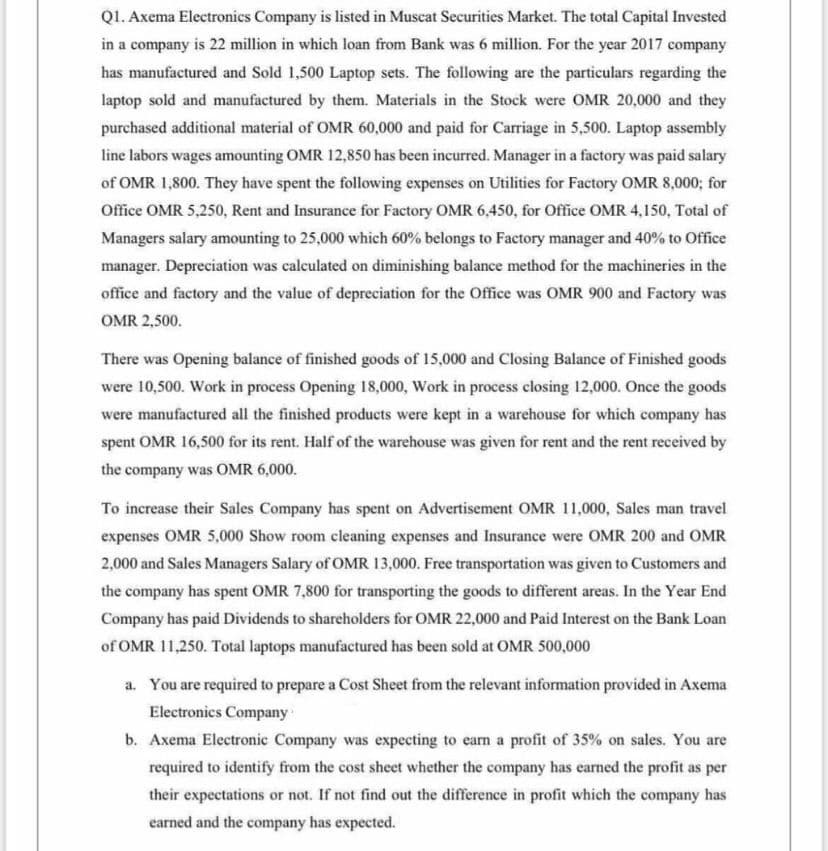

QI. Axema Electronics Company is listed in Muscat Securities Market. The total Capital Invested in a company is 22 million in which loan from Bank was 6 million. For the year 2017 company has manufactured and Sold 1,500 Laptop sets. The following are the particulars regarding the laptop sold and manufactured by them. Materials in the Stock were OMR 20,000 and they purchased additional material of OMR 60,000 and paid for Carriage in 5,500. Laptop assembly line labors wages amounting OMR 12,850 has been incurred. Manager in a factory was paid salary of OMR 1,800. They have spent the following expenses on Utilities for Factory OMR 8,000; for Office OMR 5,250, Rent and Insurance for Factory OMR 6,450, for Office OMR 4,150, Total of Managers salary amounting to 25,000 which 60% belongs to Factory manager and 40% to Office manager. Depreciation was calculated on diminishing balance method for the machineries in the office and factory and the value of depreciation for the Office was OMR 900 and Factory was OMR 2,500. There was Opening balance of finished goods of 15,000 and Closing Balance of Finished goods were 10,500. Work in process Opening 18,000, Work in process closing 12,000. Once the goods were manufactured all the finished products were kept in a warehouse for which company has spent OMR 16,500 for its rent. Half of the warehouse was given for rent and the rent received by the company was OMR 6,000. To increase their Sales Company has spent on Advertisement OMR 11,000, Sales man travel expenses OMR 5,000 Show room cleaning expenses and Insurance were OMR 200 and OMR 2,000 and Sales Managers Salary of OMR 13,000. Free transportation was given to Customers and the company has spent OMR 7,800 for transporting the goods to different areas. In the Year End Company has paid Dividends to shareholders for OMR 22,000 and Paid Interest on the Bank Loan of OMR 11,250. Total laptops manufactured has been sold at OMR 500,000 a. You are required to prepare a Cost Sheet from the relevant information provided in Axema Electronics Company b. Axema Electronic Company was expecting to earn a profit of 35% on sales. You are required to identify from the cost sheet whether the company has earned the profit as per their expectations or not. If not find out the difference in profit which the company has earned and the company has expected.

QI. Axema Electronics Company is listed in Muscat Securities Market. The total Capital Invested in a company is 22 million in which loan from Bank was 6 million. For the year 2017 company has manufactured and Sold 1,500 Laptop sets. The following are the particulars regarding the laptop sold and manufactured by them. Materials in the Stock were OMR 20,000 and they purchased additional material of OMR 60,000 and paid for Carriage in 5,500. Laptop assembly line labors wages amounting OMR 12,850 has been incurred. Manager in a factory was paid salary of OMR 1,800. They have spent the following expenses on Utilities for Factory OMR 8,000; for Office OMR 5,250, Rent and Insurance for Factory OMR 6,450, for Office OMR 4,150, Total of Managers salary amounting to 25,000 which 60% belongs to Factory manager and 40% to Office manager. Depreciation was calculated on diminishing balance method for the machineries in the office and factory and the value of depreciation for the Office was OMR 900 and Factory was OMR 2,500. There was Opening balance of finished goods of 15,000 and Closing Balance of Finished goods were 10,500. Work in process Opening 18,000, Work in process closing 12,000. Once the goods were manufactured all the finished products were kept in a warehouse for which company has spent OMR 16,500 for its rent. Half of the warehouse was given for rent and the rent received by the company was OMR 6,000. To increase their Sales Company has spent on Advertisement OMR 11,000, Sales man travel expenses OMR 5,000 Show room cleaning expenses and Insurance were OMR 200 and OMR 2,000 and Sales Managers Salary of OMR 13,000. Free transportation was given to Customers and the company has spent OMR 7,800 for transporting the goods to different areas. In the Year End Company has paid Dividends to shareholders for OMR 22,000 and Paid Interest on the Bank Loan of OMR 11,250. Total laptops manufactured has been sold at OMR 500,000 a. You are required to prepare a Cost Sheet from the relevant information provided in Axema Electronics Company b. Axema Electronic Company was expecting to earn a profit of 35% on sales. You are required to identify from the cost sheet whether the company has earned the profit as per their expectations or not. If not find out the difference in profit which the company has earned and the company has expected.

Chapter1: Financial Statements And Business Decisions

Section: Chapter Questions

Problem 1Q

Related questions

Question

Transcribed Image Text:Q1. Axema Electronics Company is listed in Muscat Securities Market. The total Capital Invested

in a company is 22 million in which loan from Bank was 6 million. For the year 2017 company

has manufactured and Sold 1,500 Laptop sets. The following are the particulars regarding the

laptop sold and manufactured by them. Materials in the Stock were OMR 20,000 and they

purchased additional material of OMR 60,000 and paid for Carriage in 5,500. Laptop assembly

line labors wages amounting OMR 12,850 has been incurred. Manager in a factory was paid salary

of OMR 1,800. They have spent the following expenses on Utilities for Factory OMR 8,000; for

Office OMR 5,250, Rent and Insurance for Factory OMR 6,450, for Office OMR 4,150, Total of

Managers salary amounting to 25,000 which 60% belongs to Factory manager and 40% to Office

manager. Depreciation was calculated on diminishing balance method for the machineries in the

office and factory and the value of depreciation for the Office was OMR 900 and Factory was

OMR 2,500.

There was Opening balance of finished goods of 15,000 and Closing Balance of Finished goods

were 10,500. Work in process Opening 18,000, Work in process closing 12,000. Once the goods

were manufactured all the finished products were kept in a warehouse for which company has

spent OMR 16,500 for its rent. Half of the warehouse was given for rent and the rent received by

the company was OMR 6,000.

To increase their Sales Company has spent on Advertisement OMR 11,000, Sales man travel

expenses OMR 5,000 Show room cleaning expenses and Insurance were OMR 200 and OMR

2,000 and Sales Managers Salary of OMR 13,000. Free transportation was given to Customers and

the company has spent OMR 7,800 for transporting the goods to different areas. In the Year End

Company has paid Dividends to shareholders for OMR 22,000 and Paid Interest on the Bank Loan

of OMR 11,250. Total laptops manufactured has been sold at OMR 500,000

a. You are required to prepare a Cost Sheet from the relevant information provided in Axema

Electronics Company

b. Axema Electronic Company was expecting to earn a profit of 35% on sales. You are

required to identify from the cost sheet whether the company has earned the profit as per

their expectations or not. If not find out the difference in profit which the company has

earned and the company has expected.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Accounting

Accounting

ISBN:

9781337272094

Author:

WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:

Cengage Learning,

Accounting Information Systems

Accounting

ISBN:

9781337619202

Author:

Hall, James A.

Publisher:

Cengage Learning,

Accounting

Accounting

ISBN:

9781337272094

Author:

WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:

Cengage Learning,

Accounting Information Systems

Accounting

ISBN:

9781337619202

Author:

Hall, James A.

Publisher:

Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis…

Accounting

ISBN:

9780134475585

Author:

Srikant M. Datar, Madhav V. Rajan

Publisher:

PEARSON

Intermediate Accounting

Accounting

ISBN:

9781259722660

Author:

J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:

McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:

9781259726705

Author:

John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:

McGraw-Hill Education