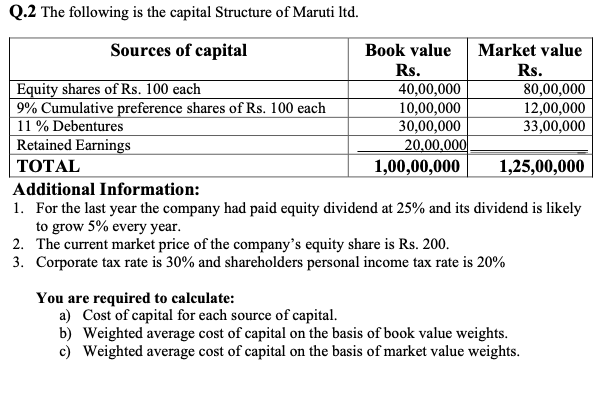

Q.2 The following is the capital Structure of Maruti Itd. Sources of capital Book value Market value Rs. Rs. Equity shares of Rs. 100 each | 9% Cumulative preference shares of Rs. 100 each 11 % Debentures Retained Earnings 80,00,000 40,00,000 10,00,000 30,00,000 20,00,000| 1,00,00,000 12,00,000 33,00,000 ТОTAL 1,25,00,000 Additional Information: 1. For the last year the company had paid equity dividend at 25% and its dividend is likely to grow 5% every year. 2. The current market price of the company's equity share is Rs. 200. 3. Corporate tax rate is 30% and shareholders personal income tax rate is 20% You are required to calculate: a) Cost of capital for each source of capital. b) Weighted average cost of capital on the basis of book value weights. c) Weighted average cost of capital on the basis of market value weights.

Q.2 The following is the capital Structure of Maruti Itd. Sources of capital Book value Market value Rs. Rs. Equity shares of Rs. 100 each | 9% Cumulative preference shares of Rs. 100 each 11 % Debentures Retained Earnings 80,00,000 40,00,000 10,00,000 30,00,000 20,00,000| 1,00,00,000 12,00,000 33,00,000 ТОTAL 1,25,00,000 Additional Information: 1. For the last year the company had paid equity dividend at 25% and its dividend is likely to grow 5% every year. 2. The current market price of the company's equity share is Rs. 200. 3. Corporate tax rate is 30% and shareholders personal income tax rate is 20% You are required to calculate: a) Cost of capital for each source of capital. b) Weighted average cost of capital on the basis of book value weights. c) Weighted average cost of capital on the basis of market value weights.

Chapter14: Distributions To Shareholders: Dividends And Repurchases

Section: Chapter Questions

Problem 2STP

Related questions

Question

Transcribed Image Text:Q.2 The following is the capital Structure of Maruti Itd.

Sources of capital

Book value

Market value

Rs.

40,00,000

10,00,000

30,00,000

20,00,000

Rs.

80,00,000

Equity shares of Rs. 100 each

9% Cumulative preference shares of Rs. 100 each

11 % Debentures

Retained Earnings

12,00,000

33,00,000

ТОTAL

1,00,00,000

1,25,00,000

Additional Information:

1. For the last year the company had paid equity dividend at 25% and its dividend is likely

to grow 5% every year.

2. The current market price of the company's equity share is Rs. 200.

3. Corporate tax rate is 30% and shareholders personal income tax rate is 20%

You are required to calculate:

a) Cost of capital for each source of capital.

b) Weighted average cost of capital on the basis of book value weights.

c) Weighted average cost of capital on the basis of market value weights.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps

Recommended textbooks for you