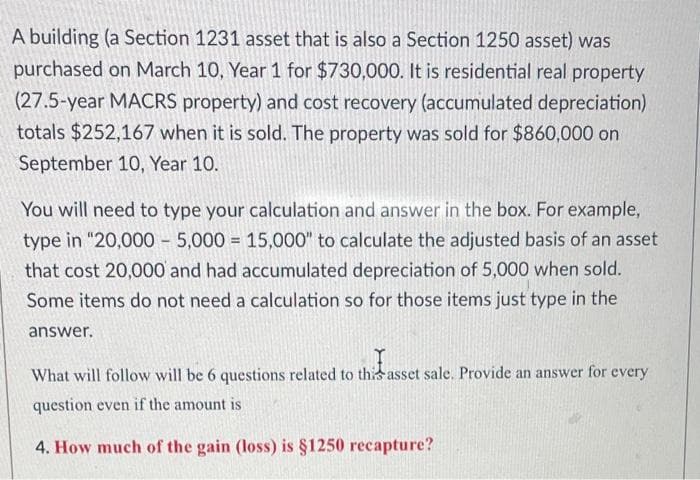

A building (a Section 1231 asset that is also a Section 1250 asset) was purchased on March 10, Year 1 for $730,000. It is residential real property (27.5-year MACRS property) and cost recovery (accumulated depreciation) totals $252,167 when it is sold. The property was sold for $860,000 on September 10, Year 10. You will need to type your calculation and answer in the box. For example, type in "20,000 - 5,000 = 15,000" to calculate the adjusted basis of an asset that cost 20,000 and had accumulated depreciation of 5,000 when sold. Some items do not need a calculation so for those items just type in the answer. What will follow will be 6 questions related to this asset sale. Provide an answer for every question even if the amount is 4. How much of the gain (loss) is §1250 recapture?

A building (a Section 1231 asset that is also a Section 1250 asset) was purchased on March 10, Year 1 for $730,000. It is residential real property (27.5-year MACRS property) and cost recovery (accumulated depreciation) totals $252,167 when it is sold. The property was sold for $860,000 on September 10, Year 10. You will need to type your calculation and answer in the box. For example, type in "20,000 - 5,000 = 15,000" to calculate the adjusted basis of an asset that cost 20,000 and had accumulated depreciation of 5,000 when sold. Some items do not need a calculation so for those items just type in the answer. What will follow will be 6 questions related to this asset sale. Provide an answer for every question even if the amount is 4. How much of the gain (loss) is §1250 recapture?

Chapter11: Long-term Assets

Section: Chapter Questions

Problem 11EB: The following intangible assets were purchased by Hanna Unlimited: A. A patent with a remaining...

Related questions

Question

100%

1

Transcribed Image Text:A building (a Section 1231 asset that is also a Section 1250 asset) was

purchased on March 10, Year 1 for $730,000. It is residential real property

(27.5-year MACRS property) and cost recovery (accumulated depreciation)

totals $252,167 when it is sold. The property was sold for $860,000 on

September 10, Year 10.

You will need to type your calculation and answer in the box. For example,

type in "20,000 – 5,000 = 15,000" to calculate the adjusted basis of an asset

that cost 20,000 and had accumulated depreciation of 5,000 when sold.

Some items do not need a calculation so for those items just type in the

answer.

What will follow will be 6 questions related to this asset sale. Provide an answer for every

question even if the amount is

4. How much of the gain (loss) is §1250 recapture?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT