(a) Calculate the following planned overhead absorption rates: (i) A machine hour rate for the Cutting Department. (ïi) A rate expressed as a direct labour cost for the Assembling Department.

(a) Calculate the following planned overhead absorption rates: (i) A machine hour rate for the Cutting Department. (ïi) A rate expressed as a direct labour cost for the Assembling Department.

Managerial Accounting

15th Edition

ISBN:9781337912020

Author:Carl Warren, Ph.d. Cma William B. Tayler

Publisher:Carl Warren, Ph.d. Cma William B. Tayler

Chapter5: Support Department And Joint Cost Allocation

Section: Chapter Questions

Problem 5E: Crystal Scarves Co. produces winter scarves. The scarves are produced in the Cutting and Sewing...

Related questions

Question

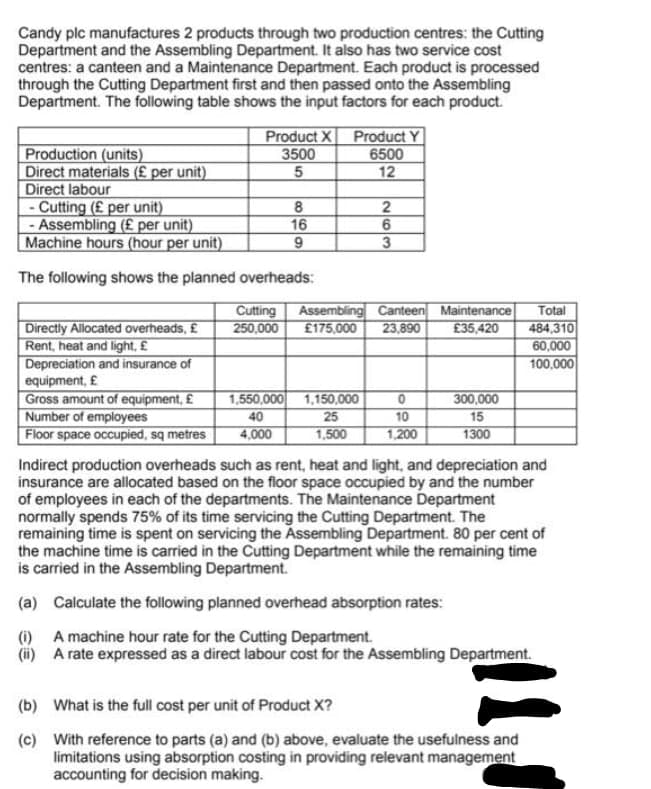

Transcribed Image Text:Candy plc manufactures 2 products through two production centres: the Cutting

Department and the Assembling Department. It also has two service cost

centres: a canteen and a Maintenance Department. Each product is processed

through the Cutting Department first and then passed onto the Assembling

Department. The following table shows the input factors for each product.

Product X

3500

Product Y

6500

12

Production (units)

Direct materials (£ per unit)

Direct labour

- Cutting (£ per unit)

- Assembling (£ per unit)

Machine hours (hour per unit)

16

The following shows the planned overheads:

Cutting

250,000

Assembling Canteen Maintenance

23,890

Total

484,310

60,000

Directly Allocated overheads, £

Rent, heat and light, £

Depreciation and insurance of

equipment, £

Gross amount of equipment, £

Number of employees

Floor space occupied, sq metres

£175,000

£35,420

100,000

1,150,000

300,000

1,550,000

40

25

10

15

4,000

1,500

1,200

1300

Indirect production overheads such as rent, heat and light, and depreciation and

insurance are allocated based on the floor space occupied by and the number

of employees in each of the departments. The Maintenance Department

normally spends 75% of its time servicing the Cutting Department. The

remaining time is spent on servicing the Assembling Department. 80 per cent of

the machine time is carried in the Cutting Department while the remaining time

is carried in the Assembling Department.

(a) Calculate the following planned overhead absorption rates:

(i) A machine hour rate for the Cutting Department.

(i) A rate expressed as a direct labour cost for the Assembling Department.

(b) What is the full cost per unit of Product X?

(c) With reference to parts (a) and (b) above, evaluate the usefulness and

limitations using absorption costing in providing relevant management

accounting for decision making.

N63

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

Principles of Cost Accounting

Accounting

ISBN:

9781305087408

Author:

Edward J. Vanderbeck, Maria R. Mitchell

Publisher:

Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning