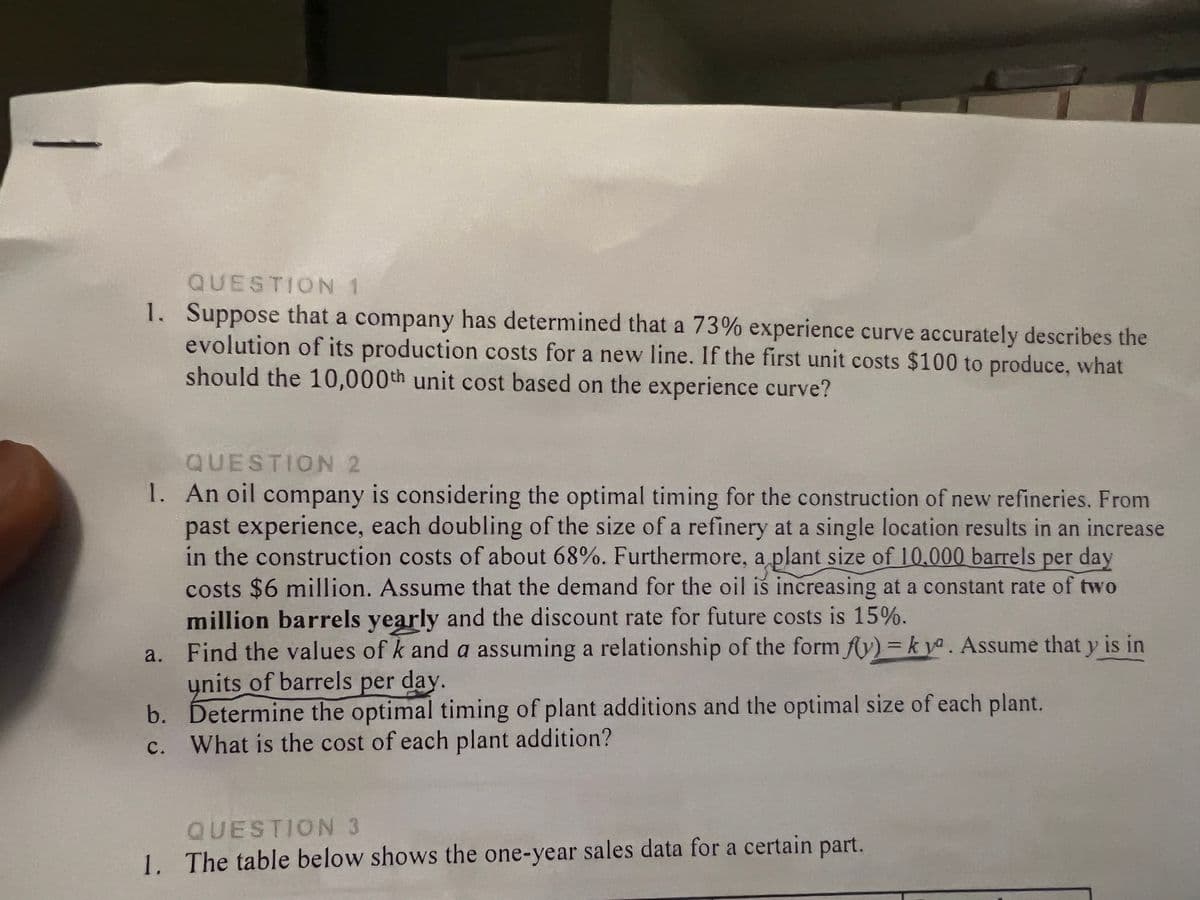

QUESTION 1 1. Suppose that a company has determined that a 73% experience curve accurately describes the evolution of its production costs for a new line. If the first unit costs $100 to produce, what should the 10,000th unit cost based on the experience curve?

QUESTION 1 1. Suppose that a company has determined that a 73% experience curve accurately describes the evolution of its production costs for a new line. If the first unit costs $100 to produce, what should the 10,000th unit cost based on the experience curve?

Elements Of Electromagnetics

7th Edition

ISBN:9780190698614

Author:Sadiku, Matthew N. O.

Publisher:Sadiku, Matthew N. O.

ChapterMA: Math Assessment

Section: Chapter Questions

Problem 1.1MA

Related questions

Question

Q2

Transcribed Image Text:QUESTION 1

1. Suppose that a company has determined that a 73% experience curve accurately describes the

evolution of its production costs for a new line. If the first unit costs $100 to produce, what

should the 10,000th unit cost based on the experience curve?

QUESTION 2

1. An oil company is considering the optimal timing for the construction of new refineries. From

past experience, each doubling of the size of a refinery at a single location results in an increase

in the construction costs of about 68%. Furthermore, a plant size of 10.000 barrels per day

costs $6 million. Assume that the demand for the oil is increasing at a constant rate of two

million barrels yearly and the discount rate for future costs is 15%.

a. Find the values of k and a assuming a relationship of the form fy) = k ya. Assume that y is in

ynits of barrels per day.

b. Determine the optimal timing of plant additions and the optimal size of each plant.

c. What is the cost of each plant addition?

с.

QUESTION 3

1. The table below shows the one-year sales data for a certain part.

Expert Solution

Step 1

Solution:

Given Data:

Note: Dear Student! As per our guidelines, we are only allowed to answer a single question. Kindly repost the other questions again.

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, mechanical-engineering and related others by exploring similar questions and additional content below.Recommended textbooks for you

Elements Of Electromagnetics

Mechanical Engineering

ISBN:

9780190698614

Author:

Sadiku, Matthew N. O.

Publisher:

Oxford University Press

Mechanics of Materials (10th Edition)

Mechanical Engineering

ISBN:

9780134319650

Author:

Russell C. Hibbeler

Publisher:

PEARSON

Thermodynamics: An Engineering Approach

Mechanical Engineering

ISBN:

9781259822674

Author:

Yunus A. Cengel Dr., Michael A. Boles

Publisher:

McGraw-Hill Education

Elements Of Electromagnetics

Mechanical Engineering

ISBN:

9780190698614

Author:

Sadiku, Matthew N. O.

Publisher:

Oxford University Press

Mechanics of Materials (10th Edition)

Mechanical Engineering

ISBN:

9780134319650

Author:

Russell C. Hibbeler

Publisher:

PEARSON

Thermodynamics: An Engineering Approach

Mechanical Engineering

ISBN:

9781259822674

Author:

Yunus A. Cengel Dr., Michael A. Boles

Publisher:

McGraw-Hill Education

Control Systems Engineering

Mechanical Engineering

ISBN:

9781118170519

Author:

Norman S. Nise

Publisher:

WILEY

Mechanics of Materials (MindTap Course List)

Mechanical Engineering

ISBN:

9781337093347

Author:

Barry J. Goodno, James M. Gere

Publisher:

Cengage Learning

Engineering Mechanics: Statics

Mechanical Engineering

ISBN:

9781118807330

Author:

James L. Meriam, L. G. Kraige, J. N. Bolton

Publisher:

WILEY