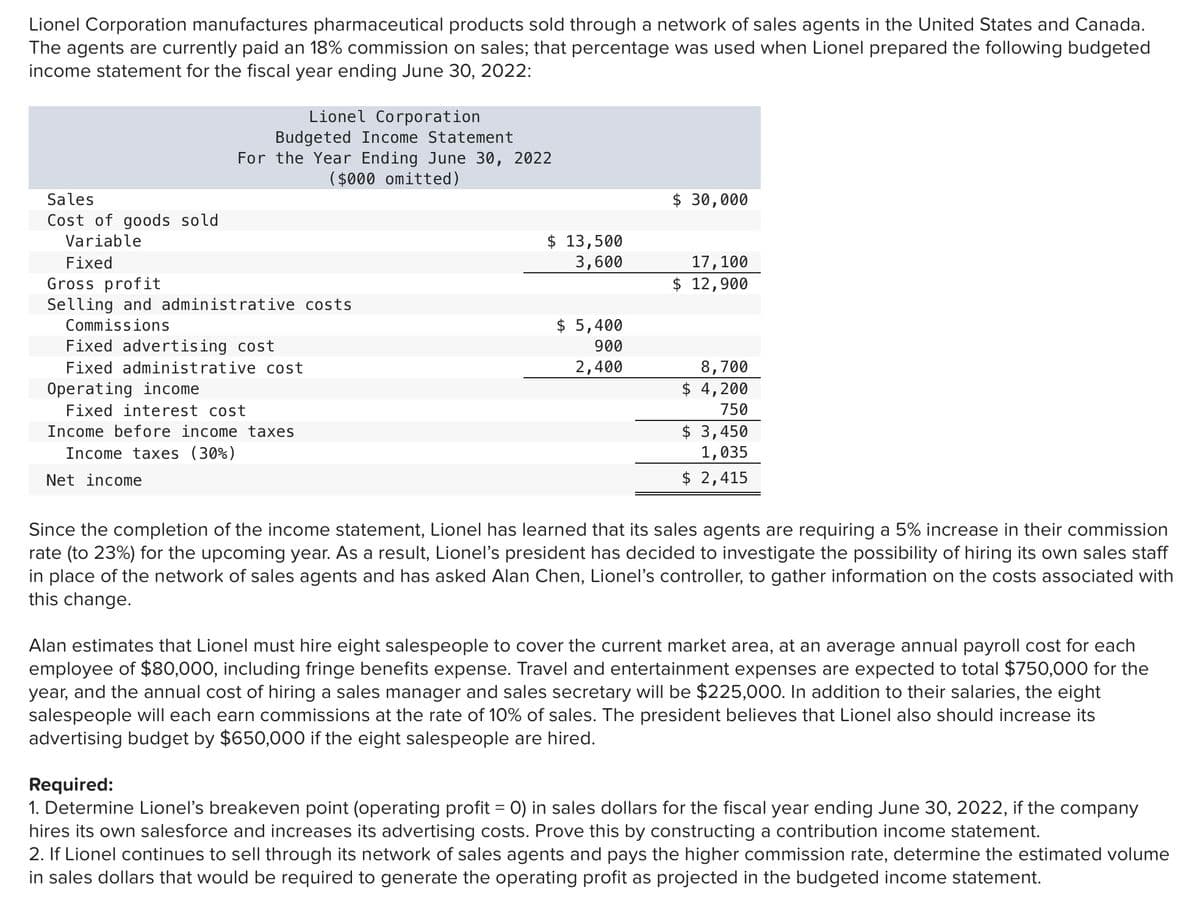

Lionel Corporation manufactures pharmaceutical products sold through a network of sales agents in the United States and Canada. The agents are currently paid an 18% commission on sales; that percentage was used when Lionel prepared the following budgeted income statement for the fiscal year ending June 30, 2022: Lionel Corporation Budgeted Income Statement For the Year Ending June 30, 2022 ($000 omitted) Sales $ 30,000 Cost of goods sold Variable $ 13,500 3,600 17,100 $ 12,900 Fixed Gross profit Selling and administrative costs Commissions $ 5,400 Fixed advertising cost 900 Fixed administrative cost 2,400 8,700 Operating income $ 4,200 Fixed interest cost 750 $ 3,450 1,035 Income before income taxes Income taxes (30%) Net income $ 2,415 Since the completion of the income statement, Lionel has learned that its sales agents are requiring a 5% increase in their commission rate (to 23%) for the upcoming year. As a result, Lionel's president has decided to investigate the possibility of hiring its own sales staff in place of the network of sales agents and has asked Alan Chen, Lionel's controller, to gather information on the costs associated with this change. Alan estimates that Lionel must hire eight salespeople to cover the current market area, at an average annual payroll cost for each employee of $80,000, including fringe benefits expense. Travel and entertainment expenses are expected to total $750,000 for the year, and the annual cost of hiring a sales manager and sales secretary will be $225,000. In addition to their salaries, the eight salespeople will each earn commissions at the rate of 10% of sales. The president believes that Lionel also should increase its advertising budget by $650,000 if the eight salespeople are hired. Required: 1. Determine Lionel's breakeven point (operating profit = 0) in sales dollars for the fiscal year ending June 30, 2022, if the company hires its own salesforce and increases its advertising costs. Prove this by constructing a contribution income statement. 2. If Lionel continues to sell through its network of sales agents and pays the higher commission rate, determine the estimated volume in sales dollars that would be required to generate the operating profit as projected in the budgeted income statement.

Lionel Corporation manufactures pharmaceutical products sold through a network of sales agents in the United States and Canada. The agents are currently paid an 18% commission on sales; that percentage was used when Lionel prepared the following budgeted income statement for the fiscal year ending June 30, 2022: Lionel Corporation Budgeted Income Statement For the Year Ending June 30, 2022 ($000 omitted) Sales $ 30,000 Cost of goods sold Variable $ 13,500 3,600 17,100 $ 12,900 Fixed Gross profit Selling and administrative costs Commissions $ 5,400 Fixed advertising cost 900 Fixed administrative cost 2,400 8,700 Operating income $ 4,200 Fixed interest cost 750 $ 3,450 1,035 Income before income taxes Income taxes (30%) Net income $ 2,415 Since the completion of the income statement, Lionel has learned that its sales agents are requiring a 5% increase in their commission rate (to 23%) for the upcoming year. As a result, Lionel's president has decided to investigate the possibility of hiring its own sales staff in place of the network of sales agents and has asked Alan Chen, Lionel's controller, to gather information on the costs associated with this change. Alan estimates that Lionel must hire eight salespeople to cover the current market area, at an average annual payroll cost for each employee of $80,000, including fringe benefits expense. Travel and entertainment expenses are expected to total $750,000 for the year, and the annual cost of hiring a sales manager and sales secretary will be $225,000. In addition to their salaries, the eight salespeople will each earn commissions at the rate of 10% of sales. The president believes that Lionel also should increase its advertising budget by $650,000 if the eight salespeople are hired. Required: 1. Determine Lionel's breakeven point (operating profit = 0) in sales dollars for the fiscal year ending June 30, 2022, if the company hires its own salesforce and increases its advertising costs. Prove this by constructing a contribution income statement. 2. If Lionel continues to sell through its network of sales agents and pays the higher commission rate, determine the estimated volume in sales dollars that would be required to generate the operating profit as projected in the budgeted income statement.

Cornerstones of Cost Management (Cornerstones Series)

4th Edition

ISBN:9781305970663

Author:Don R. Hansen, Maryanne M. Mowen

Publisher:Don R. Hansen, Maryanne M. Mowen

Chapter8: Budgeting For Planning And Control

Section: Chapter Questions

Problem 11CE: Shalimar Company manufactures and sells industrial products. For next year, Shalimar has budgeted...

Related questions

Question

Transcribed Image Text:Lionel Corporation manufactures pharmaceutical products sold through a network of sales agents in the United States and Canada.

The agents are currently paid an 18% commission on sales; that percentage was used when Lionel prepared the following budgeted

income statement for the fiscal year ending June 30, 2022:

Lionel Corporation

Budgeted Income Statement

For the Year Ending June 30, 2022

($000 omitted)

Sales

$ 30,000

Cost of goods sold

$ 13,500

3,600

Variable

Fixed

17,100

Gross profit

Selling and administrative costs

$ 12,900

Commissions

$ 5,400

Fixed advertising cost

900

Fixed administrative cost

2,400

8,700

Operating income

$ 4,200

Fixed interest cost

750

$ 3,450

1,035

$ 2,415

Income before income taxes

Income taxes (30%)

Net income

Since the completion of the income statement, Lionel has learned that its sales agents are requiring a 5% increase in their commission

rate (to 23%) for the upcoming year. As a result, Lionel's president has decided to investigate the possibility of hiring its own sales staff

in place of the network of sales agents and has asked Alan Chen, Lionel's controller, to gather information on the costs associated with

this change.

Alan estimates that Lionel must hire eight salespeople to cover the current market area, at an average annual payroll cost for each

employee of $80,000, including fringe benefits expense. Travel and entertainment expenses are expected to total $750,000 for the

year, and the annual cost of hiring a sales manager and sales secretary will be $225,000. In addition to their salaries, the eight

salespeople will each earn commissions at the rate of 10% of sales. The president believes that Lionel also should increase its

advertising budget by $650,000 if the eight salespeople are hired.

Required:

1. Determine Lionel's breakeven point (operating profit = 0) in sales dollars for the fiscal year ending June 30, 2022, if the company

hires its own salesforce and increases its advertising costs. Prove this by constructing a contribution income statement.

2. If Lionel continues to sell through its network of sales agents and pays the higher commission rate, determine the estimated volume

in sales dollars that would be required to generate the operating profit as projected in the budgeted income statement.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 6 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Principles of Cost Accounting

Accounting

ISBN:

9781305087408

Author:

Edward J. Vanderbeck, Maria R. Mitchell

Publisher:

Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Principles of Cost Accounting

Accounting

ISBN:

9781305087408

Author:

Edward J. Vanderbeck, Maria R. Mitchell

Publisher:

Cengage Learning

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT