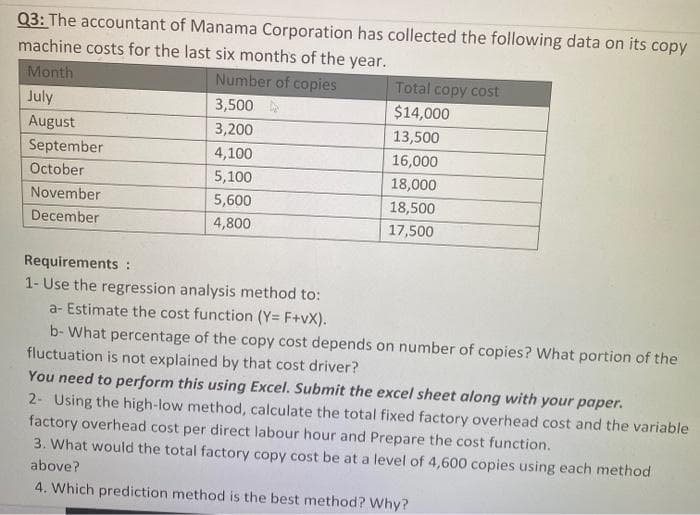

Q3: The accountant of Manama Corporation has collected the following data on its copy machine costs for the last six months of the year. Month Number of copies Total copy cost $14,000 July 3,500 August September 3,200 13,500 4,100 16,000 October 5,100 18,000 November 5,600 18,500 December 4,800 17,500 Requirements : 1- Use the regression analysis method to: a- Estimate the cost function (Y= F+vX). b- What percentage of the copy cost depends on number of copies? What portion of the fluctuation is not explained by that cost driver? You need to perform this using Excel. Submit the excel sheet along with your paper. 2- Using the high-low method, calculate the total fixed factory overhead cost and the variable factory overhead cost per direct labour hour and Prepare the cost function. 3. What would the total factory copy cost be at a level of 4,600 copies using each method above? 4. Which prediction method is the best method? Why?

Master Budget

A master budget can be defined as an estimation of the revenue earned or expenses incurred over a specified period of time in the future and it is generally prepared on a periodic basis which can be either monthly, quarterly, half-yearly, or annually. It helps a business, an organization, or even an individual to manage the money effectively. A budget also helps in monitoring the performance of the people in the organization and helps in better decision-making.

Sales Budget and Selling

A budget is a financial plan designed by an undertaking for a definite period in future which acts as a major contributor towards enhancing the financial success of the business undertaking. The budget generally takes into account both current and future income and expenses.

Step by step

Solved in 4 steps with 11 images