Li Corp. purchased a container load of antiques for resale at an invoice cost of $1,600,000. The goods were paid for when they were shipped in early June. The container arrived in Canada at the end of August, and then at Li's location, by rail, at the end of September. The goods were then available for sale. Freight costs of $168,000 were paid in October. Li has recorded $100,800 of total interest expense from $2,400,000 of general borrowing over the year. Required: Prepare the adjusting journal entry to capitalize borrowing costs on inventory at year-end December 31. (If no entry is required for a transaction/event, select "No journal entry required" in the first account field. Do not round intermediate calculations.)

Li Corp. purchased a container load of antiques for resale at an invoice cost of $1,600,000. The goods were paid for when they were shipped in early June. The container arrived in Canada at the end of August, and then at Li's location, by rail, at the end of September. The goods were then available for sale. Freight costs of $168,000 were paid in October. Li has recorded $100,800 of total interest expense from $2,400,000 of general borrowing over the year. Required: Prepare the adjusting journal entry to capitalize borrowing costs on inventory at year-end December 31. (If no entry is required for a transaction/event, select "No journal entry required" in the first account field. Do not round intermediate calculations.)

Chapter11: Long-term Assets

Section: Chapter Questions

Problem 10PA: Buchanan Imports purchased McLaren Corporation for $5,000,000 cash when McLaren had net assets worth...

Related questions

Question

Transcribed Image Text:Li Corp. purchased a container load of antiques for resale at an invoice cost of $1,600,000. The goods were paid for when they were

shipped in early June. The container arrived in Canada at the end of August, and then at Li's location, by rail, at the end of September.

The goods were then available for sale. Freight costs of $168,000 were paid in October. Li has recorded $100,800 of total interest

expense from $2,400,000 of general borrowing over the year.

Required:

Prepare the adjusting journal entry to capitalize borrowing costs on inventory at year-end December 31. (If no entry is required for a

transaction/event, select "No journal entry required" in the first account field. Do not round intermediate calculations.)

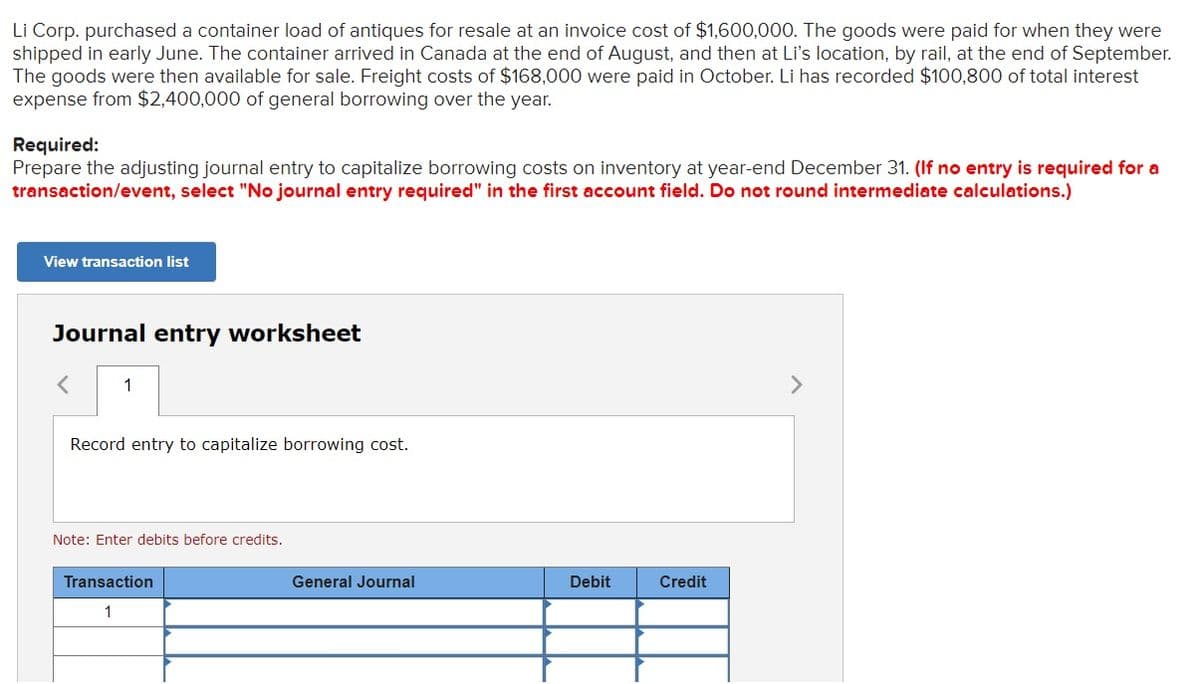

View transaction list

Journal entry worksheet

1

<>

Record entry to capitalize borrowing cost.

Note: Enter debits before credits.

Transaction

General Journal

Debit

Credit

1

Transcribed Image Text:View transaction list

1 Record entry to capitalize borrowing cost.

Credit

Note :

= journal entry has been entered

Record entry

Clear entry

View general journal

......

......

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning