a. If Northeast Productions Company is a sole proprietorship owned by Ms. Smith,: (Select the best answer below.) A. Ms. Smith has unlimited liability, which means creditors can only claim against the $25,000 she invested. B. Ms. Smith has unlimited liability, which means creditors can claim against her personal assets. C. Ms. Smith has limited liability, which is the amount of $60,000 in unpaid debts. OD. Ms. Smith has limited liability, which guarantees that she cannot lose more than the $25,000 she invested.

a. If Northeast Productions Company is a sole proprietorship owned by Ms. Smith,: (Select the best answer below.) A. Ms. Smith has unlimited liability, which means creditors can only claim against the $25,000 she invested. B. Ms. Smith has unlimited liability, which means creditors can claim against her personal assets. C. Ms. Smith has limited liability, which is the amount of $60,000 in unpaid debts. OD. Ms. Smith has limited liability, which guarantees that she cannot lose more than the $25,000 she invested.

Chapter19: Corporations: Distributions Not In Complete Liquidation

Section: Chapter Questions

Problem 1RP

Related questions

Question

Transcribed Image Text:Question 23, P1-1 (similar to)

Part 1 of 4

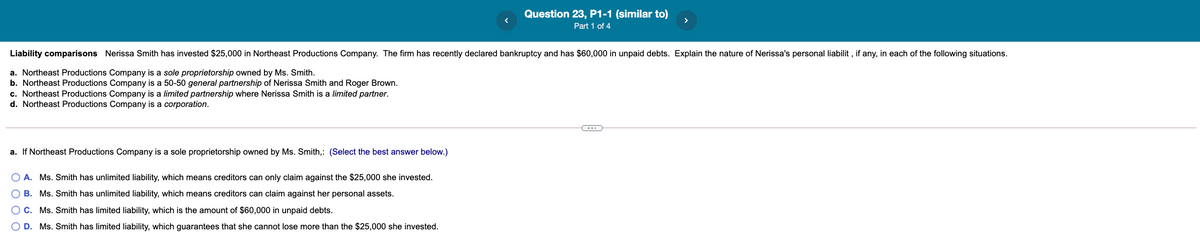

Liability comparisons Nerissa Smith has invested $25,000 in Northeast Productions Company. The firm has recently declared bankruptcy and has $60,000 in unpaid debts. Explain the nature of Nerissa's personal liabilit , if any, in each of the following situations.

a. Northeast Productions Company is a sole proprietorship owned by Ms. Smith.

b. Northeast Productions Company is a 50-50 general partnership of Nerissa Smith and Roger Brown.

c. Northeast Productions Company is a limited partnership where Nerissa Smith is a limited partner.

d. Northeast Productions Company is a corporation.

a. If Northeast Productions Company is a sole proprietorship owned by Ms. Smith,: (Select the best answer below.)

O A. Ms. Smith has unlimited liability, which means creditors can only claim against the $25,000 she invested.

O B. Ms. Smith has unlimited liability, which means creditors can claim against her personal assets.

O C. Ms. Smith has limited liability, which is the amount of $60,000 in unpaid debts.

D. Ms. Smith has limited liability, which guarantees that she cannot lose more than the $25,000 she invested.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps

Recommended textbooks for you

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning