View Policies Current Attempt in Progress Current assets Non-current assets require equal On June 30, 2020, Kovacs Company borrowed $410,000 at a bank by signing a five-year, 10% loan. The terms of the loan semi-annual principal payments plus interest beginning December 31, 2020. The loan agreement requires the company to maintain a current ratio of 2.5. The December 31, 2020, year-end statement of financial position, immediately prior to the bank loan repayment and the reclassification of long-term debt, follows: Total assets $205,200 511,800 $717,000 Current liabilities Loan payable Common shares Retained earnings Total liabilities and shareholders' equity $54,000 410,000 157,000 96,000 n $717,000 !!

View Policies Current Attempt in Progress Current assets Non-current assets require equal On June 30, 2020, Kovacs Company borrowed $410,000 at a bank by signing a five-year, 10% loan. The terms of the loan semi-annual principal payments plus interest beginning December 31, 2020. The loan agreement requires the company to maintain a current ratio of 2.5. The December 31, 2020, year-end statement of financial position, immediately prior to the bank loan repayment and the reclassification of long-term debt, follows: Total assets $205,200 511,800 $717,000 Current liabilities Loan payable Common shares Retained earnings Total liabilities and shareholders' equity $54,000 410,000 157,000 96,000 n $717,000 !!

Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:James M. Wahlen, Jefferson P. Jones, Donald Pagach

ChapterM: Time Value Of Money Module

Section: Chapter Questions

Problem 4P: Determining Loan Repayments Jerry Rockness needs 40,000 to pay off a loan due on December 31, 2028....

Related questions

Question

Transcribed Image Text:View Policies

Current Attempt in Progress

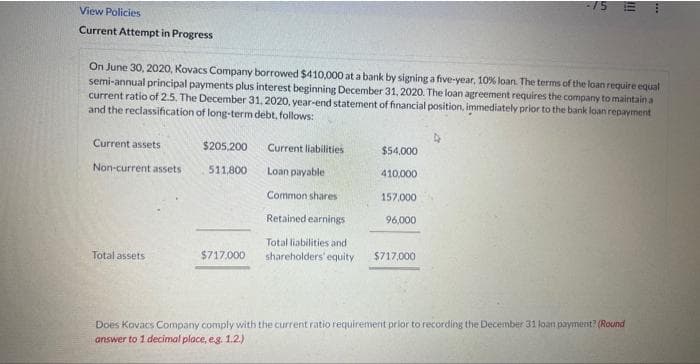

On June 30, 2020, Kovacs Company borrowed $410,000 at a bank by signing a five-year, 10% loan. The terms of the loan require equal

semi-annual principal payments plus interest beginning December 31, 2020. The loan agreement requires the company to maintain a

current ratio of 2.5. The December 31, 2020, year-end statement of financial position, immediately prior to the bank loan repayment

and the reclassification of long-term debt, follows:

Current assets

Non-current assets

Total assets

$205,200

511,800

$717.000

Current liabilities

Loan payable

Common shares

Retained earnings

$54,000

410,000

157,000

96,000

Total liabilities and

shareholders' equity $717,000

Does Kovacs Company comply with the current ratio requirement prior to recording the December 31 loan payment? (Round

answer to 1 decimal place, e.g. 1.2.)

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Fundamentals Of Financial Management, Concise Edi…

Finance

ISBN:

9781337902571

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning