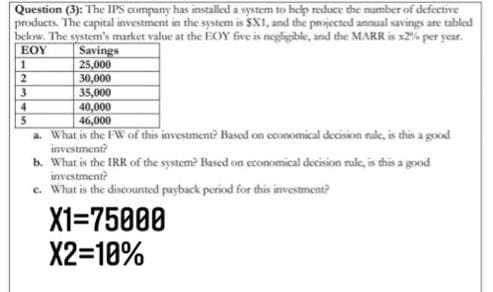

Question (3): The IPS company has installed a system to help reduce the number of defective products. The capital investment in the system is $X1, and the projected annual savings are tabl below. The system's market value at the EOY five is negligible, and the MARR is x2 per year EOY Savings 25,000 30,000 35,000 40,000 46,000 3. a What is the FW of this investment? Based on cconomical decision nuk, is this a good investment? b. What is the IRR of the system? Based on economical decision ruke, is this a good investment? c. What is the discounted payback period for this investment? X1=75000 X2=10%

Question (3): The IPS company has installed a system to help reduce the number of defective products. The capital investment in the system is $X1, and the projected annual savings are tabl below. The system's market value at the EOY five is negligible, and the MARR is x2 per year EOY Savings 25,000 30,000 35,000 40,000 46,000 3. a What is the FW of this investment? Based on cconomical decision nuk, is this a good investment? b. What is the IRR of the system? Based on economical decision ruke, is this a good investment? c. What is the discounted payback period for this investment? X1=75000 X2=10%

Managerial Accounting: The Cornerstone of Business Decision-Making

7th Edition

ISBN:9781337115773

Author:Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Chapter12: Capital Investment Decisions

Section: Chapter Questions

Problem 21BEA

Related questions

Question

without excel please

Transcribed Image Text:Question (3): The IPS company has installed a system to help reduce the number of defective

products. The capital investment in the system is $X1, and the projected annual savings are tabled

below. The system's market value at the EOY five is negligible, and the MARR is x2% per year.

Savings

25,000

30,000

35,000

40,000

46,000

EOY

2

3

4.

a. What is the FW of this investment? Based on cconomical decision rule, is this a good

investment?

b. What is the IRR of the system? Based on economical decision rule, is this a good

investment?

c. What is the discounted payback period for this investment?

X1=75000

X2=10%

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Essentials of Business Analytics (MindTap Course …

Statistics

ISBN:

9781305627734

Author:

Jeffrey D. Camm, James J. Cochran, Michael J. Fry, Jeffrey W. Ohlmann, David R. Anderson

Publisher:

Cengage Learning