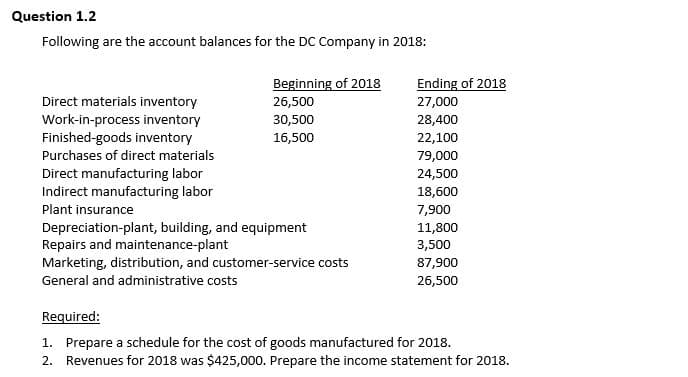

Question 1.2 Following are the account balances for the DC Company in 2018: Beginning of 2018 Ending of 2018 Direct materials inventory Work-in-process inventory Finished-goods inventory 26,500 27,000 30,500 28,400 16,500 22,100 Purchases of direct materials 79,000 Direct manufacturing labor Indirect manufacturing labor 24,500 18,600 7,900 11,800 Plant insurance Depreciation-plant, building, and equipment Repairs and maintenance-plant Marketing, distribution, and customer-service costs 3,500 87,900 General and administrative costs 26,500 Required: 1. Prepare a schedule for the cost of goods manufactured for 2018. 2. Revenues for 2018 was $425,000. Prepare the income statement for 2018.

Question 1.2 Following are the account balances for the DC Company in 2018: Beginning of 2018 Ending of 2018 Direct materials inventory Work-in-process inventory Finished-goods inventory 26,500 27,000 30,500 28,400 16,500 22,100 Purchases of direct materials 79,000 Direct manufacturing labor Indirect manufacturing labor 24,500 18,600 7,900 11,800 Plant insurance Depreciation-plant, building, and equipment Repairs and maintenance-plant Marketing, distribution, and customer-service costs 3,500 87,900 General and administrative costs 26,500 Required: 1. Prepare a schedule for the cost of goods manufactured for 2018. 2. Revenues for 2018 was $425,000. Prepare the income statement for 2018.

Managerial Accounting

15th Edition

ISBN:9781337912020

Author:Carl Warren, Ph.d. Cma William B. Tayler

Publisher:Carl Warren, Ph.d. Cma William B. Tayler

Chapter1: Introduction To Managerial Accounting

Section: Chapter Questions

Problem 5PA: Statement of cost of goods manufactured and income statement for a manufacturing company The...

Related questions

Question

Transcribed Image Text:Question 1.2

Following are the account balances for the DC Company in 2018:

Beginning of 2018

26,500

Ending of 2018

Direct materials inventory

Work-in-process inventory

Finished-goods inventory

27,000

28,400

22,100

79,000

30,500

16,500

Purchases of direct materials

Direct manufacturing labor

Indirect manufacturing labor

24,500

18,600

Plant insurance

7,900

Depreciation-plant, building, and equipment

Repairs and maintenance-plant

Marketing, distribution, and customer-service costs

11,800

3,500

87,900

General and administrative costs

26,500

Required:

1. Prepare a schedule for the cost of goods manufactured for 2018.

2. Revenues for 2018 was $425,000. Prepare the income statement for 2018.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College