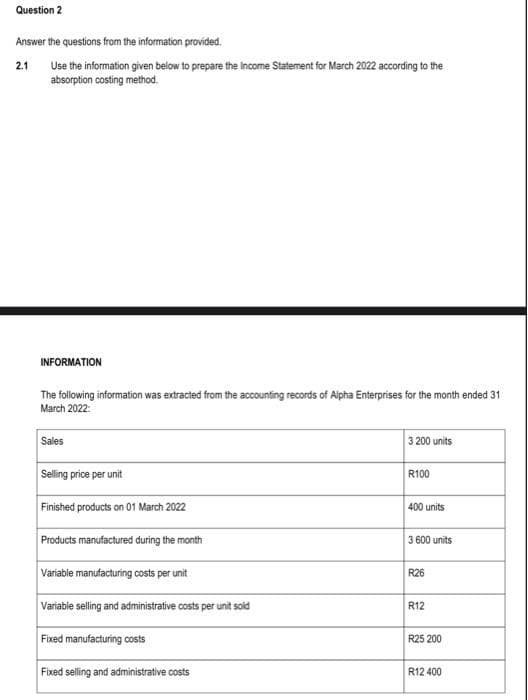

Question 2 Answer the questions from the information provided. 2.1 Use the information given below to prepare the Income Statement for March 2022 according to the absorption costing method. INFORMATION The following information was extracted from the accounting records of Alpha Enterprises for the month ended 31 March 2022: Sales Selling price per unit Finished products on 01 March 2022 Products manufactured during the month Variable manufacturing costs per unit Variable selling and administrative costs per unit sold Fixed manufacturing costs Fixed selling and administrative costs 3200 units R100 400 units 3 600 units R26 R12 R25 200 R12 400

Question 2 Answer the questions from the information provided. 2.1 Use the information given below to prepare the Income Statement for March 2022 according to the absorption costing method. INFORMATION The following information was extracted from the accounting records of Alpha Enterprises for the month ended 31 March 2022: Sales Selling price per unit Finished products on 01 March 2022 Products manufactured during the month Variable manufacturing costs per unit Variable selling and administrative costs per unit sold Fixed manufacturing costs Fixed selling and administrative costs 3200 units R100 400 units 3 600 units R26 R12 R25 200 R12 400

Accounting (Text Only)

26th Edition

ISBN:9781285743615

Author:Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:Carl Warren, James M. Reeve, Jonathan Duchac

Chapter21: Cost Behavior And Cost-volume-profit Analysis

Section: Chapter Questions

Problem 21.28EX: Appendix Absorption costing income statement On June 30, the end of the first month of operations,...

Related questions

Question

i need only income statement from abosrbtion costing method

there is no need of other questions only give answer of 2.1

Transcribed Image Text:Question 2

Answer the questions from the information provided.

2.1 Use the information given below to prepare the Income Statement for March 2022 according to the

absorption costing method.

INFORMATION

The following information was extracted from the accounting records of Alpha Enterprises for the month ended 31

March 2022:

Sales

Selling price per unit

Finished products on 01 March 2022

Products manufactured during the month

Variable manufacturing costs per unit

Variable selling and administrative costs per unit sold

Fixed manufacturing costs

Fixed selling and administrative costs

3 200 units

R100

400 units

3 600 units

R26

R12

R25 200

R12 400

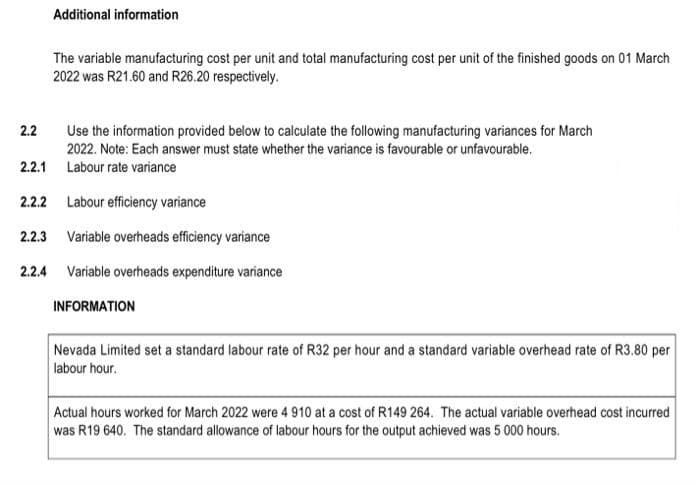

Transcribed Image Text:2.2

Additional information

The variable manufacturing cost per unit and total manufacturing cost per unit of the finished goods on 01 March

2022 was R21.60 and R26.20 respectively.

Use the information provided below to calculate the following manufacturing variances for March

2022. Note: Each answer must state whether the variance is favourable or unfavourable.

Labour rate variance

2.2.1

2.2.2 Labour efficiency variance

2.2.3 Variable overheads efficiency variance

2.2.4 Variable overheads expenditure variance

INFORMATION

Nevada Limited set a standard labour rate of R32 per hour and a standard variable overhead rate of R3.80 per

labour hour.

Actual hours worked for March 2022 were 4 910 at a cost of R149 264. The actual variable overhead cost incurred

was R19 640. The standard allowance of labour hours for the output achieved was 5 000 hours.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 6 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Accounting (Text Only)

Accounting

ISBN:

9781285743615

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

Accounting (Text Only)

Accounting

ISBN:

9781285743615

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Excel Applications for Accounting Principles

Accounting

ISBN:

9781111581565

Author:

Gaylord N. Smith

Publisher:

Cengage Learning