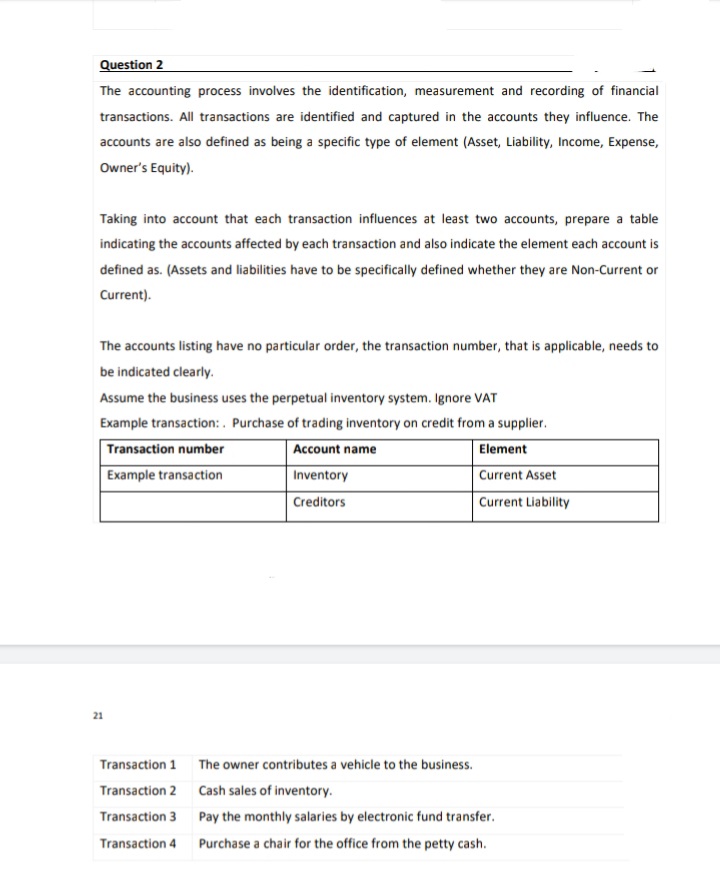

Question 2 The accounting process involves the identification, measurement and recording of financial transactions. All transactions are identified and captured in the accounts they influence. The accounts are also defined as being a specific type of element (Asset, Liability, Income, Expense, Owner's Equity). Taking into account that each transaction influences at least two accounts, prepare a table indicating the accounts affected by each transaction and also indicate the element each account is defined as. (Assets and liabilities have to be specifically defined whether they are Non-Current or Current). The accounts listing have no particular order, the transaction number, that is applicable, needs to be indicated clearly. Assume the business uses the perpetual inventory system. Ignore VAT Example transaction: . Purchase of trading inventory on credit from a supplier. Transaction number Account name Element Example transaction Inventory Current Asset Creditors Current Liability 21 Transaction 1 The owner contributes a vehicle to the business. Transaction 2 Cash sales of inventory. Transaction 3 Pay the monthly salaries by electronic fund transfer. Transaction 4 Purchase a chair for the office from the petty cash.

Question 2 The accounting process involves the identification, measurement and recording of financial transactions. All transactions are identified and captured in the accounts they influence. The accounts are also defined as being a specific type of element (Asset, Liability, Income, Expense, Owner's Equity). Taking into account that each transaction influences at least two accounts, prepare a table indicating the accounts affected by each transaction and also indicate the element each account is defined as. (Assets and liabilities have to be specifically defined whether they are Non-Current or Current). The accounts listing have no particular order, the transaction number, that is applicable, needs to be indicated clearly. Assume the business uses the perpetual inventory system. Ignore VAT Example transaction: . Purchase of trading inventory on credit from a supplier. Transaction number Account name Element Example transaction Inventory Current Asset Creditors Current Liability 21 Transaction 1 The owner contributes a vehicle to the business. Transaction 2 Cash sales of inventory. Transaction 3 Pay the monthly salaries by electronic fund transfer. Transaction 4 Purchase a chair for the office from the petty cash.

Auditing: A Risk Based-Approach (MindTap Course List)

11th Edition

ISBN:9781337619455

Author:Karla M Johnstone, Audrey A. Gramling, Larry E. Rittenberg

Publisher:Karla M Johnstone, Audrey A. Gramling, Larry E. Rittenberg

Chapter11: Auditing Inventory, Goods And Services, And Accounts Payable: The Acquisition And Payment Cycle

Section: Chapter Questions

Problem 4RQSC

Related questions

Question

Transcribed Image Text:Question 2

The accounting process involves the identification, measurement and recording of financial

transactions. All transactions are identified and captured in the accounts they influence. The

accounts are also defined as being a specific type of element (Asset, Liability, Income, Expense,

Owner's Equity).

Taking into account that each transaction influences at least two accounts, prepare a table

indicating the accounts affected by each transaction and also indicate the element each account is

defined as. (Assets and liabilities have to be specifically defined whether they are Non-Current or

Current).

The accounts listing have no particular order, the transaction number, that is applicable, needs to

be indicated clearly.

Assume the business uses the perpetual inventory system. Ignore VAT

Example transaction: . Purchase of trading inventory on credit from a supplier.

Transaction number

Account name

Element

Example transaction

Inventory

Current Asset

Creditors

Current Liability

21

Transaction 1 The owner contributes a vehicle to the business.

Transaction 2 Cash sales of inventory.

Transaction 3 Pay the monthly salaries by electronic fund transfer.

Transaction 4 Purchase a chair for the office from the petty cash.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Auditing: A Risk Based-Approach (MindTap Course L…

Accounting

ISBN:

9781337619455

Author:

Karla M Johnstone, Audrey A. Gramling, Larry E. Rittenberg

Publisher:

Cengage Learning

Corporate Financial Accounting

Accounting

ISBN:

9781305653535

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Auditing: A Risk Based-Approach (MindTap Course L…

Accounting

ISBN:

9781337619455

Author:

Karla M Johnstone, Audrey A. Gramling, Larry E. Rittenberg

Publisher:

Cengage Learning

Corporate Financial Accounting

Accounting

ISBN:

9781305653535

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781337280570

Author:

Scott, Cathy J.

Publisher:

South-Western College Pub