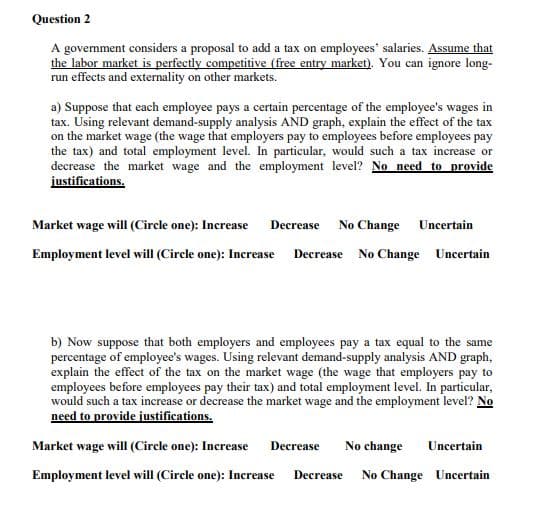

Question 2 A government considers a proposal to add a tax on employees' salaries. Assume that the labor market is perfectly competitive (free entry market). You can ignore long- run effects and externality on other markets. a) Suppose that each employee pays a certain percentage of the employee's wages in tax. Using relevant demand-supply analysis AND graph, explain the effect of the tax on the market wage (the wage that employers pay to employees before employees pay the tax) and total employment level. In particular, would such a tax increase or decrease the market wage and the employment level? No need to provide justifications. Market wage will (Circle one): Increase Decrease No Change Uncertain Employment level will (Circle one): Increase Decrease No Change Uncertain b) Now suppose that both employers and employees pay a tax equal to the same percentage of employee's wages. Using relevant demand-supply analysis AND graph, explain the effect of the tax on the market wage (the wage that employers pay to employees before employees pay their tax) and total employment level. In particular, would such a tax increase or decrease the market wage and the employment level? No need to provide justifications. Decrease No change Uncertain Market wage will (Circle one): Increase Employment level will (Circle one): Increase Decrease No Change Uncertain

Question 2 A government considers a proposal to add a tax on employees' salaries. Assume that the labor market is perfectly competitive (free entry market). You can ignore long- run effects and externality on other markets. a) Suppose that each employee pays a certain percentage of the employee's wages in tax. Using relevant demand-supply analysis AND graph, explain the effect of the tax on the market wage (the wage that employers pay to employees before employees pay the tax) and total employment level. In particular, would such a tax increase or decrease the market wage and the employment level? No need to provide justifications. Market wage will (Circle one): Increase Decrease No Change Uncertain Employment level will (Circle one): Increase Decrease No Change Uncertain b) Now suppose that both employers and employees pay a tax equal to the same percentage of employee's wages. Using relevant demand-supply analysis AND graph, explain the effect of the tax on the market wage (the wage that employers pay to employees before employees pay their tax) and total employment level. In particular, would such a tax increase or decrease the market wage and the employment level? No need to provide justifications. Decrease No change Uncertain Market wage will (Circle one): Increase Employment level will (Circle one): Increase Decrease No Change Uncertain

Chapter13: General Equilibrium And Welfare

Section: Chapter Questions

Problem 13.14P

Related questions

Question

Transcribed Image Text:Question 2

A government considers a proposal to add a tax on employees' salaries. Assume that

the labor market is perfectly competitive (free entry market). You can ignore long-

run effects and externality on other markets.

a) Suppose that each employee pays a certain percentage of the employee's wages in

tax. Using relevant demand-supply analysis AND graph, explain the effect of the tax

on the market wage (the wage that employers pay to employees before employees pay

the tax) and total employment level. In particular, would such a tax increase or

decrease the market wage and the employment level? No need to provide

justifications.

Market wage will (Circle one): Increase

Decrease

No Change Uncertain

Employment level will (Circle one): Increase Decrease No Change Uncertain

b) Now suppose that both employers and employees pay a tax equal to the same

percentage of employee's wages. Using relevant demand-supply analysis AND graph,

explain the effect of the tax on the market wage (the wage that employers pay to

employees before employees pay their tax) and total employment level. In particular,

would such a tax increase or decrease the market wage and the employment level? No

need to provide justifications.

Market wage will (Circle one): Increase

Decrease

No change

Uncertain

Employment level will (Circle one): Increase

No Change Uncertain

Decrease

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 3 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Recommended textbooks for you

Principles of Microeconomics (MindTap Course List)

Economics

ISBN:

9781305971493

Author:

N. Gregory Mankiw

Publisher:

Cengage Learning

Principles of Economics (MindTap Course List)

Economics

ISBN:

9781305585126

Author:

N. Gregory Mankiw

Publisher:

Cengage Learning

Principles of Microeconomics (MindTap Course List)

Economics

ISBN:

9781305971493

Author:

N. Gregory Mankiw

Publisher:

Cengage Learning

Principles of Economics (MindTap Course List)

Economics

ISBN:

9781305585126

Author:

N. Gregory Mankiw

Publisher:

Cengage Learning

Principles of Economics, 7th Edition (MindTap Cou…

Economics

ISBN:

9781285165875

Author:

N. Gregory Mankiw

Publisher:

Cengage Learning

Principles of Economics 2e

Economics

ISBN:

9781947172364

Author:

Steven A. Greenlaw; David Shapiro

Publisher:

OpenStax

Principles of Microeconomics

Economics

ISBN:

9781305156050

Author:

N. Gregory Mankiw

Publisher:

Cengage Learning