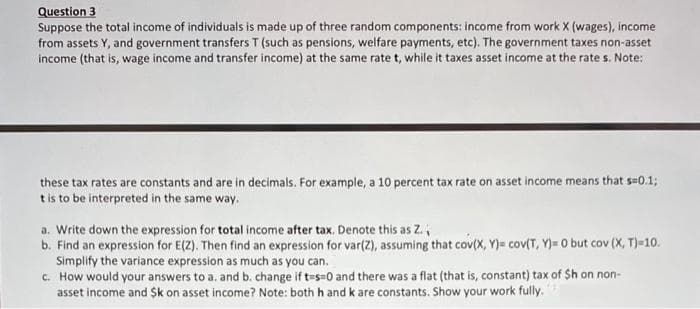

Question 3 Suppose the total income of individuals is made up of three random components: income from work X (wages), income from assets Y, and government transfers T (such as pensions, welfare payments, etc). The government taxes non-asset income (that is, wage income and transfer income) at the same rate t, while it taxes asset income at the rate s. Note: these tax rates are constants and are in decimals. For example, a 10 percent tax rate on asset income means that s-0.1; tis to be interpreted in the same way. a. Write down the expression for total income after tax. Denote this as Z., b. Find an expression for E(2). Then find an expression for var(Z), assuming that cov(X, Y)= cov(T, Y)= 0 but cov (X, T)=10. Simplify the variance expression as much as you can. C. How would your answers to a. and b. change if t=s=0 and there was a flat (that is, constant) tax of Sh on non- asset income and Sk on asset income? Note: both h and k are constants. Show your work fully.

Question 3 Suppose the total income of individuals is made up of three random components: income from work X (wages), income from assets Y, and government transfers T (such as pensions, welfare payments, etc). The government taxes non-asset income (that is, wage income and transfer income) at the same rate t, while it taxes asset income at the rate s. Note: these tax rates are constants and are in decimals. For example, a 10 percent tax rate on asset income means that s-0.1; tis to be interpreted in the same way. a. Write down the expression for total income after tax. Denote this as Z., b. Find an expression for E(2). Then find an expression for var(Z), assuming that cov(X, Y)= cov(T, Y)= 0 but cov (X, T)=10. Simplify the variance expression as much as you can. C. How would your answers to a. and b. change if t=s=0 and there was a flat (that is, constant) tax of Sh on non- asset income and Sk on asset income? Note: both h and k are constants. Show your work fully.

Functions and Change: A Modeling Approach to College Algebra (MindTap Course List)

6th Edition

ISBN:9781337111348

Author:Bruce Crauder, Benny Evans, Alan Noell

Publisher:Bruce Crauder, Benny Evans, Alan Noell

Chapter5: A Survey Of Other Common Functions

Section5.3: Modeling Data With Power Functions

Problem 6E: Urban Travel Times Population of cities and driving times are related, as shown in the accompanying...

Related questions

Question

Please all solve

Transcribed Image Text:Question 3

Suppose the total income of individuals is made up of three random components: income from work X (wages), income

from assets Y, and government transfers T (such as pensions, welfare payments, etc). The government taxes non-asset

income (that is, wage income and transfer income) at the same rate t, while it taxes asset income at the rate s. Note:

these tax rates are constants and are in decimals. For example, a 10 percent tax rate on asset income means that s=0.13;

tis to be interpreted in the same way.

a. Write down the expression for total income after tax. Denote this as Z.,

b. Find an expression for E(Z). Then find an expression for var(Z), assuming that cov(X, Y)= cov(T, Y)= 0 but cov (X, T)-10.

Simplify the variance expression as much as you can.

c. How would your answers to a. and b. change if t-s=0 and there was a flat (that is, constant) tax of Sh on non-

asset income and Sk on asset income? Note: both h and k are constants. Show your work fully.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 6 steps with 4 images

Recommended textbooks for you

Functions and Change: A Modeling Approach to Coll…

Algebra

ISBN:

9781337111348

Author:

Bruce Crauder, Benny Evans, Alan Noell

Publisher:

Cengage Learning

Algebra & Trigonometry with Analytic Geometry

Algebra

ISBN:

9781133382119

Author:

Swokowski

Publisher:

Cengage

Functions and Change: A Modeling Approach to Coll…

Algebra

ISBN:

9781337111348

Author:

Bruce Crauder, Benny Evans, Alan Noell

Publisher:

Cengage Learning

Algebra & Trigonometry with Analytic Geometry

Algebra

ISBN:

9781133382119

Author:

Swokowski

Publisher:

Cengage