Question 13 Suppose you invest $2,500 in a fund earning 15% simple interest. Further suppose that you have the option at any time of closing this account and opening an account earning compound interest at an annual effective interest rate of 9%. At what instant should you do so in order to maximize your accumulation at the end of five years? (Round your answer to two decimal places.) 4.53 years How about if you wish to maximize the

Question 13 Suppose you invest $2,500 in a fund earning 15% simple interest. Further suppose that you have the option at any time of closing this account and opening an account earning compound interest at an annual effective interest rate of 9%. At what instant should you do so in order to maximize your accumulation at the end of five years? (Round your answer to two decimal places.) 4.53 years How about if you wish to maximize the

Essentials of Economics (MindTap Course List)

8th Edition

ISBN:9781337091992

Author:N. Gregory Mankiw

Publisher:N. Gregory Mankiw

Chapter19: The Basic Tools Of Finance

Section: Chapter Questions

Problem 3PA

Related questions

Question

Question a

Full explain this question and text typing work only

We should answer our question within 2 hours takes more time then we will reduce Rating Dont ignore this line. . .

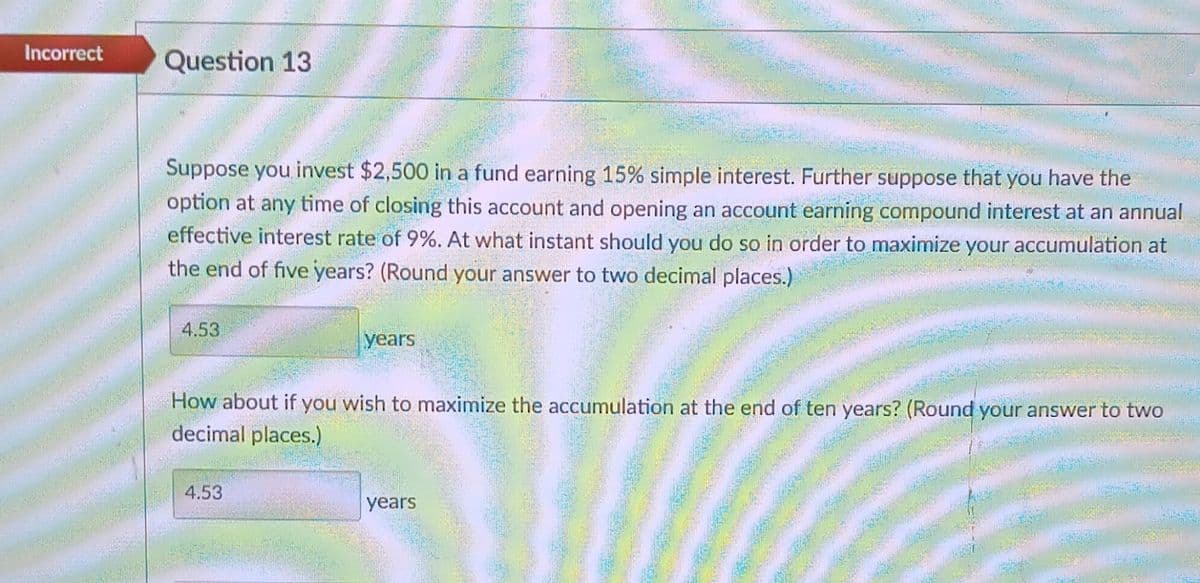

Transcribed Image Text:Incorrect

Question 13

Suppose you invest $2,500 in a fund earning 15% simple interest. Further suppose that you have the

option at any time of closing this account and opening an account earning compound interest at an annual

effective interest rate of 9%. At what instant should you do so in order to maximize your accumulation at

the end of five years? (Round your answer to two decimal places.)

4.53

years

How about if you wish to maximize the accumulation at the end of ten years? (Round your answer to two

decimal places.)

4.53

years

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Recommended textbooks for you

Essentials of Economics (MindTap Course List)

Economics

ISBN:

9781337091992

Author:

N. Gregory Mankiw

Publisher:

Cengage Learning

Principles of Economics, 7th Edition (MindTap Cou…

Economics

ISBN:

9781285165875

Author:

N. Gregory Mankiw

Publisher:

Cengage Learning

Principles of Macroeconomics (MindTap Course List)

Economics

ISBN:

9781285165912

Author:

N. Gregory Mankiw

Publisher:

Cengage Learning

Essentials of Economics (MindTap Course List)

Economics

ISBN:

9781337091992

Author:

N. Gregory Mankiw

Publisher:

Cengage Learning

Principles of Economics, 7th Edition (MindTap Cou…

Economics

ISBN:

9781285165875

Author:

N. Gregory Mankiw

Publisher:

Cengage Learning

Principles of Macroeconomics (MindTap Course List)

Economics

ISBN:

9781285165912

Author:

N. Gregory Mankiw

Publisher:

Cengage Learning

Brief Principles of Macroeconomics (MindTap Cours…

Economics

ISBN:

9781337091985

Author:

N. Gregory Mankiw

Publisher:

Cengage Learning

Principles of Economics (MindTap Course List)

Economics

ISBN:

9781305585126

Author:

N. Gregory Mankiw

Publisher:

Cengage Learning

Principles of Macroeconomics (MindTap Course List)

Economics

ISBN:

9781305971509

Author:

N. Gregory Mankiw

Publisher:

Cengage Learning