On the basis of the financial information given in this case, complete the WACC table that is prepared for this project . What was the WACC for Atlassian as at 2022? What was the WACC one year earlier? Estimate the important financial information such as the after-tax cost of debt, the risk-free rate, the market risk premium, the cost of equity and the weight of debt and equity. Clearly specify and justify the assumptions and calculations required for these analyses (ie. how did you select the beta, risk-free rate, market return, etc). WACC Calculation for Atlasian 2021 2022 Shares Outstanding (in millions) Share Price Market Value Equity Total Market Value of Debt Total Capital - Atlassian Weight of Debt Weight of Equity Cost of Debt Effective Interest Rate for Atlassian Tax Rate After-tax Cost of Debt Cost of Equity Beta Market risk premium Rf Cost of Equity

On the basis of the financial information given in this case, complete the WACC table that is prepared for this project . What was the WACC for Atlassian as at 2022? What was the WACC one year earlier? Estimate the important financial information such as the after-tax cost of debt, the risk-free rate, the market risk premium, the cost of equity and the weight of debt and equity. Clearly specify and justify the assumptions and calculations required for these analyses (ie. how did you select the beta, risk-free rate, market return, etc). WACC Calculation for Atlasian 2021 2022 Shares Outstanding (in millions) Share Price Market Value Equity Total Market Value of Debt Total Capital - Atlassian Weight of Debt Weight of Equity Cost of Debt Effective Interest Rate for Atlassian Tax Rate After-tax Cost of Debt Cost of Equity Beta Market risk premium Rf Cost of Equity

Chapter18: Long-term Debt Financing

Section: Chapter Questions

Problem 2IEE

Related questions

Question

On the basis of the financial information given in this case, complete the WACC table that is prepared for this project . What was the WACC for Atlassian as at 2022? What was the WACC one year earlier? Estimate the important financial information such as the after-tax cost of debt, the risk-free rate, the market risk premium, the

| WACC Calculation for Atlasian | ||

| 2021 | 2022 | |

| Shares Outstanding (in millions) | ||

| Share Price | ||

| Market Value Equity | ||

| Total Market Value of Debt | ||

| Total Capital - Atlassian | ||

| Weight of Debt | ||

| Weight of Equity | ||

| Cost of Debt | ||

| Effective Interest Rate for Atlassian | ||

| Tax Rate | ||

| After-tax Cost of Debt | ||

| Cost of Equity | ||

| Beta | ||

| Market risk premium | ||

| Rf | ||

| Cost of Equity | ||

| WACC |

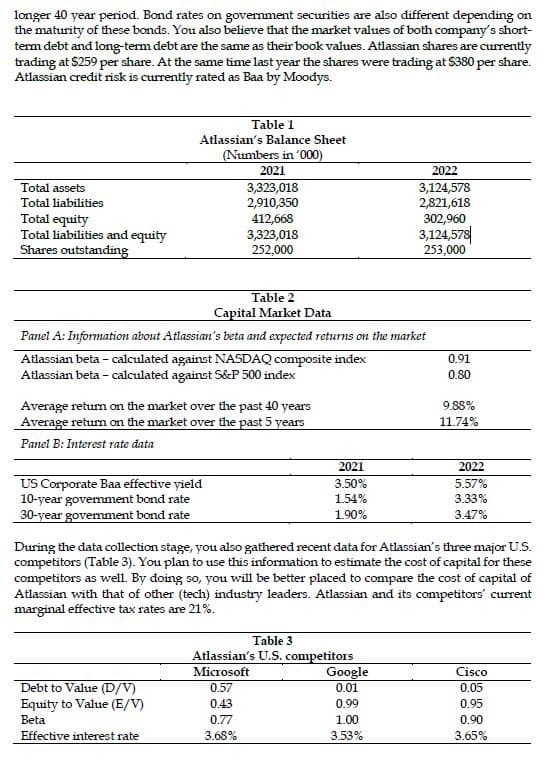

Transcribed Image Text:longer 40 year period. Bond rates on government securities are also different depending on

the maturity of these bonds. You also believe that the market values of both company's short-

term debt and long-term debt are the same as their book values. Atlassian shares are currently

trading at $259 per share. At the same time last year the shares were trading at $380 per share.

Atlassian credit risk is currently rated as Baa by Moodys.

Total assets

Total liabilities

Total equity

Total liabilities and equity

Shares outstanding

Table 1

Atlassian's Balance Sheet

(Numbers in '000)

US Corporate Baa effective yield

10-year government bond rate

30-year government bond rate

2021

3,323,018

2,910,350

412,668

Average return on the market over the past 40 years

Average return on the market over the past 5 years

Panel B: Interest rate data

Debt to Value (D/V)

Equity to Value (E/V)

Beta

Effective interest rate

3,323,018

252,000

Table 2

Capital Market Data

Panel A: Information about Atlassian's beta and expected returns on the market

Atlassian beta-calculated against NASDAQ composite index

Atlassian beta - calculated against S&P 500 index

0.77

3.68%

2021

3.50%

1.54%

1.90%

Table 3

Atlassian's U.S. competitors

Microsoft

0.57

0.43

2022

3,124,578

2,821,618

During the data collection stage, you also gathered recent data for Atlassian's three major U.S.

competitors (Table 3). You plan to use this information to estimate the cost of capital for these

competitors as well. By doing so, you will be better placed to compare the cost of capital of

Atlassian with that of other (tech) industry leaders. Atlassian and its competitors' current

marginal effective tax rates are 21%.

Google

0.01

0.99

302,960

3,124,578

253,000

1.00

3.53%

0.91

0.80

9.88%

11.74%

2022

5.57%

3.33%

3.47%

Cisco

0.05

0.95

0.90

3.65%

Transcribed Image Text:Estimating Atlassian's Cost of Capital During the Post-Pandemic Economic

Recovery Period

Case

Description/Requirements:

You are the portfolio manager of a U.S. based mutual fund company that is managing a

technology fund which holds an investment portfolio of large U.S. technology companies,

including Atlassian, Microsoft, Google, and Cisco. On September 14, 2022, you considered

purchasing additional Atlassian shares for your fund. You decided to perform a

comprehensive capital budgeting analysis on Atlassian's current investment projects to

determine the financial merits of such a decision.

The cost of capital that your team has been employing to evaluate Atlassian's projects was

estimated in early 2019. You believe that the estimation of cost of capital should be re-

estimated due to the uncertainty of the U.S. financial market following the outbreak of the

COVID-19 pandemic and the global turmoil caused by economic and geostrategic

developments. You intend to use the weighted average cost of capital (WACC) approach,

which is obtained using the following equation:

E

WACC = · ( ) × ² × ( 1 – t) + ( ) × ₁

-

where:

rp = Pre-tax cost of debt capital

te = Marginal effective corporate tax rate

re = Cost of equity capital

D/V = Proportion of debt in a market-value capital structure

E/V = Proportion of equity in a market-value capital structure

You gathered the necessary accounting information, stock price data and market data from

Atlassian's Financial Reports and other data sources. Table 1 presents the Balance Sheet

information of Atlassian as at 2021 and 2022. Table 2 presents the market data that relates to

Atlassian. You notice that some of the metrics that you collected differ depending on the way

that they are calculated. For example, the beta of Atlassian is different depending on whether

it is calculated against the NASDAQ or the S&P500 index.¹ Likewise, the expected return of

the market differs depending on whether this is calculated over a shorter 5-year period or

'The NASDAQ Composite index is skewed towards technology firms, with up to roughly 50% of the overall

composition of the index made up of stocks from the technology sector. In contrast, the S&P 500 index offers a

more equal representation of industries in the economy.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 5 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

Fundamentals Of Financial Management, Concise Edi…

Finance

ISBN:

9781337902571

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Pfin (with Mindtap, 1 Term Printed Access Card) (…

Finance

ISBN:

9780357033609

Author:

Randall Billingsley, Lawrence J. Gitman, Michael D. Joehnk

Publisher:

Cengage Learning

Fundamentals Of Financial Management, Concise Edi…

Finance

ISBN:

9781337902571

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Pfin (with Mindtap, 1 Term Printed Access Card) (…

Finance

ISBN:

9780357033609

Author:

Randall Billingsley, Lawrence J. Gitman, Michael D. Joehnk

Publisher:

Cengage Learning