47,85,000 8,00,000 75,000 10,00,000 20,00,000 Creditors 9,00,000 1,30,000 9,00,000 Tax Provision Mortgage Loans Equity Share Capital Retained Earnings 20,00,000 6,55,000 8,55,000 Total 45,30,000 47,85,000 After looking into the comparative balance sheet data. Owner commented that there is something strange going on here. These balance sheets clearly indicate that cash decreased by Rs. 1,50,000 during the year. The Company paid only Rs. 50,000 in dividends, so rather than decreasing by Rs. 1,50,000 it seems to me that it would have increased by Rs. 2,00,000. The company retired no fixed assets during the year. Prepare a Cash Flow Statement of the company for 2011.

Q# 2. Following are account balances of ABC Concern, Owner of the business received the detail of accounts showing the following comparative statement: Year 2010 3,10,000 Year 2011 1,60,000 5,00,000 Cash Debtors 4,20,000 Stock 10,00,000 40,00,000 (15,00,000) 3,00,000 8,75,000 Fixed Assets (Accumulated Depreciation) 46,00,000 (16,50.000) Investment 3,00,000 Total 45,30,000 47,85,000 8,00,000 75,000 10,00,000 20,00,000 Creditors 9,00,000 1,30,000 9,00,000 Tax Provision Mortgage Loans Equity Share Capital Retained Earnings 20,00,000 6,55,000 8,55,000 Total 45,30,000 47,85,000 After looking into the comparative balance sheet data. Owner commented that there is something strange going on here. These balance sheets clearly indicate that cash decreased by Rs. 1,50,000 during the year. The Company paid only Rs. 50,000 in dividends, so rather than decreasing by Rs. 1,50,000 it seems to me that it would have increased by Rs. 2,00,000. The company retired no fixed assets during the year. Prepare a Cash Flow Statement of the company for 2011.

Survey of Accounting (Accounting I)

8th Edition

ISBN:9781305961883

Author:Carl Warren

Publisher:Carl Warren

Chapter3: Basic Accounting Systems: Accrual Basis

Section: Chapter Questions

Problem 3.23E: Adjustment for depreciation The estimated amount of depredation on equipment for the current year is...

Related questions

Topic Video

Question

Transcribed Image Text:Q# 2. Following are account balances of ABC Concern, Owner of the business received the detail of

accounts showing the following comparative statement:

Year 2010

3,10,000

Year 2011

1,60,000

5,00,000

Cash

Debtors

4,20,000

Stock

10,00,000

40,00,000

(15,00,000)

3,00,000

8,75,000

Fixed Assets

(Accumulated Depreciation)

46,00,000

(16,50.000)

Investment

3,00,000

Total

45,30,000

47,85,000

8,00,000

75,000

10,00,000

20,00,000

Creditors

9,00,000

1,30,000

9,00,000

Tax Provision

Mortgage Loans

Equity Share Capital

Retained Earnings

20,00,000

6,55,000

8,55,000

Total

45,30,000

47,85,000

After looking into the comparative balance sheet data. Owner commented that there is something strange

going on here. These balance sheets clearly indicate that cash decreased by Rs. 1,50,000 during the year.

The Company paid only Rs. 50,000 in dividends, so rather than decreasing by Rs. 1,50,000 it seems to me

that it would have increased by Rs. 2,00,000. The company retired no fixed assets during the year. Prepare

a Cash Flow Statement of the company for 2011.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps with 3 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning