Question 1 of 11 A mortgage for a condominium had a principal balance of $42,000 that had to be amortized over the remaining period of 7 years. The interest rate was fixed at 3.42% compounded semi-annually and payments were made monthly. a. Calculate the size of the payments. $0 Round up to the next whole number b. If the monthly payments were set at $713, by how much would the time period of the mortgage shorten? 0 year(s) o months c. If the monthly payments were set at $713, calculate the size of the final payment. $0.00 Round to the nearest cent

Question 1 of 11 A mortgage for a condominium had a principal balance of $42,000 that had to be amortized over the remaining period of 7 years. The interest rate was fixed at 3.42% compounded semi-annually and payments were made monthly. a. Calculate the size of the payments. $0 Round up to the next whole number b. If the monthly payments were set at $713, by how much would the time period of the mortgage shorten? 0 year(s) o months c. If the monthly payments were set at $713, calculate the size of the final payment. $0.00 Round to the nearest cent

Cornerstones of Financial Accounting

4th Edition

ISBN:9781337690881

Author:Jay Rich, Jeff Jones

Publisher:Jay Rich, Jeff Jones

Chapter9: Long-term Liabilities

Section: Chapter Questions

Problem 85E: ExerciseInstallment Notes ABC bank loans $250,000 to Yossarian to purchase a new home. Yossarian...

Related questions

Question

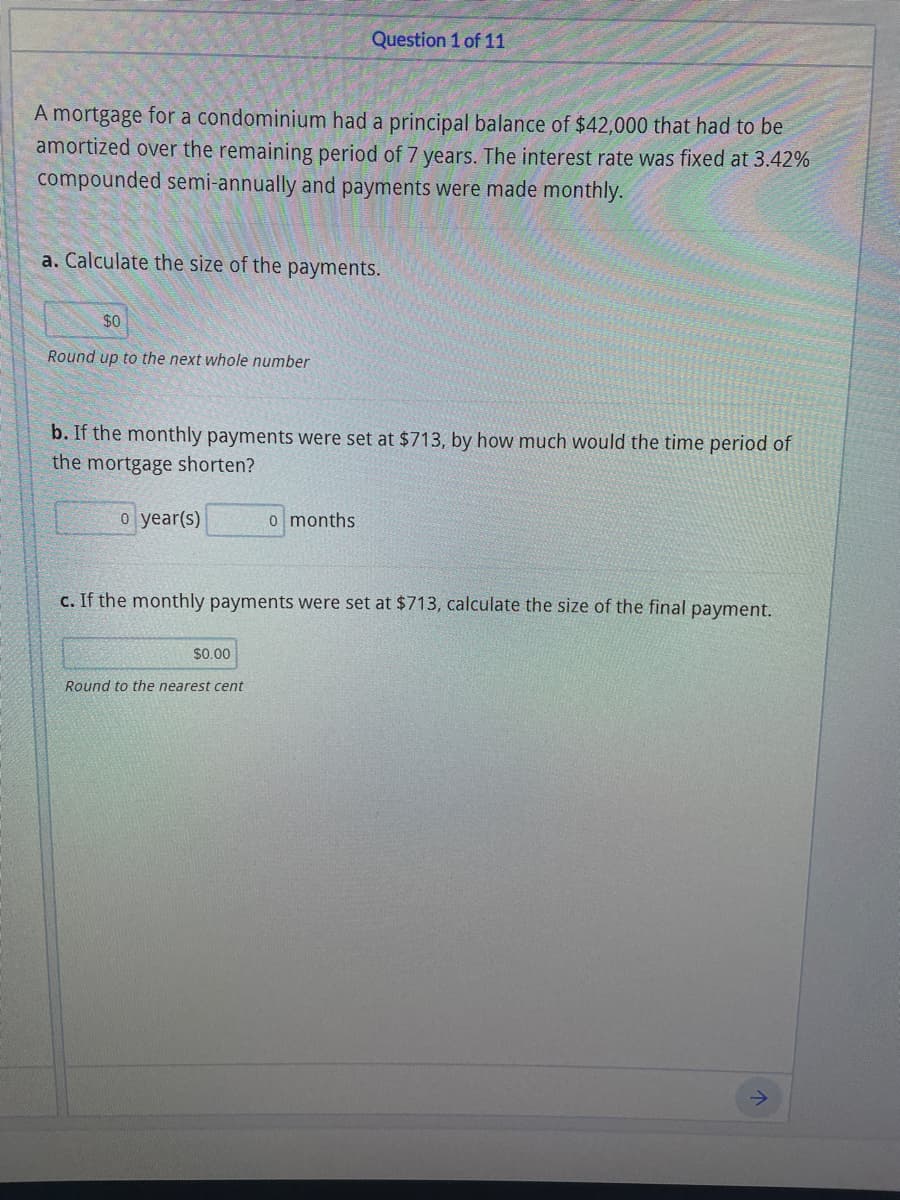

Transcribed Image Text:Question 1 of 11

A mortgage for a condominium had a principal balance of $42,000 that had to be

amortized over the remaining period of 7 years. The interest rate was fixed at 3.42%

compounded semi-annually and payments were made monthly.

a. Calculate the size of the

payments.

$0

Round up to the next whole number

b. If the monthly payments were set at $713, by how much would the time period of

the mortgage shorten?

o year(s)

o months

c. If the monthly payments were set at $713, calculate the size of the final payment.

$0.00

Round to the nearest cent

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps with 4 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

PFIN (with PFIN Online, 1 term (6 months) Printed…

Finance

ISBN:

9781337117005

Author:

Randall Billingsley, Lawrence J. Gitman, Michael D. Joehnk

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

PFIN (with PFIN Online, 1 term (6 months) Printed…

Finance

ISBN:

9781337117005

Author:

Randall Billingsley, Lawrence J. Gitman, Michael D. Joehnk

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College