Sydney Retailing (buyer) and Troy Wholesalers (seller) enter into the following transactions. May 11 Sydney accepts delivery of $29,5ee of merchandise it purchases for resale from Troy: imvoice dated May 11, terms 3/18, n/98, FOB shipping point. The goods cost Troy $19,765. Sydney pays $335 cash to Express Shipping for delivery charges on the merchandise. 12 Sydney returns $1,280 of the $29,580 of goods to Troy, who receives then the same day and restores them to its inventory- The returned goods had cost Troy $884. 28 Sydney pays Troy for the amount owed. Troy receives the cash imnediately. (Both Sydney and Troy use a perpetual Inventory system and the gross method.) 1. Prepare Joural entries that Sydney Retailing (buyer) records for these three transactions. 2 Prepare Jourmal entries that Troy Wholesalers (seller) records for these three transactions.

Sydney Retailing (buyer) and Troy Wholesalers (seller) enter into the following transactions. May 11 Sydney accepts delivery of $29,5ee of merchandise it purchases for resale from Troy: imvoice dated May 11, terms 3/18, n/98, FOB shipping point. The goods cost Troy $19,765. Sydney pays $335 cash to Express Shipping for delivery charges on the merchandise. 12 Sydney returns $1,280 of the $29,580 of goods to Troy, who receives then the same day and restores them to its inventory- The returned goods had cost Troy $884. 28 Sydney pays Troy for the amount owed. Troy receives the cash imnediately. (Both Sydney and Troy use a perpetual Inventory system and the gross method.) 1. Prepare Joural entries that Sydney Retailing (buyer) records for these three transactions. 2 Prepare Jourmal entries that Troy Wholesalers (seller) records for these three transactions.

Corporate Financial Accounting

14th Edition

ISBN:9781305653535

Author:Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:Carl Warren, James M. Reeve, Jonathan Duchac

Chapter5: Accounting For Merchandising Businesses

Section: Chapter Questions

Problem 5.4APR: Sales-related and purchase-related transactions for seller and buyer using perpetual inventory...

Related questions

Question

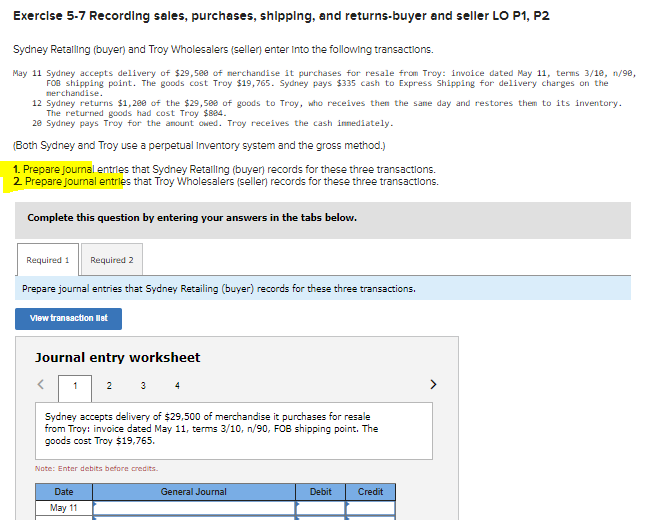

Transcribed Image Text:Exercise 5-7 Recording sales, purchases, shipplng, and returns-buyer and seller LO P1, P2

Sydney Retaling (buyer) and Troy Wholesalers (seller) enter into the following transactions.

May 11 Sydney accepts delivery of $29,500 of merchandise it purchases for resale from Troy: invoice dated May 11, terms 3/18, n/98,

FOB shipping point. The goods cost Troy $19,765. Sydney pays $335 cash to Express Shipping for delivery charges on the

nerchandise.

12 Sydney returns $1,200 of the $29,509 of goods to Troy, who receives then the same day and restores them to its inventory.

The returned goods had cost Troy $884.

20 Sydney pays Troy for the anount owed. Troy receives the cash innediately.

(Both Sydney and Troy use a perpetual Inventory system and the gross method.)

1. Prepare Journal entries that Sydney Retalling (buyer) records for these three transactions.

2 Prepare jourmal entries that Troy Wholesalers (seller records for these three transactions.

Complete this question by entering your answers in the tabs below.

Required 1

Required 2

Prepare journal entries that Sydney Retailing (buyer) records for these three transactions.

Vlew transaction let

Journal entry worksheet

1 2 3 4

Sydney accepts delivery of $29,500 of merchandise it purchases for resale

from Troy: invoice dated May 11, terms 3/10, n/90, FOB shipping point. The

goods cost Troy $19,765.

Note: Enter debits before credits.

Date

General Journal

Debit

Credit

May 11

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Corporate Financial Accounting

Accounting

ISBN:

9781305653535

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Corporate Financial Accounting

Accounting

ISBN:

9781337398169

Author:

Carl Warren, Jeff Jones

Publisher:

Cengage Learning

Financial & Managerial Accounting

Accounting

ISBN:

9781337119207

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Corporate Financial Accounting

Accounting

ISBN:

9781305653535

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Corporate Financial Accounting

Accounting

ISBN:

9781337398169

Author:

Carl Warren, Jeff Jones

Publisher:

Cengage Learning

Financial & Managerial Accounting

Accounting

ISBN:

9781337119207

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning