Question 2: Support Department Cost allocation and Job Costing Custom Boat Manufacturing Company makes customised boats and uses job costing system. The company has two support departments (administration and security) and two manufacturing departments (machining and assembly). The following table shows the total overhead costs of manufacturing departments after the support departments' cost have been allocated under three cost allocation methods. Machining Department Cost $ 8,650,000 $ 8,500,000 $9,000,000 Assembly Department Cost $ 7,350,000 $ 7,500,000 $ 7,000,000 Cost Allocation Method Direct Method Step-down Method Reciprocal Method Management of the company has decided that it will achieve the most appropriate job costs by using individual manufacturing department overhead rates to allocate the overhead costs to the jobs. These rates are developed after support-department costs are allocated to manufacturing departments. The company uses normal costing. Machining department's cost is allocated on the basis of machine hours and Assembly department's cost is allocated based on labour hours. The budgeted labour hour and machine hours for the two manufacturing departments are presented below. Manufacturing Departments Machining Department Assembly Department Machine Hours Labour Hours 200,000 80,000 15,000 35,000 Required: (a) Based on the following information, determine the total costs for Job MT27 if the company uses Reciprocal Method to allocate support departments' costs to the manufacturing departments. Assembly $6,710 $1,650 Job no. MT27 Machining $36,000 $1,550 Direct materials Direct labour cost Direct labour hours 45 70 Machine Hours 210 20 (b) The company evaluates the performance of the operating department managers on the basis of how well they managed their total costs, including allocated costs. As the manager of the Machining Department, which allocation method would you prefer to allocate support department's costs to manufacturing departments?

Question 2: Support Department Cost allocation and Job Costing Custom Boat Manufacturing Company makes customised boats and uses job costing system. The company has two support departments (administration and security) and two manufacturing departments (machining and assembly). The following table shows the total overhead costs of manufacturing departments after the support departments' cost have been allocated under three cost allocation methods. Machining Department Cost $ 8,650,000 $ 8,500,000 $9,000,000 Assembly Department Cost $ 7,350,000 $ 7,500,000 $ 7,000,000 Cost Allocation Method Direct Method Step-down Method Reciprocal Method Management of the company has decided that it will achieve the most appropriate job costs by using individual manufacturing department overhead rates to allocate the overhead costs to the jobs. These rates are developed after support-department costs are allocated to manufacturing departments. The company uses normal costing. Machining department's cost is allocated on the basis of machine hours and Assembly department's cost is allocated based on labour hours. The budgeted labour hour and machine hours for the two manufacturing departments are presented below. Manufacturing Departments Machining Department Assembly Department Machine Hours Labour Hours 200,000 80,000 15,000 35,000 Required: (a) Based on the following information, determine the total costs for Job MT27 if the company uses Reciprocal Method to allocate support departments' costs to the manufacturing departments. Assembly $6,710 $1,650 Job no. MT27 Machining $36,000 $1,550 Direct materials Direct labour cost Direct labour hours 45 70 Machine Hours 210 20 (b) The company evaluates the performance of the operating department managers on the basis of how well they managed their total costs, including allocated costs. As the manager of the Machining Department, which allocation method would you prefer to allocate support department's costs to manufacturing departments?

Managerial Accounting: The Cornerstone of Business Decision-Making

7th Edition

ISBN:9781337115773

Author:Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Chapter4: Job-order Costing And Overhead Application

Section: Chapter Questions

Problem 27BEA: Use the following information for Brief Exercises 4-27 and 4-28: Quillen Company manufactures a...

