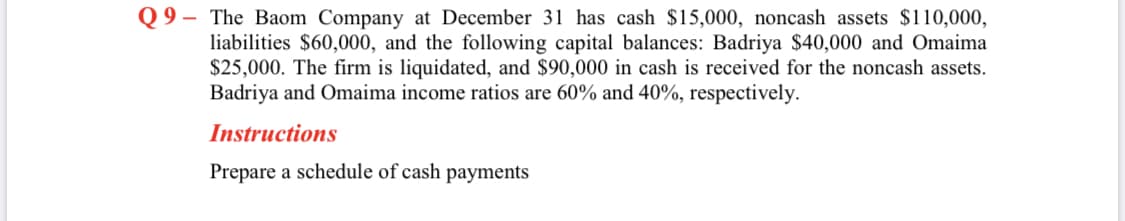

Q 9 – The Baom Company at December 31 has cash $15,000, noncash assets $110,000, liabilities $60,000, and the following capital balances: Badriya $40,000 and Omaima $25,000. The firm is liquidated, and $90,000 in cash is received for the noncash assets. Badriya and Omaima income ratios are 60% and 40%, respectively. Instructions Prepare a schedule of cash payments

Q: Q No 5 Hassan textile anticipates reaching a sales level of Rs. 6 million in one year. The company…

A: Statement of financial position is a statement that presents the book values of assets and…

Q: Q 4. Following are the five events of DDT CORPORATION: a. On December 31, purchased a machinery at a…

A: “Since you have asked multiple sub-part, we will solve the first three sub-parts for you. If you…

Q: The following transactions occurred for Donaldson Inc. during the month of July. Jul. 1 Sold 50…

A: Sales Journal is a special journal to record credit sales. Cash receipt journal includes all…

Q: 1 From the following transactions as well as additional data, please complete the entire accounting…

A: Using a journal entry, an accounting record can show how money was spent or earned at work. If a…

Q: IA 9. Problem Solving. A promissory note which is dated October 1, 20A was received from a client…

A:

Q: Q.1 Khalid and Khamis shared profits in the ratio of 2:3. Their Balance sheet on 31 December 2020…

A: The question is related to Partnership Accounting. Dissolution of firm. There are two partners…

Q: Problem 4-5 EFN [LO2] The most recent financial statements for Assouad, Inc., are shown here:…

A: Budget means the expected value of future. Budget is not affected by the actual value as it is…

Q: Q 4. Following are the five events of DDT CORPORATION: a. On December 31, purchased a machinery at a…

A: Current liabilities are expected to be settled within a year or the next operating cycle. Long-term…

Q: 15–5. (Describing a firm's capital structure) (Related to Checkpoint 15.1 on page 502) Home Depot,…

A: The company's financial structure is made up of long-term capital funds that it has raised from…

Q: Q.1 Khalid and Khamis shared profits in the ratio of 2:3. Their Balance sheet on 31 December 2020…

A: The partnership comes into existence, when two or more persons share profits and losses together.

Q: Q#6 The comparative balance sheet of Paton Corporation at Dec 31, 2004 and 2003 is as follows:…

A: Cash flow statement is a statement which is prepared to find out the cash comes in and goes out , by…

Q: Q 8: King Kong Limited acquired a piece of land for setting up a factory for Rs. 15 million on 1st…

A: “Since you have asked multiple questions, we will solve the first question for you. If you want any…

Q: At the beginning of the year, long-term debt of a firm is $280 and total debt is $325. At the end of…

A: The amount of profit paid to debt holders during an accounting period is referred to as cash flow to…

Q: 10:56 1 ul LTE Yesterday Edit 9:04 PM Problem 1-02A a,b1-b3 (Vldeo) Ruth Lewis opened a law office…

A: The accounting equation indicates the balanced relationship between the assets items on the one side…

Q: 10.4 Jelly Co has sublet part of its offices and in the year ended 30 November 20X3 the rent…

A: Rent Receivables:- These are the current assets of the company that appear in the Balance sheet and…

Q: At the beginning of the year, Shinedown, Corp. had a long-term debt balance of $46,755. During the…

A: Liabilities- Liabilities are the obligations that a company must pay in the future. Liabilities are…

Q: EXERCISE 8-6. Journal Entries and Statement Preparation 2: With capital deficiency; solvent…

A: In Partnership firm, debit balance of insolvent partner should be distributed to remaining partners…

Q: Q.1 Khalid and Khamis shared profits in the ratio of 2:3. Their Balance sheet on 31 December 2020…

A: The partners when decide to liquidate the partnership, realization account is prepared to transfer…

Q: Q.6 Calculate the current ratio and quick ratio from the following particulars and also give your…

A: There are different types of ratio.

Q: The following transactions occurred for Donaldson Inc. during the month of July. Jul. 1 Sold 50…

A: Hi, since you have posted multiple questions, I am answering the 1st question only. To get the…

Q: 3.12 L, V, and M put up an accounting firm on January 1, 200A. Their capital balances on December…

A:

Q: Mitchell purchased a franchise agreement to distribute electronic gadgets for 7 years. The agreement…

A: The internal rate of return (IRR) is a core component of capital budgeting and corporate finance.…

Q: Assume the following information just prior to the withdrawal of Partner X: Assets Liabilities…

A:

Q: 35 Question 35 Mosholu Company reported net income of $60,000 for the year. During the year,…

A: The cash flow statement is prepared to find net cash inflow or outflow from the business.

Q: Q 4. Following are the five events of DDT CORPORATION: On December 31, purchased a machinery at a…

A: Current liabilities are those liabilities which are obligated to pay within operating cycle time or…

Q: he following transactions occurred for Donaldson Inc. during the month of July. Jul. 1 Sold 50…

A: The sale term 2/10 means 2% discount will be given if payment is made is made within 10 days of…

Q: 28.9 The trial balance for a small business at 31 August 20X8 is as follows: Stock 1 September 20X7…

A: Adjusting entries are entries that are passed at the end of the period in order to accurately…

Q: 28.9 The trial balance for a small business at 31 August 20X8 is as follows: Stock 1 September 20X7…

A: Trading account is prepared to find out the gross profit where as net profit is found in profit and…

Q: EXercise 14-5 (Algorithmic) (LO. 3) Candlewood LLC began its business on March 1, 2020; and it uses…

A: Organizational expenses The tax implication of organisation expenses is that the minimum threshold…

Q: ab 1 Normal 1 No Spac... Heading 1 Heading 2 Title Subtit Paragraph Styles 1 ... I. 3 I 4 6. 1. Lulu…

A: The question is related to Income Statement. The details are given.

Q: q. 10 A company has net working capital of $687. Long term debt is $4,078, total assets are $6,201,…

A: Liabilities refer to the amount of a company's obligation to repay the sum to creditors, lenders,…

Q: 四Q 13 / 14 玩,可 116% The owner of Time Traders requested you to calculate the net profit for the year…

A: Answer: Balance sheet at the beginning:

Q: Q.1 Khalid and Khamis shared profits in the ratio of 2:3. Their Balance sheet on 31 December 2020…

A: Dissolution- It is the situation when the partnership is going to be ended due to insolvent of all…

Q: 5. EFN [LO2] The most recent financial statements for Assouad, Inc., are shown here: Income…

A: Answer - Working Note : Step 1- Calculation of Net Income for Next Year : Particulars Amount…

Q: Question 21 Harana Corp. issues P3,000,000, 15%, 120-day commercial papers and pays 1.25% as…

A: Solution:- Net proceeds means the amount received in hand after meeting all the expenses.

Q: rom the following, prepare a balance sheet for Rauscher Co. Cleaners at the end of April 201X: Cash,…

A: Balance sheet is one of the financial statements of an organization. It reports assets, Liabilities…

Q: 8.6A The following information relates to A Trader's business: Assets and liabilities at 1 January…

A: Since profit(loss) earned during the year is not given , therefore we cannot calculate closing…

Q: EA15. LO 3.5 Journalize for Harper and Co. each of the following transactions or state no entry…

A: As posted multiple independent questions we are answering only first question kindly repost the…

Q: 3.12 L, V, and M put up an accounting firm on January 1, 200A. Their capital balances on December…

A: A partnership is a legally binding contract between two or more persons to manage and operate a…

Q: A company has $628 in inventory, $1,921 in net fixed assets, $300 in accounts receivable, $141 in…

A: Current assets: Total current assets are the sum of all cash, receivables, prepaid expenses, and…

Q: 28.8 The following trial balance was extracted from the books of R Giggs at the close of business on…

A: Financial statements are prepared to depict the profitability and financial position of company at…

Q: Q 39 Question 39 Arthur Company is a construction company. In January, the company purchased an…

A: The journal entries are prepared to keep the record of day to day transactions of the business.

