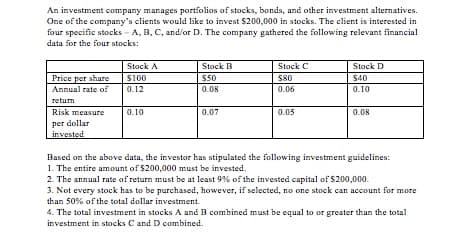

Q2. What is the optimal solution and what is the value of the objective function? Show the relevant portion of the Solver’s output. Fully interpret the results. Q3. What are the objective coefficient ranges for the four stocks? Show the relevant portion of the Solver’s output. Fully interpret these ranges. Q4. Suppose the investor decides that the annual rate of return no longer has to be at least 9% and agrees to at minimum level of 8%. What does the shadow price associated with this constraint indicate about a possible change in total risk that could occur from this lower rate of return? Show the relevant portion of the Solver’s output. Fully interpret the results.

Q2. What is the optimal solution and what is the value of the objective function? Show the relevant portion of the Solver’s output. Fully interpret the results.

Q3. What are the objective coefficient ranges for the four stocks? Show the relevant portion of the Solver’s output. Fully interpret these ranges.

Q4. Suppose the investor decides that the annual

Trending now

This is a popular solution!

Step by step

Solved in 7 steps with 5 images