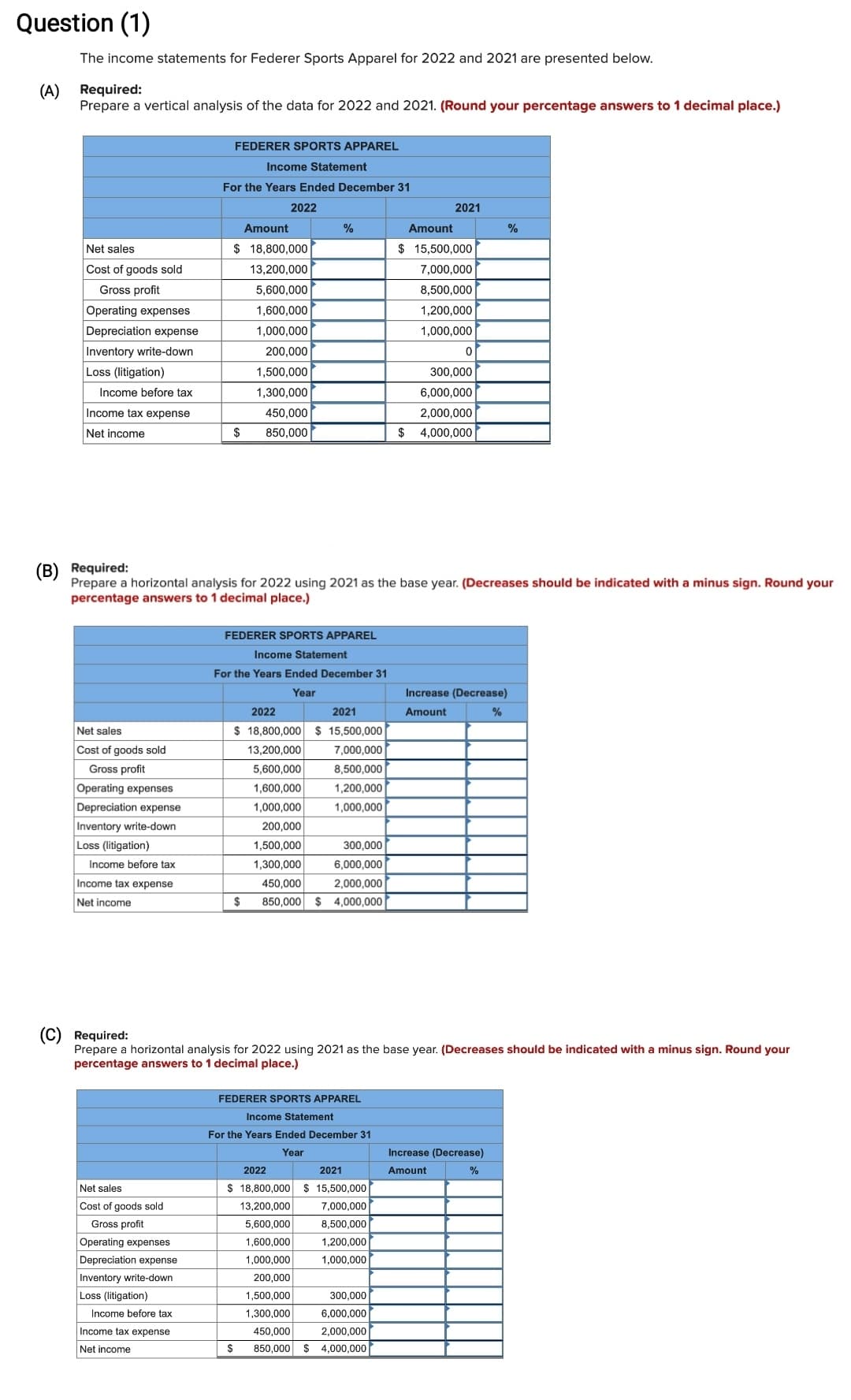

Question (1) The income statements for Federer Sports Apparel for 2022 and 2021 are presented below. (A) Required: Prepare a vertical analysis of the data for 2022 and 2021. (Round your percentage answers to 1 decimal place.) Net sales Cost of goods sold Gross profit Operating expenses Depreciation expense Inventory write-down Loss (litigation) Income before tax Income tax expense Net income Net sales Cost of goods sold Gross profit Operating expenses Depreciation expense Inventory write-down Loss (litigation) FEDERER SPORTS APPAREL Income before tax Income tax expense Net income Income Statement For the Years Ended December 31 2022 Amount $ 18,800,000 13,200,000 5,600,000 1,600,000 1,000,000 200,000 1,500,000 1,300,000 450,000 $ 850,000 % FEDERER SPORTS APPAREL Income Statement For the Years Ended December 31 Year (B) Required: Prepare a horizontal analysis for 2022 using 2021 as the base year. (Decreases should be indicated with a minus sign. Round your percentage answers to 1 decimal place.) 2022 2021 $ 18,800,000 $15,500,000 13,200,000 5,600,000 1,600,000 1,000,000 $ 7,000,000 8,500,000 1,200,000 1,000,000 2021 200,000 1,500,000 300,000 1,300,000 6,000,000 450,000 2,000,000 850,000 $ 4,000,000 Amount $ 15,500,000 7,000,000 8,500,000 1,200,000 1,000,000 0 300,000 6,000,000 2,000,000 $ 4,000,000 % Increase (Decrease) Amount %

Question (1) The income statements for Federer Sports Apparel for 2022 and 2021 are presented below. (A) Required: Prepare a vertical analysis of the data for 2022 and 2021. (Round your percentage answers to 1 decimal place.) Net sales Cost of goods sold Gross profit Operating expenses Depreciation expense Inventory write-down Loss (litigation) Income before tax Income tax expense Net income Net sales Cost of goods sold Gross profit Operating expenses Depreciation expense Inventory write-down Loss (litigation) FEDERER SPORTS APPAREL Income before tax Income tax expense Net income Income Statement For the Years Ended December 31 2022 Amount $ 18,800,000 13,200,000 5,600,000 1,600,000 1,000,000 200,000 1,500,000 1,300,000 450,000 $ 850,000 % FEDERER SPORTS APPAREL Income Statement For the Years Ended December 31 Year (B) Required: Prepare a horizontal analysis for 2022 using 2021 as the base year. (Decreases should be indicated with a minus sign. Round your percentage answers to 1 decimal place.) 2022 2021 $ 18,800,000 $15,500,000 13,200,000 5,600,000 1,600,000 1,000,000 $ 7,000,000 8,500,000 1,200,000 1,000,000 2021 200,000 1,500,000 300,000 1,300,000 6,000,000 450,000 2,000,000 850,000 $ 4,000,000 Amount $ 15,500,000 7,000,000 8,500,000 1,200,000 1,000,000 0 300,000 6,000,000 2,000,000 $ 4,000,000 % Increase (Decrease) Amount %

Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Chapter22: Accounting For Changes And Errors.

Section: Chapter Questions

Problem 4RE: Refer to RE22-2. Assume Heller Company had sales revenue of 510,000 in 2019 and 650,000 in 2020....

Related questions

Question

Transcribed Image Text:Question (1)

The income statements for Federer Sports Apparel for 2022 and 2021 are presented below.

(A) Required:

Prepare a vertical analysis of the data for 2022 and 2021. (Round your percentage answers to 1 decimal place.)

Net sales

Cost of goods sold

Gross profit

Operating expenses

Depreciation expense

Inventory write-down

Loss (litigation)

Income before tax

Income tax expense

Net income

Net sales

Cost of goods sold

Gross profit

Operating expenses

Depreciation expense

Inventory write-down

Loss (litigation)

Income before tax

Income tax expense

Net income

FEDERER SPORTS APPAREL

Net sales

Cost of goods sold

Gross profit

Operating expenses

Depreciation expense

Inventory write-down

Loss (litigation)

Income Statement

For the Years Ended December 31

Income before tax

Income tax expense

Net income

Amount

$18,800,000

$

2022

13,200,000

5,600,000

1,600,000

1,000,000

200,000

1,500,000

1,300,000

450,000

850,000

%

(B) Required:

Prepare a horizontal analysis for 2022 using 2021 as the base year. (Decreases should be indicated with a minus sign. Round your

percentage answers to 1 decimal place.)

FEDERER SPORTS APPAREL

$

Income Statement

For the Years Ended December 31

Year

2022

2021

$ 18,800,000 $ 15,500,000

13,200,000

7,000,000

5,600,000

8,500,000

1,600,000

1,200,000

1,000,000

1,000,000

200,000

1,500,000

1,300,000

450,000

850,000 $4,000,000

300,000

6,000,000

2,000,000

FEDERER SPORTS APPAREL

Income Statement

For the Years Ended December 31

Year

2022

2021

$ 18,800,000 $15,500,000|

13,200,000

7,000,000

5,600,000

8,500,000

1,600,000

1,200,000

1,000,000

1,000,000

200,000

1,500,000

1,300,000

2021

300,000

6,000,000

2,000,000

Amount

$ 15,500,000

7,000,000

8,500,000

1,200,000

1,000,000

450,000

$ 850,000 $4,000,000

0

(C) Required:

Prepare a horizontal analysis for 2022 using 2021 as the base year. (Decreases should be indicated with a minus sign. Round your

percentage answers to 1 decimal place.)

300,000

6,000,000

2,000,000

$ 4,000,000

Increase (Decrease)

Amount

%

Increase (Decrease)

Amount

%

%

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Century 21 Accounting Multicolumn Journal

Accounting

ISBN:

9781337679503

Author:

Gilbertson

Publisher:

Cengage

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Century 21 Accounting Multicolumn Journal

Accounting

ISBN:

9781337679503

Author:

Gilbertson

Publisher:

Cengage

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning