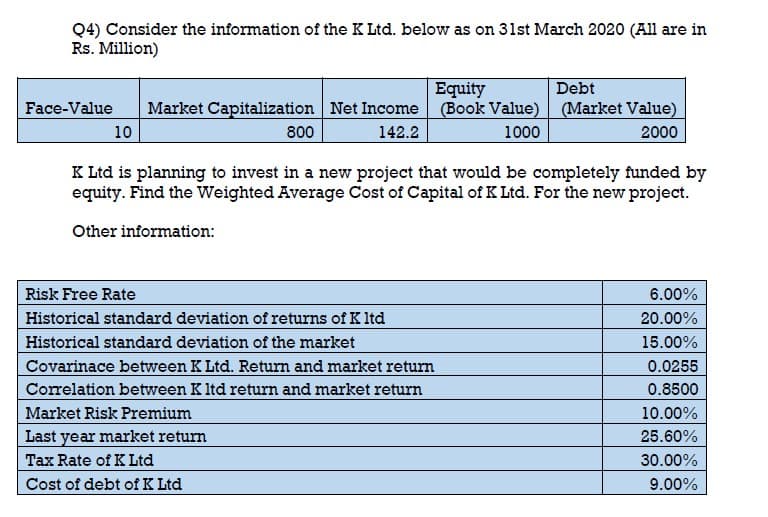

Q4) Consider the information of the K Ltd. below as on 31st March 2020 (All are in Rs. Million) Equity Market Capitalization Net Income (Book Value) (Market Value) 142.2 Debt Face-Value 10 800 1000 2000 K Ltd is planning to invest in a new project that would be completely funded by equity. Find the Weighted Average Cost of Capital of K Ltd. For the new project. Other information: Risk Free Rate Historical standard deviation of returns of K ltd Historical standard deviation of the market Covarinace between K Ltd. Return and market return 6.00% 20.00% 15.00% 0.0255 Correlation between K ltd return and market return 0.8500 Market Risk Premium Last year market return Tax Rate of KLtd 10.00% 25.60% 30.00% Cost of debt of K Ltd 9.00%

Q4) Consider the information of the K Ltd. below as on 31st March 2020 (All are in Rs. Million) Equity Market Capitalization Net Income (Book Value) (Market Value) 142.2 Debt Face-Value 10 800 1000 2000 K Ltd is planning to invest in a new project that would be completely funded by equity. Find the Weighted Average Cost of Capital of K Ltd. For the new project. Other information: Risk Free Rate Historical standard deviation of returns of K ltd Historical standard deviation of the market Covarinace between K Ltd. Return and market return 6.00% 20.00% 15.00% 0.0255 Correlation between K ltd return and market return 0.8500 Market Risk Premium Last year market return Tax Rate of KLtd 10.00% 25.60% 30.00% Cost of debt of K Ltd 9.00%

Chapter15: Harvesting The Business Venture Investment

Section: Chapter Questions

Problem 1eM

Related questions

Question

Find the Weighted Average Cost of Capital of K Ltd. For the new project.

Transcribed Image Text:Q4) Consider the information of the K Ltd. below as on 31st March 2020 (All are in

Rs. Million)

Debt

Equity

Market Capitalization Net Income (Book Value) (Market Value)

Face-Value

10

800

142.2

1000

2000

K Ltd is planning to invest in a new project that would be completely funded by

equity. Find the Weighted Average Cost of Capital of K Ltd. For the new project.

Other infor

on:

Risk Free Rate

6.00%

Historical standard deviation of returns of Kltd

20.00%

Historical standard deviation of the market

15.00%

Covarinace between K Ltd. Return and market return

0.0255

Correlation between K ltd return and market return

0.8500

Market Risk Premium

10.00%

Last year market return

25.60%

Tax Rate of KLtd

30.00%

Cost of debt of K Ltd

9.00%

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you