Q: Illustration 24 A, B and C were partners sharing profits in 2 :1: 1. The Bala sheet of the firm as…

A: “Since you have asked multiple questions, we will solve the first question for you. If you want any…

Debenture Valuation

A debenture is a private and long-term debt instrument issued by financial, non-financial institutions, governments, or corporations. A debenture is classified as a type of bond, where the instrument carries a fixed rate of interest, commonly known as the ‘coupon rate.’ Debentures are documented in an indenture, clearly specifying the type of debenture, the rate and method of interest computation, and maturity date.

Note Valuation

It is the process to determine the value or worth of an asset, liability, debt of the company. It can be determined by many processes or techniques. Many factors can impact the valuation of an asset, liability, or the company, like:

Trending now

This is a popular solution!

Step by step

Solved in 3 steps

- Investment reporting Teasdale Inc. manufactures and sells commercial and residential security equipment. The comparative unclassified balance sheets for December 31, Year 2 and Year 1 are provided below. Selected missing balances are shown by letters. Teasdale Inc. Balance Sheet December 31, Year 2 and Year 1 Dec. 31, Year 2 Dec. 31, Year 1 Cash 160,000 156,000 Accounts receivable (net) 11S.OOO 108,000 Available for-sale investments (at cost)Note 1 a. 91,200 Plus valuation allowance for available-for-sale investments b. 8,776 Available for-sale investments (fair value) c 99,976 Interest receivable d. Investment in Wright Co. stockNote 2 e. 69,200 Office equipment (net) 96,000 105,000 Total assets f. 5538,176 Accounts payable 91,000 72,000 Common stock 80,000 80,000 Excess of issue price over par 250,000 250,000 Retained earnings g 127,400 Unrealized gain (loss) on available for-sale investments h. 8,776 Total liabilities and stockholders' equity S i. 5538,176 Note 1. Investments are classified as available for sale. The investments at cost and fair value on December 31, Year 1, are as follows: No. of Shares Cost per Share Total Cost Total Fair Value Alvarez Inc stock 960 38,00 36,480 39,936 Hirsch Inc. stock 1,900 28,80 4,720 60,040 91,200 99,976 Note 2. The Investment in Wright Co. stack is an equity method investment representing 30% of the outstanding shares of Wright Co. The following selected investment transactions occurred during Year 2: Mar. 18. Purchased 800 shares of Richter Inc. at 40, including brokerage commission. Richter is classified as an available-for-sale security. July 12. Dividends of 12,000 art: received on the Wright Co. investment. Oct 1. Purchased 24,000 of Toon Co. 4%, 10-year bonds at 100. the bonds are classified as available for sale. The bonds pay interest on October 1 and April 1. December 31. Wright Co. reported a total net income of 80,000 for Year 2. Teasdale recorder equity earnings for its share of Wright Co. net income. 31. Accrued interest for three months on the Toon Co. bonds purchased on October 1. 31. Adjusted the available-for-sale investment portfolio to fair value, using the following fair value per-share amounts: Available for Sale Investments Fair Value Alvarez Inc. stock 41,50 per share Hirsch Inc stock 26,00 per share Richter Inc. stock 48,00 per share Toon Co. bonds 101 per 100 of face amount 31. Closed the Teasdale Inc. net income of 51,240. Teasdale Int. paid no dividends during the year. Instructions Determine the missing letters in the unclassified balance sheet. Provide appropriate supporting calculations.Investment reporting O'Brien Industries Inc. is a hook publisher. The comparative unclassified balance sheets for December 31, Year 2 and Year 1 follow. Selected missing balances are shown by letters. Brien Industries Inc. Balance Sheet December 31, Year 2 and Year 1 Dec. 31, Year 2 Dec 31, Year 1 cash 233,000 220,000 Accounts receivable (net) 136,530 138,000 Available for sale investments (at cost)Note 1 a 103,770 Less valuation allowance for available-for-sale investments b. 2,500 Available for-sale investments (fair value) c 101,270 Interest receivable d Investment in Jolly Roger Co. stockNote 2 e. 77,000 Office equipment (net) 115,000 130,000 Total assets f. 666,270 Accounts payable 69.400 65,000 Common stock 70.000 70,000 Excess of issue price over par 225,000 225,000 Retained earnings g 308,770 Unrealized gain (loss) on available for-sale investments h. (2,500) Total liabilities and Stockholders equity i. 666,270 Note 1. Investments are classified as available for sale. The investments at cost and fair value on December 31, Year 1, are as follows: No. of Shares Cost per Share Total Cost Total Fair Value Bernard Co. stock 2,250 17 38,250 37,500 Chadwick Co. stock 1,260 52 65,520 63,770 103,770 101,270 Note 2. The investment in Jolly Roger Co. stock is an equity method investment representing 30% of the outstanding .shares of Jolly Roger Co. The following selected investment transactions occurred during Year 2: May 5. Purchased 3,080 shares of Gozar Inc. at 30 per share including brokerage commission. Gozar Inc. is classified as an available-for-sale security. Oct. 1. Purchased 40,000 of Nightline co. 6%, 10-Year bonds at 100. The bonds are classified as available for sale. The bonds pay interest on October 1 and April 1. 9. Dividends of 12,500 are received on the Jolly Roger co. investment. Dec. 31 Jolly Roger co. reported a total net income of 112,000 for year 2. O'Brien industries Inc. recorded equity earnings for its share of Jolly Roger co. net income. 31. Accrued three months of interest on the Nightline bonds. 31. Adjusted the available-for-sale investment portfolio to fair value, using the following fair value per-share amounts: Available-for-Sale Investments Fair Value Bernard Co. stock 15,40 per share Chadwick Co. stock 46,00 per share Gozar Inc. stock 32,00 per share Nightline Co. bonds 98 per 100 of face amount Dec. 31. Closed the OBrien Industries Inc. net income of 146,230. O'Brien Industries Inc. paid no dividends during the year. Instructions Determine the missing letters in the unclassified balance sheet. Provide appropriate supporting calculations.Ethics in Action Lucas Hunter, president of Simmons Industries Inc., believes that reporting operating cash flow per share on the income statement would be a useful addition to the companys just completed financial statements. The following discussion took place between Lucas Hunter and Simmons' controller, John Jameson, in January, after the close of the fiscal year: Lucas: Ive been reviewing our financial statements for the last year. I am disappointed that our net income per share has dropped by 10% from last year. This won't look good to our shareholders. Is there anything we can do about this? John. What do you means? The past is the past, and the numbers are in. There isnt much that can be done about it Our financial statements were prepared according to generally accepted accounting principles, and I dont see much leeway for significant change at this point. Lucan No, no. Ive not suggesting that we cook the books. But look at the cash flow from operating activities on the statement of cash flows. The cash flow from operating activities has increased by 20%. This is very good newsand. I might add, useful information. The higher cash flow from operating activities will give our creditors comfort. John. Well, the cash flow from operating activities is on the statement of cash flows, so I guess users will be able to see the improved cash flow figures there Lucas: This is true, but somehow I think this information should be given a much higher profile. I don't like this information being buried in the statement of cash flows. You know as well as I do that many users will focus on the income statement Therefore. I think we ought to include an operating cash flow per share number on the face of the income statementsomeplace under the earnings per share number In this way, users will get the complete picture of our operating performance. Yes, our earnings per share dropped this year, but our cash flow from operating activities improved! And all the information is in one place where users can see and compare the figures. What do you think? John I've never really thought about it like that before I guess we could put the operating cash flow per share on the income statement, underneath the earnings per share amount. Users would really benefit from this disclosure. Thanks for the ideaI'll start working on it. Lucas: Glad to be of service. How would you interpret this situation? Is John behaving in an ethical and professional manner?

