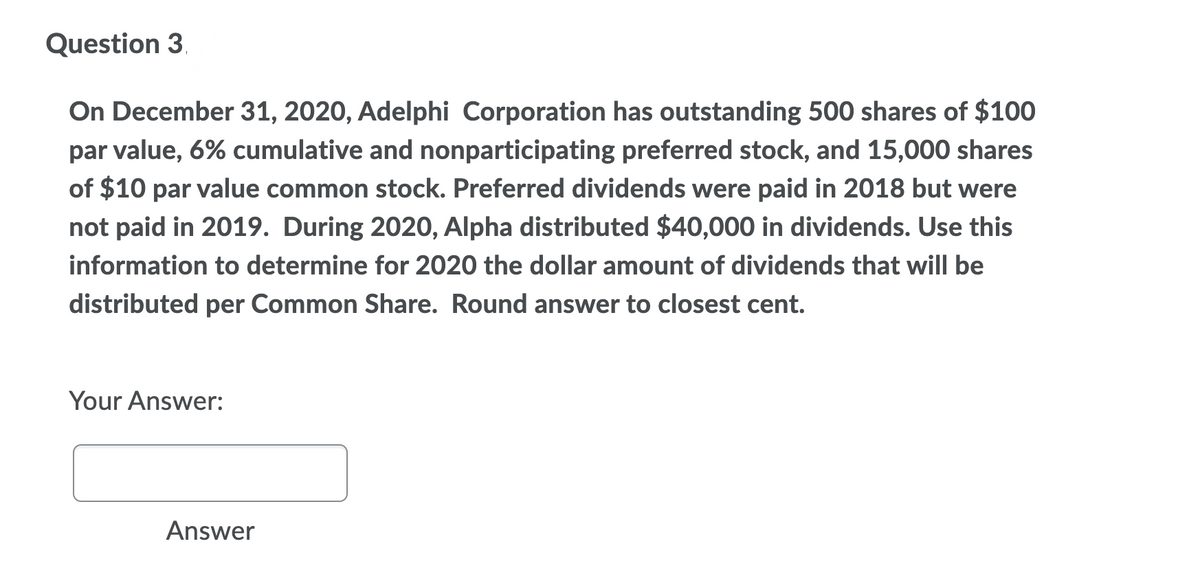

Question 3. On December 31, 2020, Adelphi Corporation has outstanding 500 shares of $100 par value, 6% cumulative and nonparticipating preferred stock, and 15,000 shares of $10 par value common stock. Preferred dividends were paid in 2018 but were not paid in 2019. During 2020, Alpha distributed $40,000 in dividends. Use this information to determine for 2020 the dollar amount of dividends that will be distributed per Common Share. Round answer to closest cent. Your Answer: Answer

Q: On January 2, Y1, Arch and Bean contribute $10,000 cash Partnership. Arch and Bean share profits and…

A:

Q: Keshara has the following net § 1231 results for each of the years shown: Tax Year Net § 1231 Loss…

A: Amount treated as long term capital gain = Cumulative total of net 1231 gain - Cumulative total of…

Q: The following information was available from the inventory records of Apollo Company for January:…

A: Cost of inventory after 1st sale (January 9) = (P29,310 + P20,600) x (2,500 / 5,000) = P24,955

Q: 1 Dollar General reported stronger than typical earnings with annual sales of $2,000,000 per store…

A: Profit margin is one of the measure of profitability of the business. This is calculated by dividing…

Q: 3. As of January 1, 2018, the partnership of Canton, Yulls, and Garr had the following account…

A: A. = $ 228000 B. = $ 68400 Explanation:

Q: A. Bina Ria Sdn Bhd (BRSB) is a local resident company incorporated in 2011 for the manufacture of…

A: An expenditure incurred as a cost of construction or the purchase price of the building and the…

Q: Below are accounts were taken from the books of Enrique Hill Cross School Security Services for…

A: Introduction: Income statement: All revenues and expenses are to be shown in income statement. It…

Q: Fried Inc. purchased 90% ownership of Chicken Corp. in 2020, at underlying book value. On that…

A:

Q: Haystalk Company issues 4,000 shares of restricted stock to its CFO, Corn Needle, on January 1,…

A: Total par value of 4000 shares = 4000 shares ×$5 =$20000

Q: Donut Inc. issued 20,000 common shares in exchange for all the outstanding shares of Munchkin Inc.…

A: Purchase consideration is the consideration paid or payable in cash or in-kind including in the form…

Q: Example: Cinco Mayo Corporation issued 250 shares of $20 par value common stock and 100 shares of…

A: >Sometimes, the common stock shares and preferred stock shares are issued together, and the…

Q: To improve her body shape Ms. Ganda decided to undergo procedure and sought the services of the Body…

A: VAT i.e. Value Added Tax is an indirect form of tax. It majorly eliminates cascading effect of tax…

Q: The following information was available from the inventory records of Apollo Company for January:…

A: Formula: Inventory value at year end = No. of units in ending inventory x Average cost per unit…

Q: please answer all aprts wi

A: Assets are resources that are controlled which results from prior transactions that are expected to…

Q: 1b) Banks offer overdraft facilities and term loans, among other services, to their corporate…

A: The answer is stated below:

Q: Direct materials purchases budget for glue: FlashKick Company Direct Materials Purchases Budget -…

A: Direct material purchase budget shows estimated amount of direct materials to be purchased in order…

Q: The Regal Cycle Company manufactures three types of bicycles-a dirt bike, a mountain bike, and a…

A: Financial advantage means the product/policy is giving positive results. Financial disadvantage…

Q: At December 31. 2022. end of the first year, XYZ Lessee's Journal entry would Linclude a Oa Debit to…

A: The lease is a written agreement between two parties in which one part rents its asset to another…

Q: A gain on the disposal of an asset indicates that the asset was sold for more than Its fair value.…

A: Lets understand the basics. When there is sale happens of asset then there is profit or loss arise.…

Q: On January 1, an entity issues 50,000 shares of $10 par value common stock for $18 per share. On…

A: Additional Paid-In Capital: In the case of stocks, additional paid-in capital (APIC) is the…

Q: Thompson Company incurred research and development costs of $120,000 and legal fees of $50,000 to…

A: Depreciation is charged on fixed assets whereas amortisation is charged on intangible assets.…

Q: 19,000, would have a useful life o at the investment has been in ope 11 years (including the year…

A: NPV= present value of cash flow- Intial Investment when the NPV is greater than $ 0 , accept the…

Q: Assets Cash Accounts Receivable Inventory Prepaid Rent Equipment Total Assets ary transactions…

A: Cash balance as on 31 December , 2021 : $ 323, 492 Total liablities as on 31December , 2021: $…

Q: révenue during November was $131,500. The revenue activity variance is: $6,700F. O $9,600F. $9,600U.…

A: Revenue Activity Variance measures the difference between what we had planned and what we had…

Q: Pol Corp. acquired 80% of Gas Corp. on January 1, 2020. Pol Corp. purchased inventory for P280,000…

A: The question is related to Consolidated Financial Statements. The details of the question are as…

Q: Ana Chavarria, front office manager of The Times Hotel, and Lorraine DeSantes, the hotel's director…

A: Here discuss about the details of the Arrangement of first meeting agenda and suggestions which are…

Q: Mr. Uno had the following records of his horse races in the current month of 20X1: Туpe of Cost of…

A: On each horse racing ticket, there shall be collected a documentary stamp tax of 10 centavos…

Q: Crescent Company produces stuffed toy animals; one of these is “Arabeau the Cow.” Each Arabeau takes…

A: A budget is a forecast of revenue and expenses for a certain future period of time that is generally…

Q: RY Corporation had a profit margin of 6.25%, a total assets turnover of 1.5, and an equity…

A: Return on equity (ROE): ROE measure the profitability of the organization in relation to the equity.…

Q: 36. The following data relate to direct labor costs for the current period: Standard costs 7,200…

A: Formula: Labor time variance = (Actual hours worked - Standard hours allowed)*Standard rate per hour…

Q: 5) Insert the following account opening balances: Account no. Account name Debit Credit 1-1110…

A: T-accounts are the ledger accounts whereby the transactions recorded in the journal are posted.

Q: Direct Materials Purchases Budget: Direct Labor Budget Crescent Company produces stuffed toy…

A: Budgets are the estimates or forecasts made for future period. Production budget, material cost…

Q: Which of the following is NOT an advantage of the valuation multiple method as compared to the…

A: Valuation multiples are financial assessment tools that compare different organizations by…

Q: Ayna Inc. is an all-equity firm with 400,000 shares outstanding. It has P3,000,000 of EBIT, and…

A: Calculate the earnings per share before recapitalization as follows: Particulars Amount…

Q: The following data pertain to Charlie Company for the year ended December 31, 2018: Accounts Payable…

A: GIVEN The following data pertain to Charlie Company for the year ended December 31, 2018: Accounts…

Q: Reconstruct the account of DTA Corp. for analysis. The available financial data were Gross margin…

A: Operating Income is also known as Income before interest and taxes. It is calculated by deducting…

Q: Blue Company has the following data for the year: $140,000 Beginning inventory Net sales revenue…

A: Cost of goods sold is the actual cost of goods that are being sold to the customers. This is…

Q: Cash Receipts Budget and Accounts Receivable Aging Schedule Shalimar Company manufactures and sells…

A: Following calculations by making table has been done for the required information in the…

Q: Paulis Kennel uses tenant-days as its measure of activity; an animal housed in the kennel for one…

A: Total fixed cost in the flexible budget for 4,580 tenant days will be same as static budget for…

Q: Statement I – In order that a property previously taxed may be claimed as a deduction from the gross…

A: Both the Statements are True.

Q: Wartlow Electric Manufacturing Company introduced lean principles in 2018 and reported a successful…

A: Strategic Goal- Strategic goals are the specific financial and non-financial objectives and…

Q: A building (a Section 1231 asset that is also a Section 1250 asset) was purchased on March 10, Year…

A: Depreciation is an accounting method for dispersing a tangible or physical asset's cost over its…

Q: What is the issue with trying to abolish all property tax? Is property tax mandated by the…

A: The main source of revenue to the government is by the levy of tax on various goods, services,…

Q: To determine the amount of debt a corporation has, the user should examine: O A. Income statement B.…

A: Introduction: Financial statements: 1 ) Income statement 2 ) Cash flows statement 3 ) Balance sheet.

Q: The divisional managers of West plc have requested that the method for calculating bonuses at the…

A: Residual income is that income of the division which remains after deducting income at weighted cost…

Q: Which of the following statements is true of a trial balance? O A. A trial balance is the first step…

A: Trial balance means the statement prepared from ledger account where all debit and credit balance…

Q: Love Company has current assets of P400,000 including inventory of P160,000 and a quick ratio of…

A: Quick assets = Total current assets - Inventory = P400,000 - P160,000 = P240,000

Q: What is the journal entry for," Hire three employees for $3,000 a month?

A: According to accrual concept, transaction is recorded when such transaction takes place and not when…

Q: Entries for Stock Dividends Healthy Life Co. is an HMO for businesses in the Fresno area. The…

A: 1. Journalize the entry to record the declaration of the dividend, capitalizing an amount equal to…

Q: Mocha Company manufactures a single product by a continuous process, involving three production…

A: Process costing is the one in which the costs are allocated to the product in every process of…

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

- Lyon Company shows the following condensed income statement information for the year ended December 31, 2019: Lyon declared dividends of 6,000 on preferred stock and 17,280 on common stock. At the beginning of 2019, 10,000 shares of common stock were outstanding. On May 1, 2019, the company issued 2,000 additional common shares, and on October 31, 2019, it issued a 20% stock dividend on its common stock. The preferred stock is not convertible. Required: 1. Compute the 2019 basic earnings per share. 2. Show the 2019 income statement disclosure of basic earnings per share. 3. Draft a related note to accompany the 2019 financial statements.Cash dividends on the 10 par value common stock of Garrett Company were as follows: The 4th-quarter cash dividend was declared on December 21, 2019, to shareholders of record on December 31, 2019. Payment of the 4th-quarter cash dividend was made on January 18, 2020. In addition, Garrett declared a 5% stock dividend on its 10 par value common stock on December 3, 2019, when there were 300,000 shares issued and outstanding and the market value of the common stock was 20 per share. The shares were issued on December 24, 2019. What was the effect on Garretts shareholders equity accounts as a result of the preceding transactions?Cash Dividends on Common and Preferred Stock Lemon Inc. has the following information regarding its preferred and common stock: Preferred stock, S30 par, 12% cumulative; 300,000 shares authorized; 150,000 shares issued and outstanding Common stock, $2 par; 2,500,000 shares authorized; 1,200,000 shares issued; 1,000,000 outstanding As of December 31, 2019, Lemon was 3 years in arrears on its dividends. During 2020, Lemon declared and paid dividends. As a result, the common stockholders received dividends of $0.45 per share. Required: What was the total amount of dividends declared and paid? What journal entry was made at the date of declaration?

- Preferred Stock Dividends Seashell Corporation has 25,000 shares outstanding of 8%, S10 par value, cumulative preferred stock. In 2017 and 2018, no dividends were declared on preferred stock. In 2019, Seashell had a profitable year and decided to pay dividends to stockholders of both preferred and common stock. Required: If Seashell has $200,000 available for dividends in 2019, how much could it pay to the common stockholders Seashell Corporation has 25,000 shares outstanding of 8%, S10 par value, cumulative preferred stock. In 2017 and 2018, no dividends were declared on preferred stock. In 2019, Seashell had a profitable year and decided to pay dividends to stockholders of both preferred and common stock. Required: If Seashell has S200,000 available for dividends in 2019, how much could it pay to the common stockholdersStatement of Stockholders' Equity At the end of 2019, Stanley Utilities Inc. had the following equity accounts and balances: During 2020, Haley engaged in the following transactions involving its equity accounts: Sold 5,000 shares of common stock for $19 per share. Sold 1.200 shares of 12%, $50 par preferred stock at $75 per share. Declared and paid cash dividends of $22,000. Repurchased 1,000 shares of treasury stock (common) for $24 per share. Sold 300 of the treasury shares for $26 per share. Required: Prepare the journal entries for Transactions a through e. Assume that 2020 net income was $123,700. Prepare a statement of stockholders equity at December 31, 2020.Raun Company had the following equity items as of December 31, 2019: Preferred stock, 9% cumulative, 100 par, convertible Paid-in capital in excess of par value on preferred stock Common stock, 1 stated value Paid-in capital in excess of stated value on common stock| Retained earnings The following additional information about Raun was available for the year ended December 31, 2019: 1. There were 2 million shares of preferred stock authorized, of which 1 million were outstanding. All 1 million shares outstanding were issued on January 2, 2016, for 120 a share. The preferred stock is convertible into common stock on a 1-for-1 basis until December 31, 2025; thereafter, the preferred stock ceases to be convertible and is callable at par value by the company. No preferred stock has been converted into common stock, and there were no dividends in arrears at December 31, 2019. 2. The common stock has been issued at amounts above stated value per share since incorporation in 2002. Of the 5 million shares authorized, 3,580,000 were outstanding at January 1, 2019. The market price of the outstanding common stock has increased slowly but consistently for the last 5 years. 3. Raun has an employee share option plan where certain key employees and officers may purchase shares of common stock at 100% of the marker price at the date of the option grant. All options are exercisable in installments of one-third each year, commencing 1 year after the date of the grant, and expire if not exercised within 4 years of the grant date. On January 1, 2019, options for 70,000 shares were outstanding at prices ranging from 47 to 83 a share. Options for 20,000 shares were exercised at 47 to 79 a share during 2019. During 2019, no options expired and additional options for 15,000 shares were granted at 86 a share. The 65,000 options outstanding at December 31, 2019, were exercisable at 54 to 86 a share; of these, 30,000 were exercisable at that date at prices ranging from 54 to 79 a share. 4. Raun also has an employee share purchase plan whereby the company pays one-half and the employee pays one-half of the market price of the stock at the date of the subscription. During 2019, employees subscribed to 60,000 shares at an average price of 87 a share. All 60,000 shares were paid for and issued late in September 2019. 5. On December 31, 2019, there was a total of 355,000 shares of common stock set aside for the granting of future share options and for future purchases under the employee share purchase plan. The only changes in the shareholders equity for 2019 were those described previously, the 2019 net income, and the cash dividends paid. Required: Prepare the shareholders equity section of Rauns balance sheet at December 31, 2019. Substitute, where appropriate, Xs for unknown dollar amounts. Use good form and provide full disclosure. Write appropriate notes as they should appear in the publisher financial statements.

- Statement of Stockholders' Equity At the end of 2019, Stanley Utilities Inc. had the following equity accounts and balances: During 2020, Stanley Utilities engaged in the following transactions involving its equity accounts: Sold 3,300 shares of common stock for $15 per share. Sold 1,000 shares of 12%, $100 par preferred stock at $105 per share. Declared and paid cash dividends of $8,000. Repurchased 1,000 shares of treasury stock (common) for $38 per share. Sold 400 of the treasury shares for $42 per share. Required: Prepare the journal entries for Transactions a through e. Assume that 2020 net income was $87,000. Prepare a statement of stockholders equity at December 31, 2020.Anoka Company reported the following selected items in the shareholders equity section of its balance sheet on December 31, 2019, and 2020: In addition, it listed the following selected pretax items as a December 31, 2019 and 2020: The preferred shares were outstanding during all of 2019 and 2020; annual dividends were declared and paid in each year. During 2019, 2,000 common shares were sold for cash on October 4. During 2020, a 20% stock dividend was declared and issued in early May. At the end of 2019 and 2020, the common stock was selling for 25.75 and 32.20, respectively. The company is subject to a 30% income tax rate. Required: 1. Prepare the comparative 2019 and 2020 income statements (multiple-step), and the related note that would appear in Anokas 2020 annual report. 2. Next Level Compute the price/earnings ratio for 2020. How does this compare to 2019? Why is it different?Contributed Capital Adams Companys records provide the following information on December 31, 2019: Additional information: 1. Common stock has a 5 par value, 50,000 shares are authorized, 15,000 shares have been issued and are outstanding. 2. Preferred stock has a 100 par value, 3,000 shares are authorized, 800 shares have been issued and are outstanding. Two hundred shares have been subscribed at 120 per share. The stock pays an 8% dividend, is cumulative, and is callable at 130 per share. 3. Bonds payable mature on January 1, 2023. They carry a 12% annual interest rate, payable semiannually. Required: Prepare the Contributed Capital section of the December 31, 2019, balance sheet for Adams. Include appropriate parenthetical notes.

- Stockholders' Equity Terminology A list of terms and a list of definitions or examples are presented below. Make a list of the numbers 1 through 12 and match the letter of the most directly related definition or example with each number Definitions and Examples Capitalizes retained earnings. Shares issued minus treasury shares. Emerson Electric will pay a dividend to all persons holding shares of its common stock on December 15, 2019, even if they just bought the shares and sell them a few days later. The accumulated earnings over the entire life of the corporation that have not been paid out in dividends. Common Stock account balance divided by the number of shares issued. The state of Louisiana set an upper limit of 1,000,000 on the number of shares that Gumps Catch Inc. can issue. Shares that never earn dividends. Any changes to stockholders equity from transactions with no owners. A right to purchase stock at a specified future time and specified price. j. A stock issue that requires no journal entry. k. Shares that may earn guaranteed dividends. 1. On October 15, 2019, General Electric announced its intention to pay a dividend on common stock.On January 1, 2019, Kittson Company had a retained earnings balance of 218,600. It is subject to a 30% corporate income tax rate. During 2019, Kittson earned net income of 67,000, and the following events occurred: 1. Cash dividends of 3 per share on 4,000 shares of common stock were declared and paid. 2. A small stock dividend was declared and issued. The dividend consisted of 600 shares of 10 par common stock. On the date of declaration, the market price of the companys common stock was 36 per share. 3. The company recalled and retired 500 shares of 100 par preferred stock. The call price was 125 per share; the stock had originally been issued for 110 per share. 4. The company discovered that it had erroneously recorded depreciation expense of 45,000 in 2018 for both financial reporting and income tax reporting. The correct depreciation for 2018 should have been 20,000. This is considered a material error. Required: 1. Prepare journal entries to record Items 1 through 4. 2. Prepare Kittsons statement of retained earnings for the year ended December 31, 2019.Stock Dividends Crystal Corporation has the following information regarding its common stock: S10 par. with 500.000 shares authorized, 213,000 shares issued, and 183,700 shares outstanding. On August 22, 2019, Crystal declared and paid a 15% stock dividend when the market price of the common stock was $30 per share. Required: Prepare the journal entries to record declaration and payment of this stock dividend. Prepare the journal entries to record declaration and payment assuming it was a 30% stock dividend.