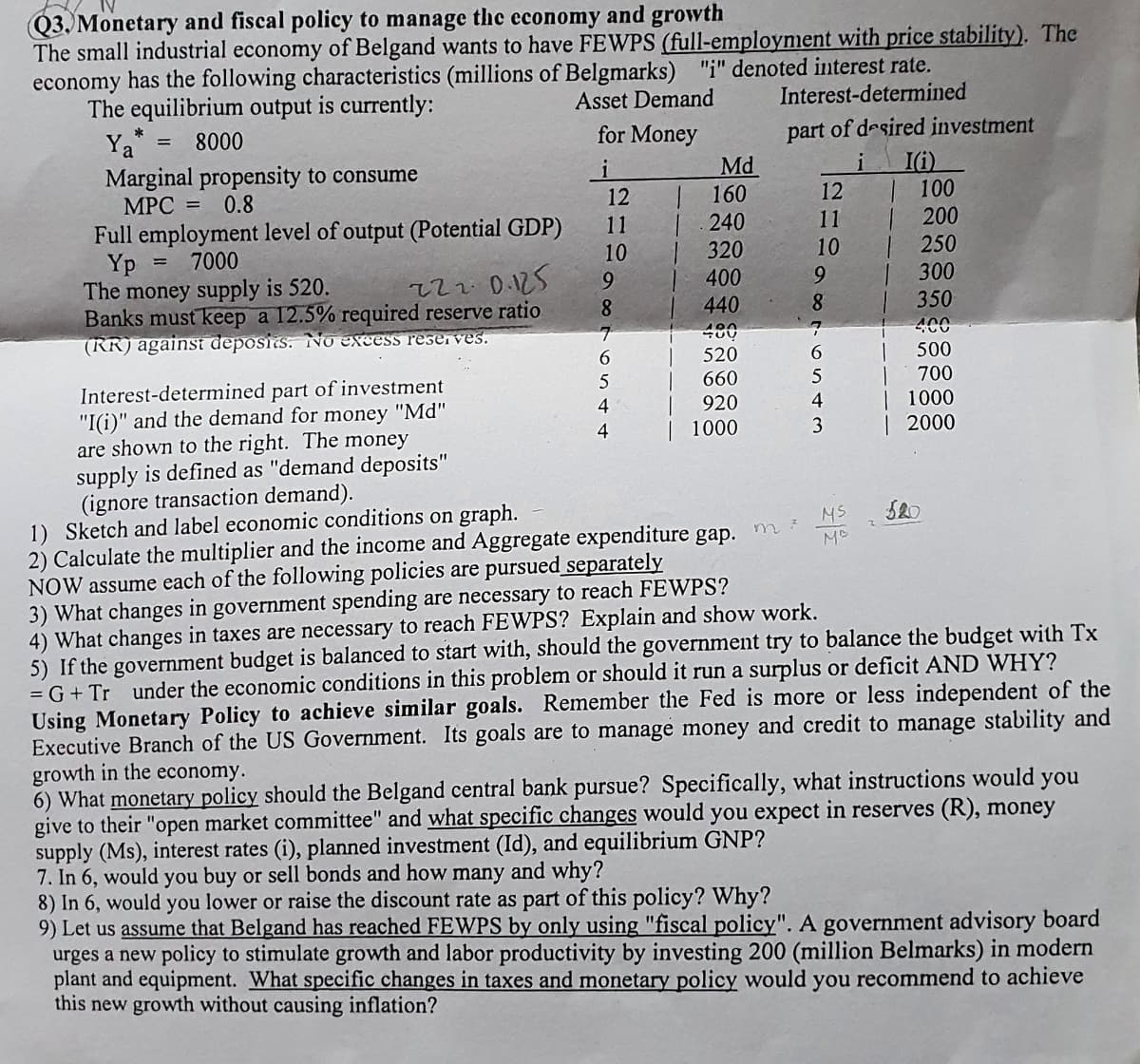

Q3. Monetary and fiscal policy to manage the economy and growth The small industrial economy of Belgand wants to have FEWPS (full-employment with price stability). The economy has the following characteristics (millions of Belgmarks) "i" denoted interest rate. The equilibrium output is currently: Asset Demand Interest-determined Ya* 8000 for Money part of desired investment i i I(i) Marginal propensity to consume 0.8 MPC = Full employment level of output (Potential GDP) Yp = 7000 The money supply is 520. 2220.125 Banks must keep a 12.5% required reserve ratio (RR) against deposits. No excess reserves. 12 11 10 9 8 7 6 5 Md 4 160 240 320 400 440 480 520 660 920 | 1000 12 11 10 m 9 8 7 6 5 4 3 Interest-determined part of investment "I(i)" and the demand for money "Md" are shown to the right. The money supply is defined as "demand deposits" (ignore transaction demand). 1) Sketch and label economic conditions on graph. Calculate the multiplier and the income and Aggregate expenditure gap. NOW assume each of the following policies are pursued separately 3) What changes in government spending are necessary to reach FEWPS? 4) What changes in taxes are necessary to reach FEWPS? Explain and show work. 5) If the government budget is balanced to start with, should the government try to balance the budget with Tx = G + Tr under the economic conditions in this problem or should it run a surplus or deficit AND WHY? Using Monetary Policy to achieve similar goals. Remember the Fed is more or less independent of the Executive Branch of the US Government. Its goals are to manage money and credit to manage stability and growth in the economy. | 100 | 200 250 300 350 400 500 700 | 1000 | 2000 MS Mo 520 6) What monetary policy should the Belgand central bank pursue? Specifically, what instructions would you give to their "open market committee" and what specific changes would you expect in reserves (R), money supply (Ms), interest rates (i), planned investment (Id), and equilibrium GNP? 7. In 6, would you buy or sell bonds and how many and why? 8) In 6, would you lower or raise the discount rate as part of this policy? Why? 9) Let us assume that Belgand has reached FEWPS by only using "fiscal policy". A government advisory board urges a new policy to stimulate growth and labor productivity by investing 200 (million Belmarks) in modern plant and equipment. What specific changes in taxes and monetary policy would you recommend to achieve this new growth without causing inflation?

Q3. Monetary and fiscal policy to manage the economy and growth The small industrial economy of Belgand wants to have FEWPS (full-employment with price stability). The economy has the following characteristics (millions of Belgmarks) "i" denoted interest rate. The equilibrium output is currently: Asset Demand Interest-determined Ya* 8000 for Money part of desired investment i i I(i) Marginal propensity to consume 0.8 MPC = Full employment level of output (Potential GDP) Yp = 7000 The money supply is 520. 2220.125 Banks must keep a 12.5% required reserve ratio (RR) against deposits. No excess reserves. 12 11 10 9 8 7 6 5 Md 4 160 240 320 400 440 480 520 660 920 | 1000 12 11 10 m 9 8 7 6 5 4 3 Interest-determined part of investment "I(i)" and the demand for money "Md" are shown to the right. The money supply is defined as "demand deposits" (ignore transaction demand). 1) Sketch and label economic conditions on graph. Calculate the multiplier and the income and Aggregate expenditure gap. NOW assume each of the following policies are pursued separately 3) What changes in government spending are necessary to reach FEWPS? 4) What changes in taxes are necessary to reach FEWPS? Explain and show work. 5) If the government budget is balanced to start with, should the government try to balance the budget with Tx = G + Tr under the economic conditions in this problem or should it run a surplus or deficit AND WHY? Using Monetary Policy to achieve similar goals. Remember the Fed is more or less independent of the Executive Branch of the US Government. Its goals are to manage money and credit to manage stability and growth in the economy. | 100 | 200 250 300 350 400 500 700 | 1000 | 2000 MS Mo 520 6) What monetary policy should the Belgand central bank pursue? Specifically, what instructions would you give to their "open market committee" and what specific changes would you expect in reserves (R), money supply (Ms), interest rates (i), planned investment (Id), and equilibrium GNP? 7. In 6, would you buy or sell bonds and how many and why? 8) In 6, would you lower or raise the discount rate as part of this policy? Why? 9) Let us assume that Belgand has reached FEWPS by only using "fiscal policy". A government advisory board urges a new policy to stimulate growth and labor productivity by investing 200 (million Belmarks) in modern plant and equipment. What specific changes in taxes and monetary policy would you recommend to achieve this new growth without causing inflation?

Brief Principles of Macroeconomics (MindTap Course List)

8th Edition

ISBN:9781337091985

Author:N. Gregory Mankiw

Publisher:N. Gregory Mankiw

Chapter16: The Influence Of Monetary And Fiscal Policy On Aggregate Demand

Section: Chapter Questions

Problem 8PA

Related questions

Question

Transcribed Image Text:Q3. Monetary and fiscal policy to manage the economy and growth

The small industrial economy of Belgand wants to have FEWPS (full-employment with price stability). The

economy has the following characteristics (millions of Belgmarks) "i" denoted interest rate.

The equilibrium output is currently:

Ya*

Marginal propensity to consume

Asset Demand

Interest-determined

8000

for Money

part of desired investment

%3D

I(i)

| 100

| 200

250

Md

160

i

MPC =

0.8

12

12

Full employment level of output (Potential GDP)

Yp

The money supply is 520.

Banks must keep a 12.5% required reserve ratio

(RR) against deposits. No ENcess reserves.

11

240

11

7000

10

320

10

222 0.125

8.

9.

400

9.

300

440

8.

350

480

400

6.

520

6

500

Interest-determined part of investment

"I(i)" and the demand for money

are shown to the right. The money

supply is defined as "demand deposits"

(ignore transaction demand).

1) Sketch and label economic conditions on graph.

2) Calculate the multiplier and the income and Aggregate expenditure gap.

NOW assume each of the following policies are pursued separately

3) What changes in government spending are necessary to reach FEWPS?

4) What changes in taxes are necessary to reach FEWPS? Explain and show work.

5) If the government budget is balanced to start with, should the government try to balance the budget with Tx

= G + Tr under the economic conditions in this problem or should it run a surplus or deficit AND WHY?

Using Monetary Policy to achieve similar goals. Remember the Fed is more or less independent of the

Executive Branch of the US Government. Its goals are to manage money and credit to manage stability and

growth in the economy.

6) What monetary policy should the Belgand central bank pursue? Specifically, what instructions would you

give to their "open market committee" and what specific changes would you expect in reserves (R), money

supply (Ms), interest rates (i), planned investment (Id), and equilibrium GNP?

7. In 6, would you buy or sell bonds and how many and why?

8) In 6, would you lower or raise the discount rate as part of this policy? Why?

9) Let us assume that Belgand has reached FEWPS by only using "fiscal policy". A government advisory board

urges a new policy to stimulate growth and labor productivity by investing 200 (million Belmarks) in modern

plant and equipment. What specific changes in taxes and monetary policy would you recommend to achieve

this new growth without causing inflation?

660

5

700

"Md"

4

920

4

1000

4

| 1000

3

2000

M5

MC

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 4 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Recommended textbooks for you

Brief Principles of Macroeconomics (MindTap Cours…

Economics

ISBN:

9781337091985

Author:

N. Gregory Mankiw

Publisher:

Cengage Learning

Essentials of Economics (MindTap Course List)

Economics

ISBN:

9781337091992

Author:

N. Gregory Mankiw

Publisher:

Cengage Learning

Principles of Economics (MindTap Course List)

Economics

ISBN:

9781305585126

Author:

N. Gregory Mankiw

Publisher:

Cengage Learning

Brief Principles of Macroeconomics (MindTap Cours…

Economics

ISBN:

9781337091985

Author:

N. Gregory Mankiw

Publisher:

Cengage Learning

Essentials of Economics (MindTap Course List)

Economics

ISBN:

9781337091992

Author:

N. Gregory Mankiw

Publisher:

Cengage Learning

Principles of Economics (MindTap Course List)

Economics

ISBN:

9781305585126

Author:

N. Gregory Mankiw

Publisher:

Cengage Learning

Principles of Macroeconomics (MindTap Course List)

Economics

ISBN:

9781305971509

Author:

N. Gregory Mankiw

Publisher:

Cengage Learning

Principles of Economics, 7th Edition (MindTap Cou…

Economics

ISBN:

9781285165875

Author:

N. Gregory Mankiw

Publisher:

Cengage Learning

Principles of Macroeconomics (MindTap Course List)

Economics

ISBN:

9781285165912

Author:

N. Gregory Mankiw

Publisher:

Cengage Learning