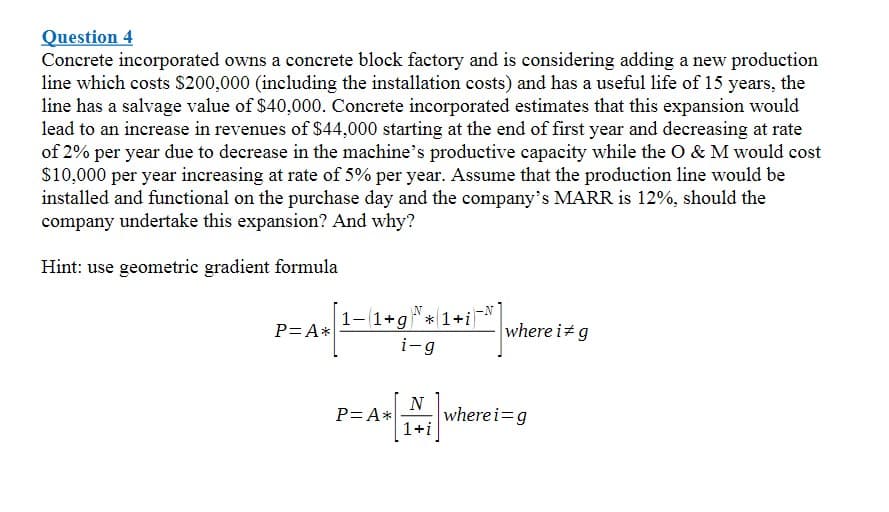

Question 4 Concrete incorporated owns a concrete block factory and is considering adding a new production line which costs $200,000 (including the installation costs) and has a useful life of 15 years, the line has a salvage value of $40,000. Concrete incorporated estimates that this expansion would lead to an increase in revenues of $44,000 starting at the end of first year and decreasing at rate of 2% per year due to decrease in the machine's productive capacity while the O & M would cost $10,000 per year increasing at rate of 5% per year. Assume that the production line would be installed and functional on the purchase day and the company's MARR is 12%, should the company undertake this expansion? And why? Hint: use geometric gradient formula 1-1+g" * 1+i P=A* where i+g i-g N where i=g 1+i P= A*

Question 4 Concrete incorporated owns a concrete block factory and is considering adding a new production line which costs $200,000 (including the installation costs) and has a useful life of 15 years, the line has a salvage value of $40,000. Concrete incorporated estimates that this expansion would lead to an increase in revenues of $44,000 starting at the end of first year and decreasing at rate of 2% per year due to decrease in the machine's productive capacity while the O & M would cost $10,000 per year increasing at rate of 5% per year. Assume that the production line would be installed and functional on the purchase day and the company's MARR is 12%, should the company undertake this expansion? And why? Hint: use geometric gradient formula 1-1+g" * 1+i P=A* where i+g i-g N where i=g 1+i P= A*

Managerial Economics: Applications, Strategies and Tactics (MindTap Course List)

14th Edition

ISBN:9781305506381

Author:James R. McGuigan, R. Charles Moyer, Frederick H.deB. Harris

Publisher:James R. McGuigan, R. Charles Moyer, Frederick H.deB. Harris

Chapter17: Long-term Investment Analysis

Section: Chapter Questions

Problem 2E

Related questions

Question

Transcribed Image Text:Question 4

Concrete incorporated owns a concrete block factory and is considering adding a new production

line which costs $200,000 (including the installation costs) and has a useful life of 15 years, the

line has a salvage value of $40,000. Concrete incorporated estimates that this expansion would

lead to an increase in revenues of $44,000 starting at the end of first year and decreasing at rate

of 2% per year due to decrease in the machine's productive capacity while the O & M would cost

$10,000 per year increasing at rate of 5% per year. Assume that the production line would be

installed and functional on the purchase day and the company's MARR is 12%, should the

company undertake this expansion? And why?

Hint: use geometric gradient formula

1-1+g" * 1+i

-

where i+g

P= A*

i-g

N

P= A wherei=g

1+i

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 3 steps with 3 images

Recommended textbooks for you

Managerial Economics: Applications, Strategies an…

Economics

ISBN:

9781305506381

Author:

James R. McGuigan, R. Charles Moyer, Frederick H.deB. Harris

Publisher:

Cengage Learning

Managerial Economics: Applications, Strategies an…

Economics

ISBN:

9781305506381

Author:

James R. McGuigan, R. Charles Moyer, Frederick H.deB. Harris

Publisher:

Cengage Learning