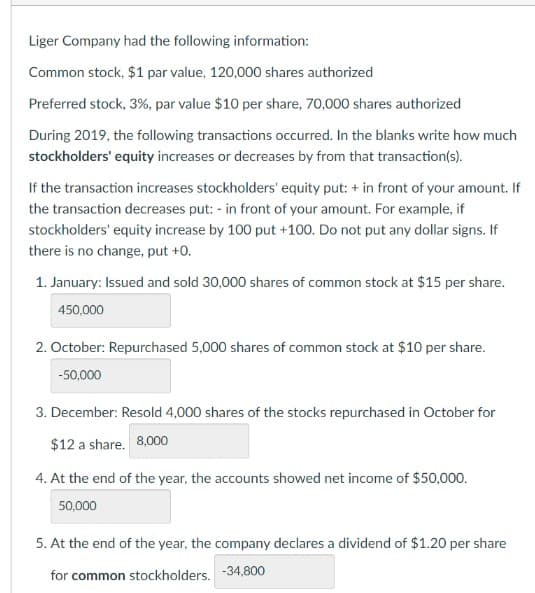

Liger Company had the following information: Common stock, $1 par value, 120,000 shares authorized Preferred stock, 3%, par value $10 per share, 70,000 shares authorized During 2019, the following transactions occurred. In the blanks write how much stockholders' equity increases or decreases by from that transaction(s). If the transaction increases stockholders' equity put: + in front of your amount. If the transaction decreases put: - in front of your amount. For example, if stockholders' equity increase by 100 put +100. Do not put any dollar signs. If there is no change, put +0. 1. January: Issued and sold 30,000 shares of common stock at $15 per share. 450,000 2. October: Repurchased 5,000 shares of common stock at $10 per share. -50,000 3. December: Resold 4,000 shares of the stocks repurchased in October for $12 a share. 8,000 4. At the end of the year, the accounts showed net income of $50,000. 50,000 5. At the end of the year, the company declares a dividend of $1.20 per share for common stockholders. -34,800

Liger Company had the following information: Common stock, $1 par value, 120,000 shares authorized Preferred stock, 3%, par value $10 per share, 70,000 shares authorized During 2019, the following transactions occurred. In the blanks write how much stockholders' equity increases or decreases by from that transaction(s). If the transaction increases stockholders' equity put: + in front of your amount. If the transaction decreases put: - in front of your amount. For example, if stockholders' equity increase by 100 put +100. Do not put any dollar signs. If there is no change, put +0. 1. January: Issued and sold 30,000 shares of common stock at $15 per share. 450,000 2. October: Repurchased 5,000 shares of common stock at $10 per share. -50,000 3. December: Resold 4,000 shares of the stocks repurchased in October for $12 a share. 8,000 4. At the end of the year, the accounts showed net income of $50,000. 50,000 5. At the end of the year, the company declares a dividend of $1.20 per share for common stockholders. -34,800

Cornerstones of Financial Accounting

4th Edition

ISBN:9781337690881

Author:Jay Rich, Jeff Jones

Publisher:Jay Rich, Jeff Jones

Chapter10: Stockholder's Equity

Section: Chapter Questions

Problem 57E: Outstanding Stock Lars Corporation shows the following information in the stockholders equity...

Related questions

Question

Transcribed Image Text:Liger Company had the following information:

Common stock, $1 par value, 120,000 shares authorized

Preferred stock, 3%, par value $10 per share, 70,000 shares authorized

During 2019, the following transactions occurred. In the blanks write how much

stockholders' equity increases or decreases by from that transaction(s).

If the transaction increases stockholders' equity put: + in front of your amount. If

the transaction decreases put: - in front of your amount. For example, if

stockholders' equity increase by 100 put +100. Do not put any dollar signs. If

there is no change, put +0.

1. January: Issued and sold 30,000 shares of common stock at $15 per share.

450,000

2. October: Repurchased 5,000 shares of common stock at $10 per share.

-50,000

3. December: Resold 4,000 shares of the stocks repurchased in October for

$12 a share. 8,000

4. At the end of the year, the accounts showed net income of $50,000.

50,000

5. At the end of the year, the company declares a dividend of $1.20 per share

for common stockholders. -34,800

AI-Generated Solution

Unlock instant AI solutions

Tap the button

to generate a solution

Recommended textbooks for you

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Excel Applications for Accounting Principles

Accounting

ISBN:

9781111581565

Author:

Gaylord N. Smith

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Excel Applications for Accounting Principles

Accounting

ISBN:

9781111581565

Author:

Gaylord N. Smith

Publisher:

Cengage Learning

Corporate Financial Accounting

Accounting

ISBN:

9781305653535

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning