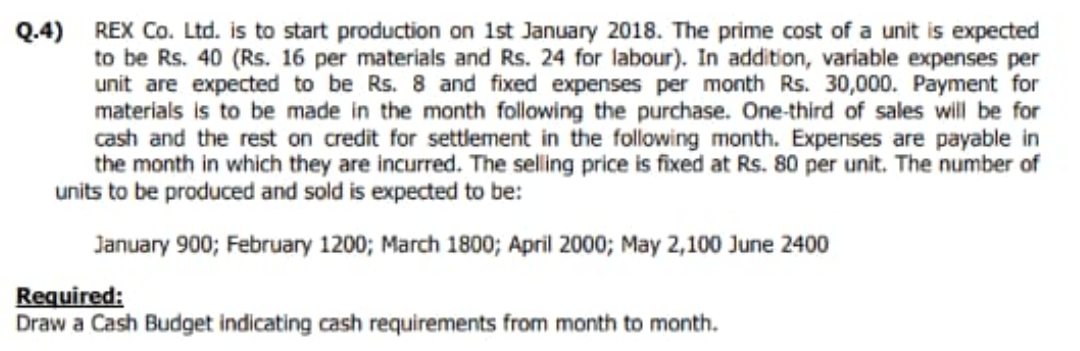

Q.4) REX Co. Ltd. is to start production on 1st January 2018. The prime cost of a unit is expected to be Rs. 40 (Rs. 16 per materials and Rs. 24 for labour). In addition, variable expenses per unit are expected to be Rs. 8 and fixed expenses per month Rs. 30,000. Payment for materials is to be made in the month following the purchase. One-third of sales will be for cash and the rest on credit for settlement in the following month. Expenses are payable in the month in which they are incurred. The selling price is fixed at Rs. 80 per unit. The number of units to be produced and sold is expected to be: January 900; February 1200; March 1800; April 2000; May 2,100 June 2400 Required: Draw a Cash Budget indicating cash requirements from month to month.

Q.4) REX Co. Ltd. is to start production on 1st January 2018. The prime cost of a unit is expected to be Rs. 40 (Rs. 16 per materials and Rs. 24 for labour). In addition, variable expenses per unit are expected to be Rs. 8 and fixed expenses per month Rs. 30,000. Payment for materials is to be made in the month following the purchase. One-third of sales will be for cash and the rest on credit for settlement in the following month. Expenses are payable in the month in which they are incurred. The selling price is fixed at Rs. 80 per unit. The number of units to be produced and sold is expected to be: January 900; February 1200; March 1800; April 2000; May 2,100 June 2400 Required: Draw a Cash Budget indicating cash requirements from month to month.

Cornerstones of Cost Management (Cornerstones Series)

4th Edition

ISBN:9781305970663

Author:Don R. Hansen, Maryanne M. Mowen

Publisher:Don R. Hansen, Maryanne M. Mowen

Chapter2: Basic Cost Management Concepts

Section: Chapter Questions

Problem 4CE: Refer to Cornerstone Exercises 2.2 and 2.3. Next year, Pietro expects to produce 50,000 units and...

Related questions

Question

Transcribed Image Text:Q.4) REX Co. Ltd. is to start production on 1st January 2018. The prime cost of a unit is expected

to be Rs. 40 (Rs. 16 per materials and Rs. 24 for labour). In addition, variable expenses per

unit are expected to be Rs. 8 and fixed expenses per month Rs. 30,000. Payment for

materials is to be made in the month following the purchase. One-third of sales will be for

cash and the rest on credit for settlement in the following month. Expenses are payable in

the month in which they are incurred. The selling price is fixed at Rs. 80 per unit. The number of

units to be produced and sold is expected to be:

January 900; February 1200; March 1800; April 2000; May 2,100 June 2400

Required:

Draw a Cash Budget indicating cash requirements from month to month.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 3 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning