Question 1 The following transactions pertain to the Bongiorno Corporation's 20x4 fiscal year: Jan 1 The business was established by Joe Bongiorno who invested $100,000 cash in exchange for common shares. Signed a two-year lease for office space. The monthly rent is $3,000. The first month's rent was paid on Jan 2. In addition, a $5,000 security deposit was also paid to the Jan 2 landlord. This security deposit will be refundable on December 31, 20x5. Jan 15 Purchased $3,500 of supplies on account. Jan 30 Purchased office furniture costing $15,000 for cash.

Question 1 The following transactions pertain to the Bongiorno Corporation's 20x4 fiscal year: Jan 1 The business was established by Joe Bongiorno who invested $100,000 cash in exchange for common shares. Signed a two-year lease for office space. The monthly rent is $3,000. The first month's rent was paid on Jan 2. In addition, a $5,000 security deposit was also paid to the Jan 2 landlord. This security deposit will be refundable on December 31, 20x5. Jan 15 Purchased $3,500 of supplies on account. Jan 30 Purchased office furniture costing $15,000 for cash.

Financial And Managerial Accounting

15th Edition

ISBN:9781337902663

Author:WARREN, Carl S.

Publisher:WARREN, Carl S.

Chapter1: Introduction To Accounting And Business

Section: Chapter Questions

Problem 4PB: Transactions; financial statements 2. Net income: 10,850 On April 1, 20Y8, Maria Adams established...

Related questions

Question

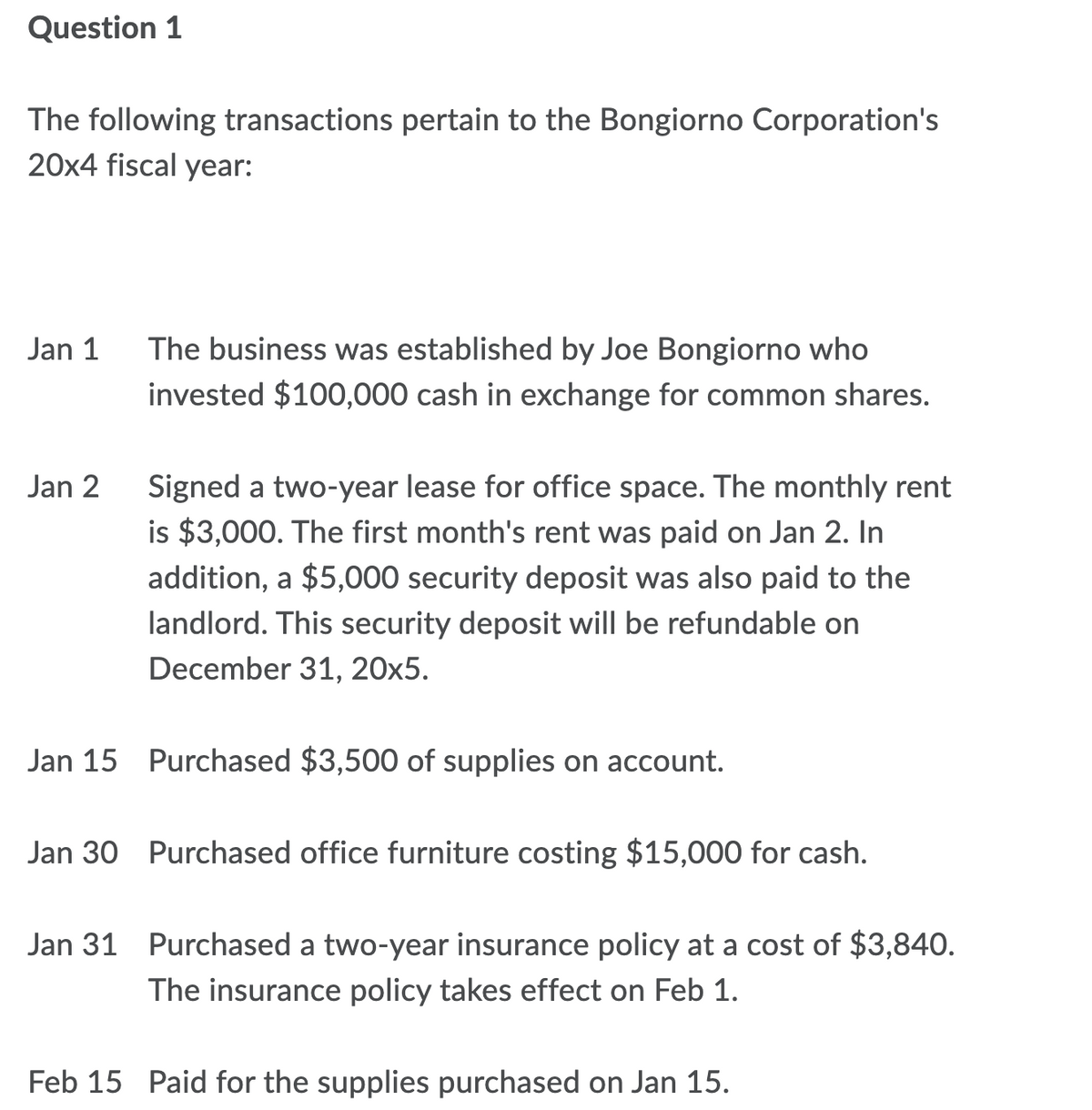

Transcribed Image Text:Question 1

The following transactions pertain to the Bongiorno Corporation's

20x4 fiscal year:

Jan 1

The business was established by Joe Bongiorno who

invested $100,000 cash in exchange for common shares.

Signed a two-year lease for office space. The monthly rent

is $3,000. The first month's rent was paid on Jan 2. In

addition, a $5,000 security deposit was also paid to the

Jan 2

landlord. This security deposit will be refundable on

December 31, 20x5.

Jan 15 Purchased $3,500 of supplies on account.

Jan 30 Purchased office furniture costing $15,000 for cash.

Jan 31 Purchased a two-year insurance policy at a cost of $3,840.

The insurance policy takes effect on Feb 1.

Feb 15 Paid for the supplies purchased on Jan 15.

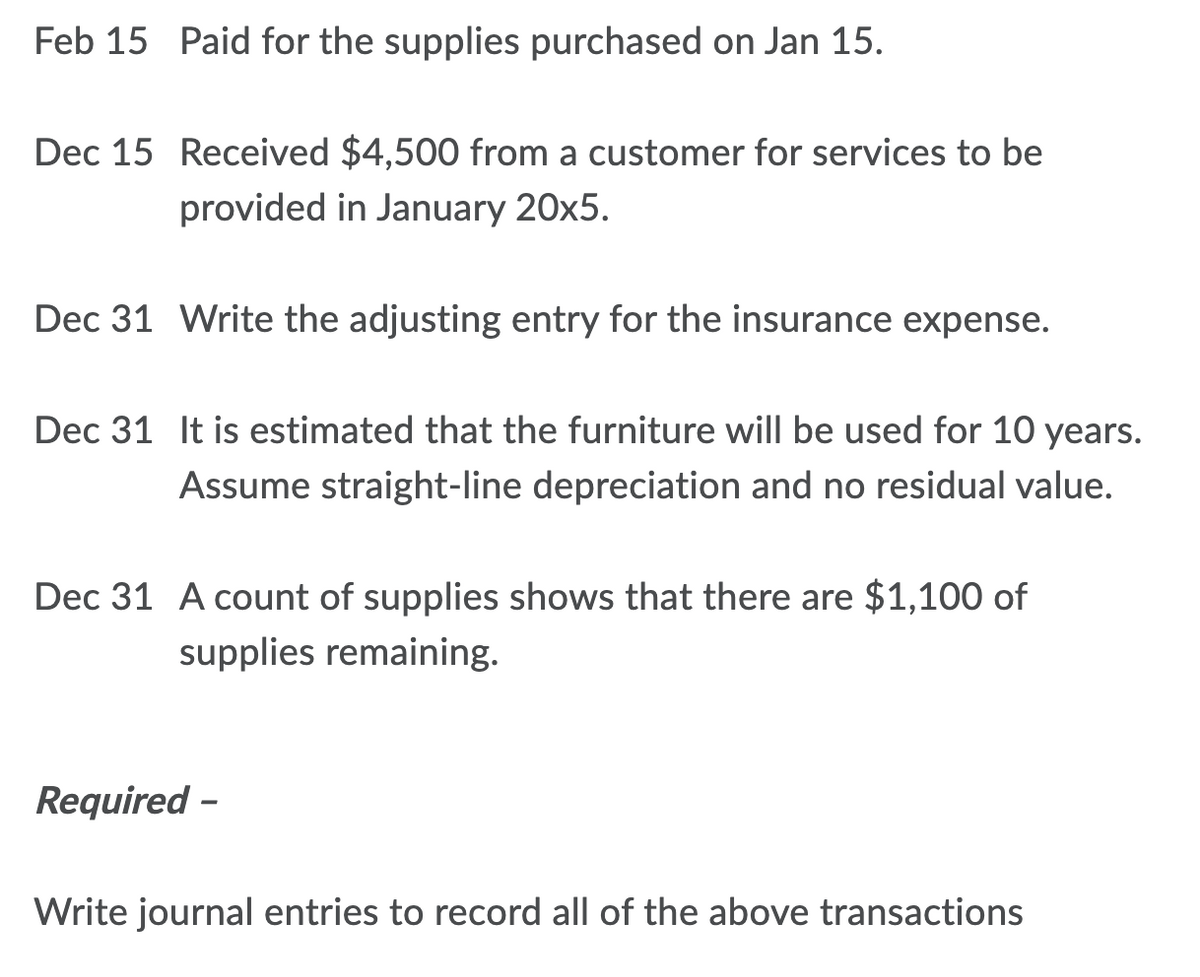

Transcribed Image Text:Feb 15 Paid for the supplies purchased on Jan 15.

Dec 15 Received $4,500 from a customer for services to be

provided in January 20x5.

Dec 31 Write the adjusting entry for the insurance expense.

Dec 31 It is estimated that the furniture will be used for 10 years.

Assume straight-line depreciation and no residual value.

Dec 31 A count of supplies shows that there are $1,100 of

supplies remaining.

Required -

Write journal entries to record all of the above transactions

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Corporate Financial Accounting

Accounting

ISBN:

9781305653535

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Corporate Financial Accounting

Accounting

ISBN:

9781305653535

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Financial & Managerial Accounting

Accounting

ISBN:

9781337119207

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Financial Reporting, Financial Statement Analysis…

Finance

ISBN:

9781285190907

Author:

James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Publisher:

Cengage Learning