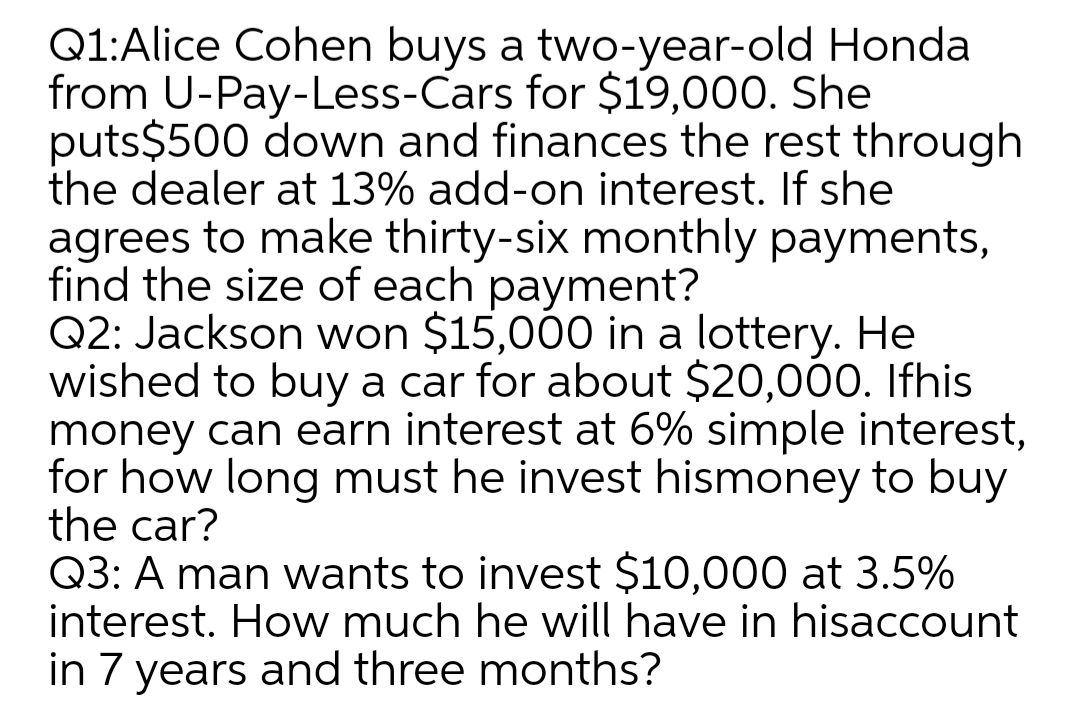

Q1:Alice Cohen buys a two-year-old Honda from U-Pay-Less-Cars for $19,000. She puts$500 down and finances the rest through the dealer at 13% add-on interest. If she agrees to make thirty-six monthly payments, find the size of each payment? Q2: Jackson won $15,000 in a lottery. He wished to buy a car for about $20,000. Ifhis money can earn interest at 6% simple interest, for how long must he invest hismoney to buy the car? Q3: A man wants to invest $10,000 at 3.5% interest. How much he will have in hisaccount in 7 years and three months?

Q1:Alice Cohen buys a two-year-old Honda from U-Pay-Less-Cars for $19,000. She puts$500 down and finances the rest through the dealer at 13% add-on interest. If she agrees to make thirty-six monthly payments, find the size of each payment? Q2: Jackson won $15,000 in a lottery. He wished to buy a car for about $20,000. Ifhis money can earn interest at 6% simple interest, for how long must he invest hismoney to buy the car? Q3: A man wants to invest $10,000 at 3.5% interest. How much he will have in hisaccount in 7 years and three months?

Chapter4: Time Value Of Money

Section: Chapter Questions

Problem 25PROB

Related questions

Question

Help me fast......so that I will give Upvote

Transcribed Image Text:Q1:Alice Cohen buys a two-year-old Honda

from U-Pay-Less-Cars for $19,000. She

puts$500 down and finances the rest through

the dealer at 13% add-on interest. If she

agrees to make thirty-six monthly payments,

find the size of each payment?

Q2: Jackson won $15,000 in a lottery. He

wished to buy a car for about $20,000. Ifhis

money can earn interest at 6% simple interest,

for how long must he invest hismoney to buy

the car?

Q3: A man wants to invest $10,000 at 3.5%

interest. How much he will have in hisaccount

in 7 years and three months?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 4 steps with 5 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning