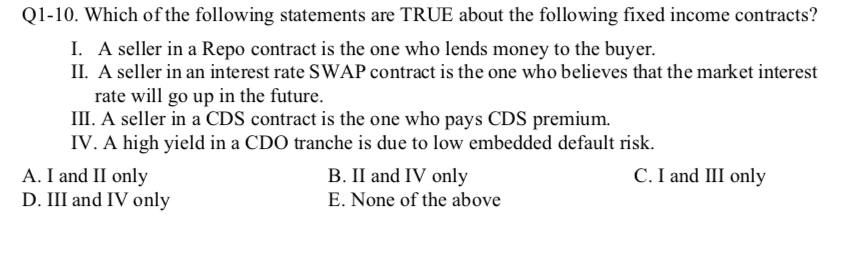

Q1-10. Which of the following statements are TRUE about the following fixed income contracts? I. A seller in a Repo contract is the one who lends money to the buyer. II. A seller in an interest rate SWAP contract is the one who believes that the market interest rate will go up in the future. III. A seller in a CDS contract is the one who pays CDS premium. IV. A high yield in a CDO tranche is due to low embedded default risk. A. I and II only D. III and IV only C. I and III only B. II and IV only E. None of the above

Q1-10. Which of the following statements are TRUE about the following fixed income contracts? I. A seller in a Repo contract is the one who lends money to the buyer. II. A seller in an interest rate SWAP contract is the one who believes that the market interest rate will go up in the future. III. A seller in a CDS contract is the one who pays CDS premium. IV. A high yield in a CDO tranche is due to low embedded default risk. A. I and II only D. III and IV only C. I and III only B. II and IV only E. None of the above

Chapter9: Forecasting Exchange Rates

Section: Chapter Questions

Problem 1BIC

Related questions

Question

PLEASE HELP ME. THANK YOU

Transcribed Image Text:Q1-10. Which of the following statements are TRUE about the following fixed income contracts?

I. A seller in a Repo contract is the one who lends money to the buyer.

II. A seller in an interest rate SWAP contract is the one who believes that the market interest

rate will go up in the future.

III. A seller in a CDS contract is the one who pays CDS premium.

IV. A high yield in a CDO tranche is due to low embedded default risk.

A. I and II only

D. III and IV only

C. I and III only

B. II and IV only

E. None of the above

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you