Question 2. Assume that the money demand function is (M/ Pd = 3,000 – 200r, where r is the interest rate in percent. If the price level is fixed at P = 2, and the Bank of Canada wants to fix the interest rate at 7 percent, what is the size of the money supply that the Bank of Canada should set at?

Question 2. Assume that the money demand function is (M/ Pd = 3,000 – 200r, where r is the interest rate in percent. If the price level is fixed at P = 2, and the Bank of Canada wants to fix the interest rate at 7 percent, what is the size of the money supply that the Bank of Canada should set at?

Economics: Private and Public Choice (MindTap Course List)

16th Edition

ISBN:9781305506725

Author:James D. Gwartney, Richard L. Stroup, Russell S. Sobel, David A. Macpherson

Publisher:James D. Gwartney, Richard L. Stroup, Russell S. Sobel, David A. Macpherson

Chapter13: Money And The Banking System

Section: Chapter Questions

Problem 8CQ

Related questions

Question

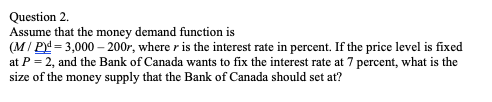

Transcribed Image Text:Question 2.

Assume that the money demand function is

(M/ P = 3,000 – 200r, where r is the interest rate in percent. If the price level is fixed

at P = 2, and the Bank of Canada wants to fix the interest rate at 7 percent, what is the

size of the money supply that the Bank of Canada should set at?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Recommended textbooks for you

Economics: Private and Public Choice (MindTap Cou…

Economics

ISBN:

9781305506725

Author:

James D. Gwartney, Richard L. Stroup, Russell S. Sobel, David A. Macpherson

Publisher:

Cengage Learning

Macroeconomics: Private and Public Choice (MindTa…

Economics

ISBN:

9781305506756

Author:

James D. Gwartney, Richard L. Stroup, Russell S. Sobel, David A. Macpherson

Publisher:

Cengage Learning

Economics: Private and Public Choice (MindTap Cou…

Economics

ISBN:

9781305506725

Author:

James D. Gwartney, Richard L. Stroup, Russell S. Sobel, David A. Macpherson

Publisher:

Cengage Learning

Macroeconomics: Private and Public Choice (MindTa…

Economics

ISBN:

9781305506756

Author:

James D. Gwartney, Richard L. Stroup, Russell S. Sobel, David A. Macpherson

Publisher:

Cengage Learning