Q1. The balance in the unearned rent account for Jones Co. as of December 31 is $1,200. If Jones Co. failed to record the adjusting entry for $600 of rent earned during December, the effect on the balance sheet and income statement for December would be:

Q1. The balance in the unearned rent account for Jones Co. as of December 31 is $1,200. If Jones Co. failed to record the adjusting entry for $600 of rent earned during December, the effect on the balance sheet and income statement for December would be:

Survey of Accounting (Accounting I)

8th Edition

ISBN:9781305961883

Author:Carl Warren

Publisher:Carl Warren

Chapter3: Basic Accounting Systems: Accrual Basis

Section: Chapter Questions

Problem 5SEQ: The balance in the unearned rent account for Jones Co. as of December 31 is $1 ,20(). If Jones Co....

Related questions

Topic Video

Question

Transcribed Image Text:11:04

< Вack

Week 6 HW.docx

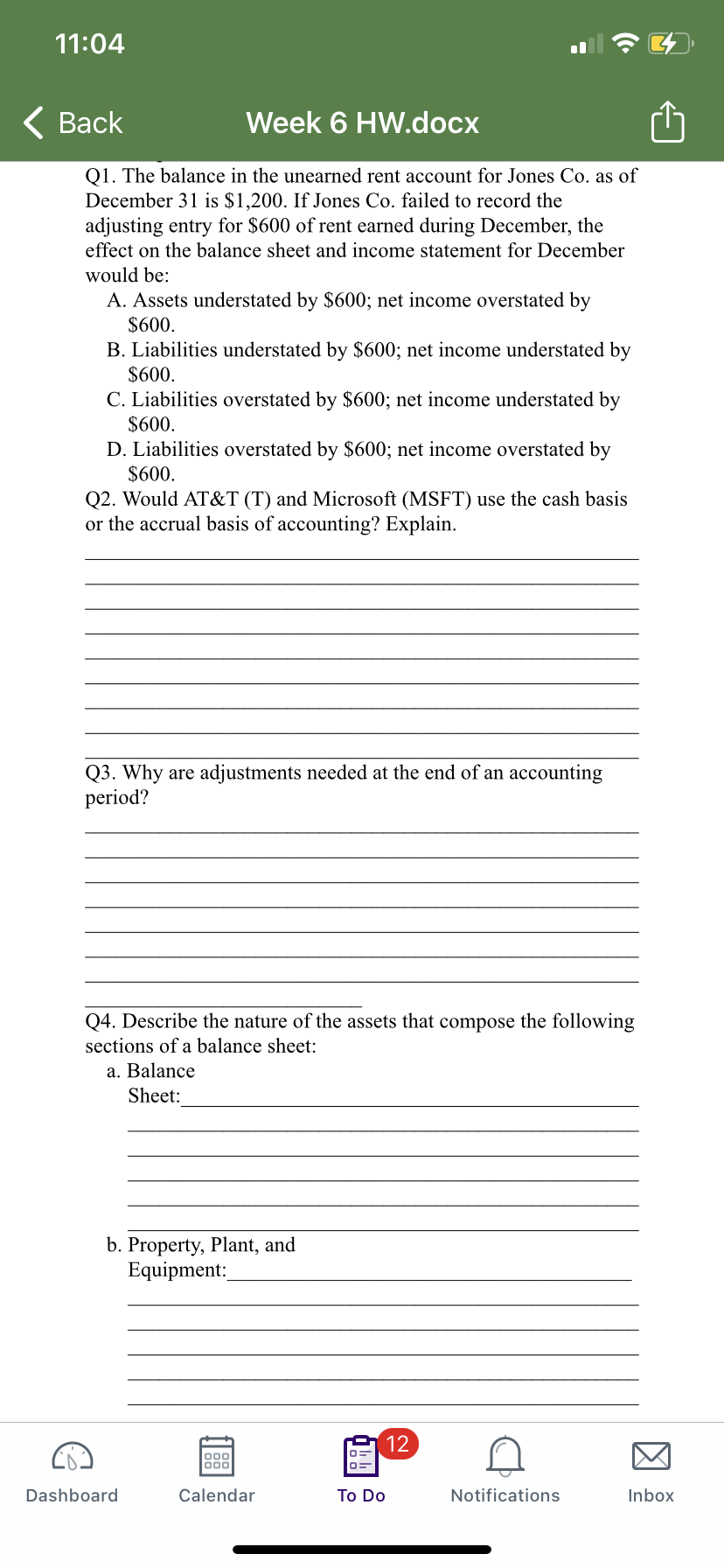

Q1. The balance in the unearned rent account for Jones Co. as of

December 31 is $1,200. If Jones Co. failed to record the

adjusting entry for $600 of rent earned during December, the

effect on the balance sheet and income statement for December

would be:

A. Assets understated by $600; net income overstated by

$600.

B. Liabilities understated by $600; net income understated by

$600.

C. Liabilities overstated by $600; net income understated by

$600.

D. Liabilities overstated by $600; net income overstated by

$600.

Q2. Would AT&T (T) and Microsoft (MSFT) use the cash basis

or the accrual basis of accounting? Explain.

Q3. Why are adjustments needed at the end of an accounting

period?

Q4. Describe the nature of the assets that compose the following

sections of a balance sheet:

a. Balance

Sheet:

b. Property, Plant, and

Equipment:

12

000

00

Dashboard

Calendar

To Do

Notifications

Inbox

Expert Solution

Step 1

Unearned rent is the amount of revenue received in advance. It is in the nature of liability. The amount which is earned is adjusted against it using adjustment entry.

We given in the question that,

Unearned revenue account shows the balance of $1,200.

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Century 21 Accounting Multicolumn Journal

Accounting

ISBN:

9781337679503

Author:

Gilbertson

Publisher:

Cengage

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Century 21 Accounting Multicolumn Journal

Accounting

ISBN:

9781337679503

Author:

Gilbertson

Publisher:

Cengage