Question 2h Given the following information QD = 240 – 5P QS = P where QD is the quantity demanded, QS is the quantity supplied and P is the price. Suppose that the government decides to impose a tax of $12 per unit on sellers in this market. Determine: Deadweight loss of the tax ENTER FINAL ANSWER ONLY AS NEAREST WHOLE NUMBER. NO WORKINGS

Question 2h Given the following information QD = 240 – 5P QS = P where QD is the quantity demanded, QS is the quantity supplied and P is the price. Suppose that the government decides to impose a tax of $12 per unit on sellers in this market. Determine: Deadweight loss of the tax ENTER FINAL ANSWER ONLY AS NEAREST WHOLE NUMBER. NO WORKINGS

Microeconomics: Principles & Policy

14th Edition

ISBN:9781337794992

Author:William J. Baumol, Alan S. Blinder, John L. Solow

Publisher:William J. Baumol, Alan S. Blinder, John L. Solow

Chapter17: Taxation And Resource Allocation

Section: Chapter Questions

Problem 4TY

Related questions

Question

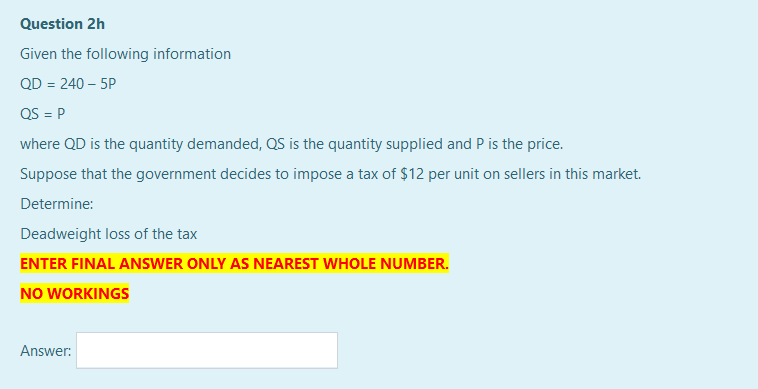

Transcribed Image Text:Question 2h

Given the following information

QD = 240 – 5P

QS = P

where QD is the quantity demanded, QS is the quantity supplied and P is the price.

Suppose that the government decides to impose a tax of $12 per unit on sellers in this market.

Determine:

Deadweight loss of the tax

ENTER FINAL ANSWER ONLY AS NEAREST WHOLE NUMBER.

NO WORKINGS

Answer:

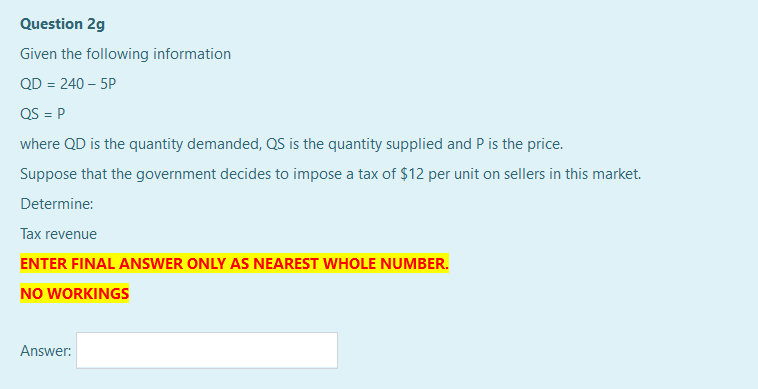

Transcribed Image Text:Question 2g

Given the following information

QD = 240 – 5P

QS = P

where QD is the quantity demanded, QS is the quantity supplied and P is the price.

Suppose that the government decides to impose a tax of $12 per unit on sellers in this market.

Determine:

Tax revenue

ENTER FINAL ANSWER ONLY AS NEAREST WHOLE NUMBER.

NO WORKINGS

Answer:

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 4 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Recommended textbooks for you

Microeconomics: Principles & Policy

Economics

ISBN:

9781337794992

Author:

William J. Baumol, Alan S. Blinder, John L. Solow

Publisher:

Cengage Learning

Macroeconomics: Private and Public Choice (MindTa…

Economics

ISBN:

9781305506756

Author:

James D. Gwartney, Richard L. Stroup, Russell S. Sobel, David A. Macpherson

Publisher:

Cengage Learning

Microeconomics: Private and Public Choice (MindTa…

Economics

ISBN:

9781305506893

Author:

James D. Gwartney, Richard L. Stroup, Russell S. Sobel, David A. Macpherson

Publisher:

Cengage Learning

Microeconomics: Principles & Policy

Economics

ISBN:

9781337794992

Author:

William J. Baumol, Alan S. Blinder, John L. Solow

Publisher:

Cengage Learning

Macroeconomics: Private and Public Choice (MindTa…

Economics

ISBN:

9781305506756

Author:

James D. Gwartney, Richard L. Stroup, Russell S. Sobel, David A. Macpherson

Publisher:

Cengage Learning

Microeconomics: Private and Public Choice (MindTa…

Economics

ISBN:

9781305506893

Author:

James D. Gwartney, Richard L. Stroup, Russell S. Sobel, David A. Macpherson

Publisher:

Cengage Learning

Economics: Private and Public Choice (MindTap Cou…

Economics

ISBN:

9781305506725

Author:

James D. Gwartney, Richard L. Stroup, Russell S. Sobel, David A. Macpherson

Publisher:

Cengage Learning

Principles of Microeconomics (MindTap Course List)

Economics

ISBN:

9781305971493

Author:

N. Gregory Mankiw

Publisher:

Cengage Learning

Principles of Macroeconomics (MindTap Course List)

Economics

ISBN:

9781285165912

Author:

N. Gregory Mankiw

Publisher:

Cengage Learning