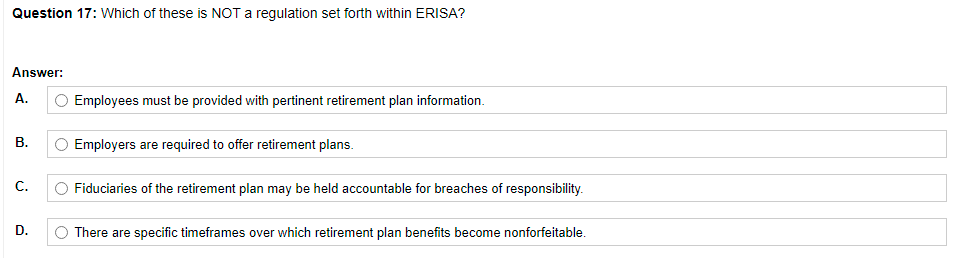

Question 17: Which of these is NOT a regulation set forth within ERISA? Answer: A. Employees must be provided with pertinent retirement plan information. В. Employers are required to offer retirement plans. С. Fiduciaries of the retirement plan may be held accountable for breaches of responsibility. D. There are specific timeframes over which retirement plan benefits become nonforfeitable.

Question 17: Which of these is NOT a regulation set forth within ERISA? Answer: A. Employees must be provided with pertinent retirement plan information. В. Employers are required to offer retirement plans. С. Fiduciaries of the retirement plan may be held accountable for breaches of responsibility. D. There are specific timeframes over which retirement plan benefits become nonforfeitable.

Financial Reporting, Financial Statement Analysis and Valuation

8th Edition

ISBN:9781285190907

Author:James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Publisher:James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Chapter9: Operating Activities

Section: Chapter Questions

Problem 11QE

Related questions

Question

Transcribed Image Text:Question 17: Which of these is NOT a regulation set forth within ERISA?

Answer:

A.

Employees must be provided with pertinent retirement plan information.

В.

Employers are required to offer retirement plans.

C.

Fiduciaries of the retirement plan may be held accountable for breaches of responsibility.

D.

There are specific timeframes over which retirement plan benefits become nonforfeitable.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Financial Reporting, Financial Statement Analysis…

Finance

ISBN:

9781285190907

Author:

James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Publisher:

Cengage Learning

Financial Reporting, Financial Statement Analysis…

Finance

ISBN:

9781285190907

Author:

James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning