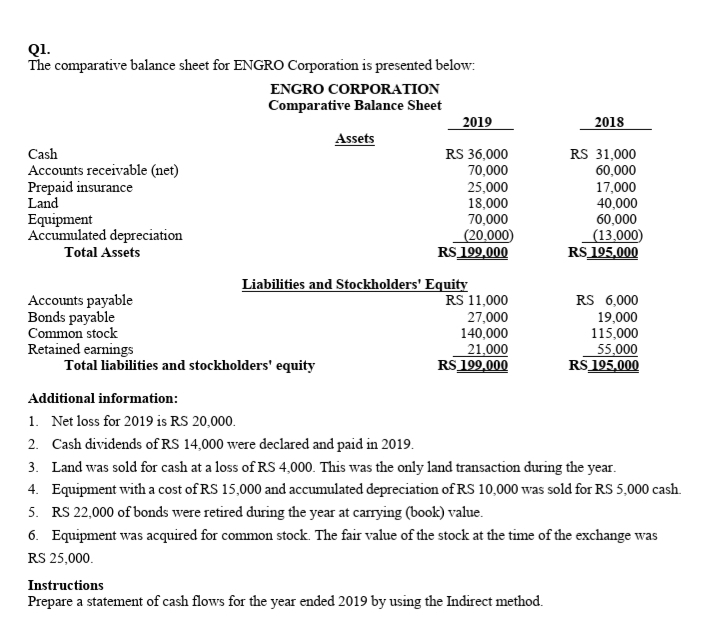

Ql. The comparative balance sheet for ENGRO Corporation is presented below: ENGRO CORPORATION Comparative Balance Sheet 2019 2018 Assets Cash RS 36,000 RS 31,000 Accounts receivable (net) Prepaid insurance Land Equipment Accumulated depreciation Total Assets 70,000 25,000 18,000 70,000 (20,000) RS 199,000 60,000 17,000 40,000 60,000 _(13,000) RS 195,000 Accounts payable Bonds payable Common stock Retained earnings Total liabilities and stockholders' equity Liabilities and Stockholders' Equity RS 11,000 27,000 140,000 RS 6,000 19,000 115,000 55,000 RS 195,000 21.000 RS 199,000 Additional information: 1. Net loss for 2019 is RS 20,000. 2. Cash dividends of RS 14,000 were declared and paid in 2019. 3. Land was sold for cash at a loss of RS 4,000. This was the only land transaction during the year. 4. Equipment with a cost of RS 15,000 and accumulated depreciation of RS 10,000 was sold for RS 5,000 cash. 5. RS 22,000 of bonds were retired during the year at carrying (book) value. 6. Equipment was acquired for common stock. The fair value of the stock at the time of the exchange was RS 25,000. Instructions Prepare a statement of cash flows for the year ended 2019 by using the Indirect method.

Ql. The comparative balance sheet for ENGRO Corporation is presented below: ENGRO CORPORATION Comparative Balance Sheet 2019 2018 Assets Cash RS 36,000 RS 31,000 Accounts receivable (net) Prepaid insurance Land Equipment Accumulated depreciation Total Assets 70,000 25,000 18,000 70,000 (20,000) RS 199,000 60,000 17,000 40,000 60,000 _(13,000) RS 195,000 Accounts payable Bonds payable Common stock Retained earnings Total liabilities and stockholders' equity Liabilities and Stockholders' Equity RS 11,000 27,000 140,000 RS 6,000 19,000 115,000 55,000 RS 195,000 21.000 RS 199,000 Additional information: 1. Net loss for 2019 is RS 20,000. 2. Cash dividends of RS 14,000 were declared and paid in 2019. 3. Land was sold for cash at a loss of RS 4,000. This was the only land transaction during the year. 4. Equipment with a cost of RS 15,000 and accumulated depreciation of RS 10,000 was sold for RS 5,000 cash. 5. RS 22,000 of bonds were retired during the year at carrying (book) value. 6. Equipment was acquired for common stock. The fair value of the stock at the time of the exchange was RS 25,000. Instructions Prepare a statement of cash flows for the year ended 2019 by using the Indirect method.

Survey of Accounting (Accounting I)

8th Edition

ISBN:9781305961883

Author:Carl Warren

Publisher:Carl Warren

Chapter9: Metric-analysis Of Financial Statements

Section: Chapter Questions

Problem 9.4.10P: Twenty metrics of liquidity, solvency, and profitability The comparative financial statements of...

Related questions

Question

Transcribed Image Text:Q1.

The comparative balance sheet for ENGROo Corporation is presented below:

ENGRO CORPORATION

Comparative Balance Sheet

2019

2018

Assets

Cash

RS 36,000

70,000

RS 31,000

60,000

Accounts receivable (net)

Prepaid insurance

Land

Equipment

Accumulated depreciation

Total Assets

25,000

18,000

70,000

(20,000)

RS 199,000

17,000

40,000

60,000

(13,000)

RS 195,000

Liabilities and Stockholders' Equity

RS 11,000

Accounts payable

Bonds payable

RS 6,000

27,000

140,000

19,000

115,000

Common stock

Retained earnings

Total liabilities and stockholders' equity

21,000

RS 199,000

55,000

RS 195,000

Additional information:

1. Net loss for 2019 is RS 20,000.

2. Cash dividends of RS 14,000 were declared and paid in 2019.

3. Land was sold for cash at a loss of RS 4,000. This was the only land transaction during the year.

4. Equipment with a cost of RS 15,000 and accumulated depreciation of RS 10,000 was sold for RS 5,000 cash.

5. RS 22,000 of bonds were retired during the year at carrying (book) value.

6. Equipment was acquired for common stock. The fair value of the stock at the time of the exchange was

RS 25,000.

Instructions

Prepare a statement of cash flows for the year ended 2019 by using the Indirect method.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 4 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning