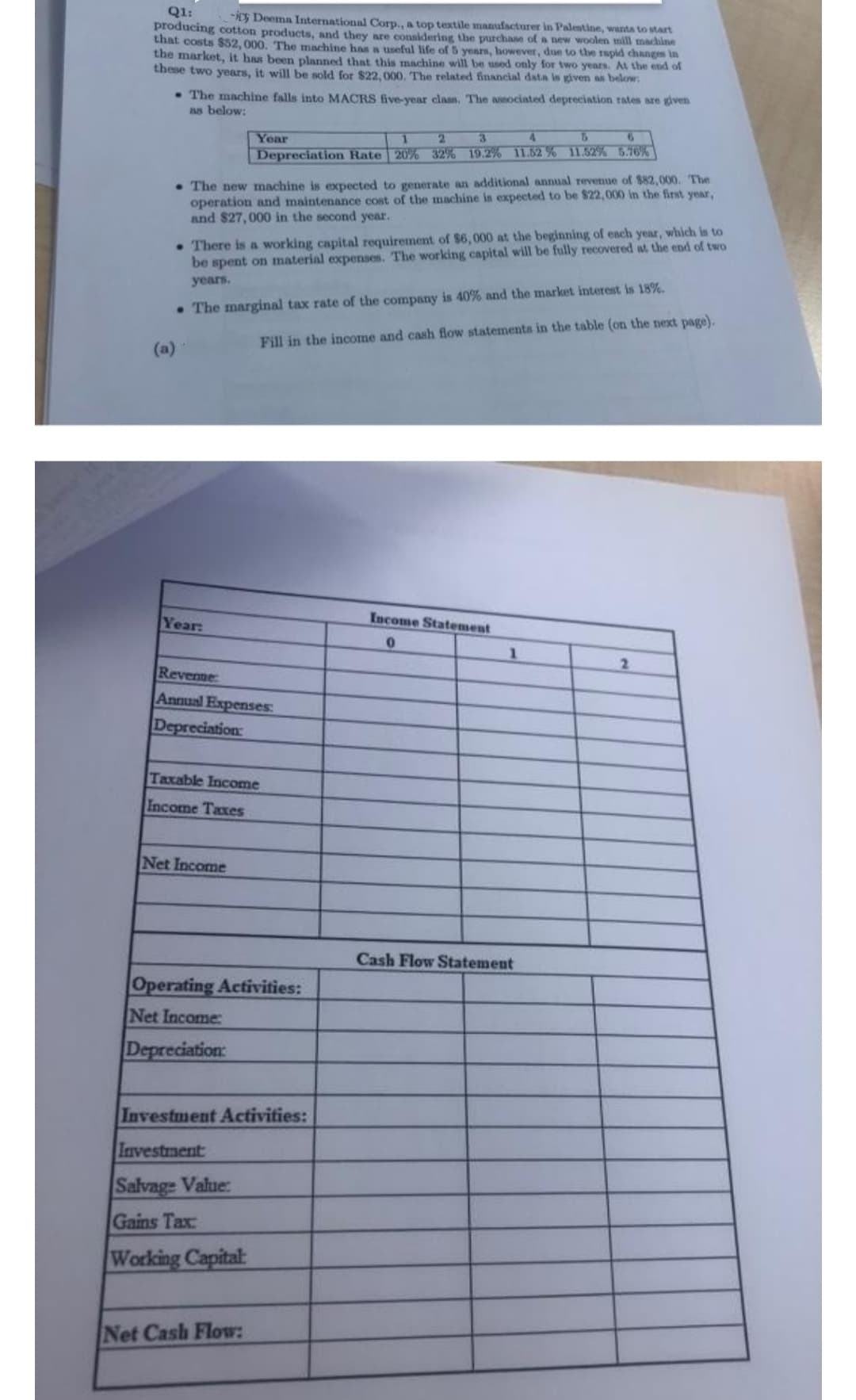

Q1: ity Deema International Corp., a top textile manufacturer in Palestine, wants to start producing cotton products, and they are considering the purchase of a new woolen mill machine that costs $52, 000. The machine has a useful life of 5 years, however, due to the rapid changes in the market, it has been planned that this machine will be used only for two years. At the end of these two years, it will be sold for $22,000. The related financial data is given as below: The machine falls into MACRS five-year class. The associated depreciation rates are given as below: Year 3 4 6 Depreciation Rate 20% 32% 19.2% 11.52 % 11.52% 5.76% The new machine is expected to generate an additional annual revenue of $82,000. The operation and maintenance cost of the machine is expected to be $22,000 in the first year, and $27,000 in the second year. . There is a working capital requirement of $6,000 at the beginning of each year, which is to be spent on material expenses. The working capital will be fully recovered at the end of two years. The marginal tax rate of the company is 40% and the market interest is 18%.

Q1: ity Deema International Corp., a top textile manufacturer in Palestine, wants to start producing cotton products, and they are considering the purchase of a new woolen mill machine that costs $52, 000. The machine has a useful life of 5 years, however, due to the rapid changes in the market, it has been planned that this machine will be used only for two years. At the end of these two years, it will be sold for $22,000. The related financial data is given as below: The machine falls into MACRS five-year class. The associated depreciation rates are given as below: Year 3 4 6 Depreciation Rate 20% 32% 19.2% 11.52 % 11.52% 5.76% The new machine is expected to generate an additional annual revenue of $82,000. The operation and maintenance cost of the machine is expected to be $22,000 in the first year, and $27,000 in the second year. . There is a working capital requirement of $6,000 at the beginning of each year, which is to be spent on material expenses. The working capital will be fully recovered at the end of two years. The marginal tax rate of the company is 40% and the market interest is 18%.

Chapter10: Project Cash Flows And Risk

Section: Chapter Questions

Problem 5PROB

Related questions

Question

Transcribed Image Text:Q1: - Deema International Corp., a top textile manufacturer in Palestine, wants to start

producing cotton products, and they are considering the purchase of a new woolen mill machine

that costs $52, 000. The machine has a useful life of 5 years, however, due to the rapid changes in

the market, it has been planned that this machine will be used only for two years. At the end of

these two years, it will be sold for $22,000. The related financial data is given as below:

The machine falls into MACRS five-year class. The associated depreciation rates are given

as below:

(a)

The new machine is expected to generate an additional annual revenue of $82,000. The

operation and maintenance cost of the machine is expected to be $22,000 in the first year,

and $27,000 in the second year.

. There is a working capital requirement of $6,000 at the beginning of each year, which is to

be spent on material expenses. The working capital will be fully recovered at the end of two

years,

The marginal tax rate of the company is 40% and the market interest is 18%.

Year:

Year

1

2

4

6

6

Depreciation Rate 20% 32% 19.2% 11.52% 11.52% 5.76%

Net Income

Revenne:

Annual Expenses:

Depreciation:

Taxable Income

Income Taxes

Fill in the income and cash flow statements in the table (on the next page).

Salvage Value:

Gains Tax:

Working Capital:

Operating Activities:

Net Income:

Depreciation:

Net Cash Flow:

Investment Activities:

Investment

Income Statement

0

1

Cash Flow Statement

2

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps with 4 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

Fundamentals Of Financial Management, Concise Edi…

Finance

ISBN:

9781337902571

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

Fundamentals Of Financial Management, Concise Edi…

Finance

ISBN:

9781337902571

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College