Related questions

Question

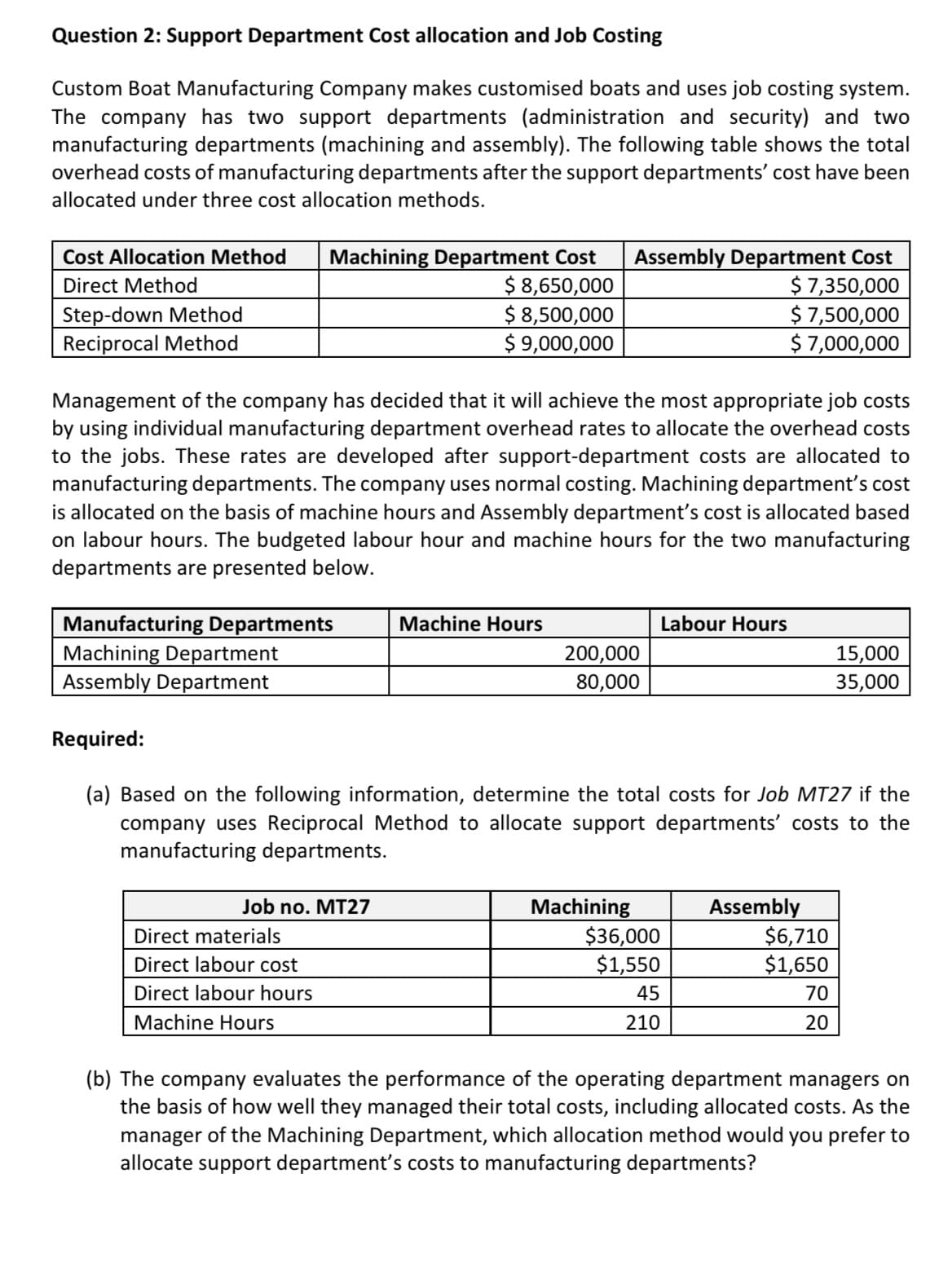

Transcribed Image Text:Question 2: Support Department Cost allocation and Job Costing

Custom Boat Manufacturing Company makes customised boats and uses job costing system.

The company has two support departments (administration and security) and two

manufacturing departments (machining and assembly). The following table shows the total

overhead costs of manufacturing departments after the support departments' cost have been

allocated under three cost allocation methods.

Machining Department Cost

$ 8,650,000

$ 8,500,000

$ 9,000,000

Assembly Department Cost

$ 7,350,000

$ 7,500,000

$ 7,000,000

Cost Allocation Method

Direct Method

Step-down Method

Reciprocal Method

Management of the company has decided that it will achieve the most appropriate job costs

by using individual manufacturing department overhead rates to allocate the overhead costs

to the jobs. These rates are developed after support-department costs are allocated to

manufacturing departments. The company uses normal costing. Machining department's cost

is allocated on the basis of machine hours and Assembly department's cost is allocated based

on labour hours. The budgeted labour hour and machine hours for the two manufacturing

departments are presented below.

Manufacturing Departments

Machining Department

Assembly Department

Machine Hours

Labour Hours

200,000

80,000

15,000

35,000

Required:

(a) Based on the following information, determine the total costs for Job MT27 if the

company uses Reciprocal Method to allocate support departments' costs to the

manufacturing departments.

Assembly

$6,710

$1,650

Job no. MT27

Machining

$36,000

$1,550

Direct materials

Direct labour cost

Direct labour hours

45

70

Machine Hours

210

20

(b) The company evaluates the performance of the operating department managers on

the basis of how well they managed their total costs, including allocated costs. As the

manager of the Machining Department, which allocation method would you prefer to

allocate support department's costs to manufacturing departments?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 3 steps with 3 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

Principles of Cost Accounting

Accounting

ISBN:

9781305087408

Author:

Edward J. Vanderbeck, Maria R. Mitchell

Publisher:

Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College