- q. 19 A frim has net working capital of $509, net fixed assets of $2,336, sales of $7,000 and current liabilities of $900. How many dollars worth of sales are generate from every $1 in total assets? $3.00 $1.83 $1.53 $2.16 $2.39Q. 8 At the beginning of the year, long-term debt of a firm is $280 and total debt is $325. At the end of the year, long term debt is $255 and total debt is $335. The interest paid is $21. What is the amount of the cash flow to creditors? $46 -$25 -$46 $25 $21q. 10 A company has net working capital of $687. Long term debt is $4,078, total assets are $6,201, and fixed assets are $3,948. What is the amount of total liabilities? $8,026 $6,888 $4,765 $5,514 $5,644

- Q 7. Prepare a 2021 balance sheet for Willis Corporation based on the following information: Cash = $129,000; Patents and copyrights = $630,000; Accounts payable = $211,000; Accounts receivable = $125,000; Tangible net fixed assets = $1,625,000; Inventory = $294,000; Notes payable = $170,000; Accumulated retained earnings = $1,274,000; Long-term debt = $847,000q. 9 At the beginning of the year, Shinedown, Corp. had a long-term debt balance of $46,755. During the year, the company repaid a long-term loan in the amount of $12,630. The company paid $4,795 in interest during the year, and opened a new long-term loan for $11,145. How much is the ending long-term debt account of the company’s balance sheet? $53,105 $48,240 $45,270 $50,065 $6,280K 11 Mars Corporation reported the following information for the year ended March 31, 2021 Administrative expenses $ 15,000 Cost of goods sold 60,000 Dividends paid by Mars to its shareholders 18,000 Dividends received by Mars from investments 10,000 Error calculating cost of goods sold in 2019 (increase income) 13,000 Interest earned on available-for-sale debt securities 6,000 Unrealized gain on hedging transactions 8,000 Loss on sale of debt securities 14,000 Net Sales 150,000 Retained earnings April 1, 2020 100,000 Selling expenses 12,000 Ignoring income taxes and earnings per share, prepare an Income Statement (multi-step), Statement of Comprehensive Income…

- PA3. LO 7.4The following transactions occurred for Donaldson Inc. during the month of July. Jul. 1 Sold 50 items to Palm Springs Inc. and offered terms of 2/10, n/30, $4,000 on July 1, and issued invoice #12 on account number #312 Jul. 5 Sold 20 thing-a-jigs to Miami Inc. for $2,150 cash on July 5, and issued invoice #13 Jul. 8 Sold 30 what-is to Smith Mfg. for $5,000 and offered terms of 2/10, n/30; issued invoice #14 on account number #178 Jul. 9 Received payment from Palm Springs Inc. Jul. 22 Received payment from Smith Mfg. after expiration of the discount period Record the transactions for Donaldson Inc. in the proper special journal and subsidiary ledger. Record the same transactions using QuickBooks, and print the journals and subsidiary ledger. They should match.Q 39 Question 39 Arthur Company is a construction company. In January, the company purchased an equity investment for $73,500. At year end, the investment had a fair market value of $65,000, Arthur company’s adjusting entry should include a … Select one: a. Credit (decrease) to Equity Investments – Balance Sheet account. b. Credit to Unrealized Loss Income – Income Statement c. Debit to Loss on Sale of Equity Investment – Income Statement d. Debit (increase) to Equity Investments – Balance SheetChapter 7 p. 514 Problem Set A PA3 The following transactions occurred for Donaldson Inc. during the month of July. Jul. 1 Sold 50 items to Palm Springs Inc. and offered terms of 2/10, n/30, $4,000 on July 1, and issued invoice #12 on account number #312Jul. 5 Sold 20 thing-a-jigs to Miami Inc. for $2,150 cash on July 5, and issued invoice #13Jul. 8 Sold 30 what-is to Smith Mfg. for $5,000 and offered terms of 2/10, n/30; issued invoice #14 on account number #178Jul. 9 Received payment from Palm Springs Inc.Jul. 22 Received payment from Smith Mfg. after expiration of the discount period Record the transactions for Donaldson Inc. in the proper special journal and subsidiary ledger. SALES JOURNAL Page 22 Date Account Invoice No. Ref. DR Accts. Receivable CR Sales DR COGS CR Merchandise Inventory 2019 Jul. 1 Palm Springs Inc. (312) 12 ???? 2,000.00 Jul. 8 Smith Mfg (178) 14 ???? 2,500.00 Date…