QUESTION 1 The transactions related to liabilities by SNM Bhd (SNM) for the year 2020 are as follows: 3 July SNM purchased machine for RM75,000 from Gagah Sdn Bhd and the term was 2/15, n/45. Net method was used to record the purchase. 17 July Made payment to Gagah Sdn Bhd for the purchase of 3 July. 1 Aug SNM borrowed RM170,000, by signing a one-year, 5% interest-bearing RM170,000 note with Bank Muhibbah. 1 Sept SNM purchased safety equipment from Guardian Enterprise with the price of RM25,000. As for the payment, RM5,000 was in cash at the date of acquisition and the balance by signing a one-year, 10% note. 7 Sept A cash dividend of RM325,000 was declared and will be paid to the shareholders on 5 November 2020. 9 Sept SNM announced to its employees, bonuses of two-month salary for the financial year end 30 September 2020. The total amount of the bonuses is RM254,000 and will be paid on 3 October 2020. Additional information: 1. The financial year end for SNM Bhd is on 30 September. 2. The taxable income for the year ended 30 September 2020 is RM2,500,000 with an effective tax rate of 24%. The tax is payable to the Inland Revenue Board. REQUIRED: (Round all figures to the nearest RM) (a) Prepare the journal entries to record the transactions above. (b) Prepare the necessary adjusting entries at 30 September 2020.

QUESTION 1 The transactions related to liabilities by SNM Bhd (SNM) for the year 2020 are as follows: 3 July SNM purchased machine for RM75,000 from Gagah Sdn Bhd and the term was 2/15, n/45. Net method was used to record the purchase. 17 July Made payment to Gagah Sdn Bhd for the purchase of 3 July. 1 Aug SNM borrowed RM170,000, by signing a one-year, 5% interest-bearing RM170,000 note with Bank Muhibbah. 1 Sept SNM purchased safety equipment from Guardian Enterprise with the price of RM25,000. As for the payment, RM5,000 was in cash at the date of acquisition and the balance by signing a one-year, 10% note. 7 Sept A cash dividend of RM325,000 was declared and will be paid to the shareholders on 5 November 2020. 9 Sept SNM announced to its employees, bonuses of two-month salary for the financial year end 30 September 2020. The total amount of the bonuses is RM254,000 and will be paid on 3 October 2020. Additional information: 1. The financial year end for SNM Bhd is on 30 September. 2. The taxable income for the year ended 30 September 2020 is RM2,500,000 with an effective tax rate of 24%. The tax is payable to the Inland Revenue Board. REQUIRED: (Round all figures to the nearest RM) (a) Prepare the journal entries to record the transactions above. (b) Prepare the necessary adjusting entries at 30 September 2020.

Chapter16: Accounting Periods And Methods

Section: Chapter Questions

Problem 4RP

Related questions

Question

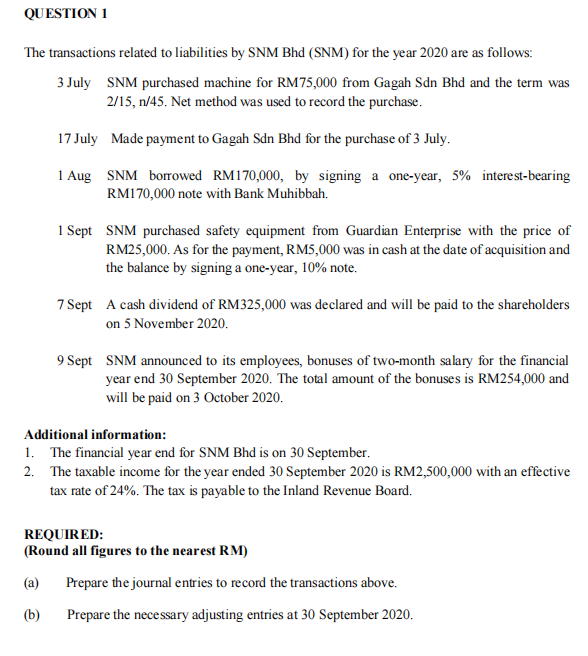

Transcribed Image Text:QUESTION 1

The transactions related to liabilities by SNM Bhd (SNM) for the year 2020 are as follows:

3 July SNM purchased machine for RM75,000 from Gagah Sdn Bhd and the term was

2/15, n/45. Net method was used to record the purchase.

17 July Made payment to Gagah Sdn Bhd for the purchase of 3 July.

1 Aug SNM borowed RM170,000, by signing a one-year, 5% interest-bearing

RM170,000 note with Bank Muhibbah.

1 Sept SNM purchased safety equipment from Guardian Enterprise with the price of

RM25,000. As for the payment, RM5,000 was in cash at the date of acquisition and

the balance by signing a one-year, 10% note.

7 Sept A cash dividend of RM325,000 was declared and will be paid to the shareholders

on 5 November 2020.

9 Sept SNM announced to its employees, bonuses of two-month salary for the financial

year end 30 September 2020. The total amount of the bonuses is RM254,000 and

will be paid on 3 October 2020.

Additional information:

1. The financial year end for SNM Bhd is on 30 September.

2. The taxable income for the year ended 30 September 2020 is RM2,500,000 with an effective

tax rate of 24%. The tax is payable to the Inland Revenue Board.

REQUIRED:

(Round all figures to the nearest RM)

(a)

Prepare the journal entries to record the transactions above.

(b)

Prepare the necessary adjusting entries at 30 September 2020.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning