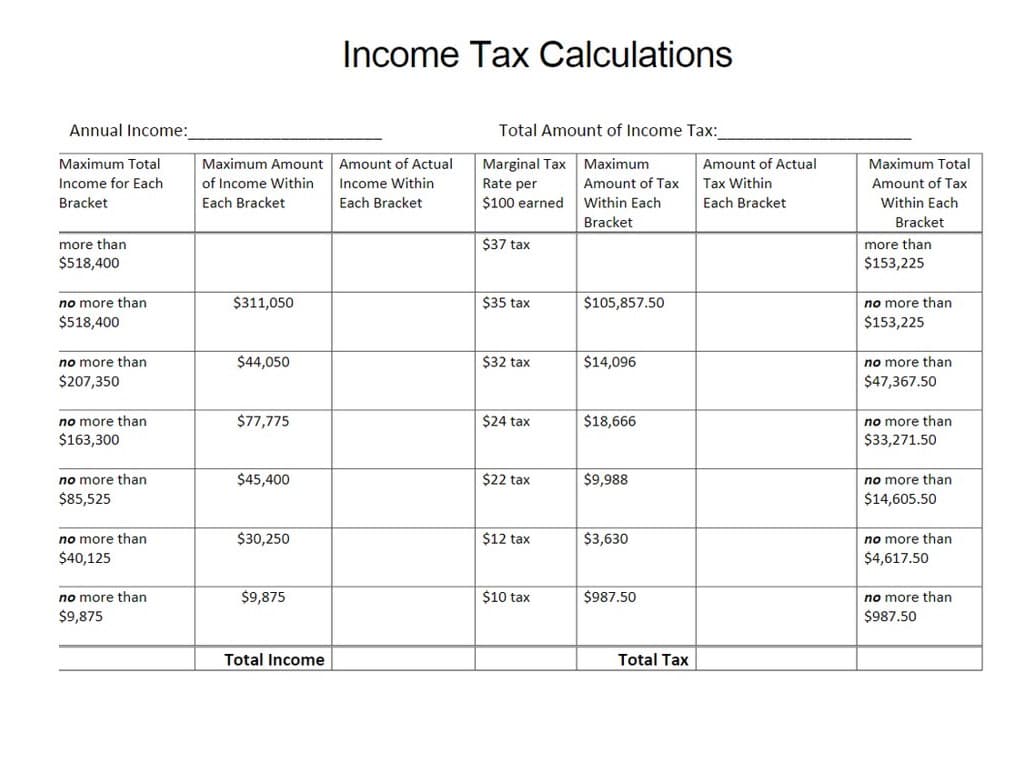

Question 4 Use the following Total Tax / Annual Income relationship to determine which of the following is Beverly's total tax for last year if her income last was $164,000. What total income tax did Beverly pay in income tax. $52,480.00 $33,495.50 $32,800.00

Question 4 Use the following Total Tax / Annual Income relationship to determine which of the following is Beverly's total tax for last year if her income last was $164,000. What total income tax did Beverly pay in income tax. $52,480.00 $33,495.50 $32,800.00

Chapter20: Corporations And Partnerships

Section: Chapter Questions

Problem 6DQ: LO.3, 4, 5 Contrast the income taxation of individuals and C corporations as to: a. Alternative...

Related questions

Question

100%

Question 4

Use the following Total Tax / Annual Income relationship to determine which of the following is Beverly's total tax for last year if her income last was $164,000. What total income tax did Beverly pay in income tax.

$52,480.00

$33,495.50

$32,800.00

Transcribed Image Text:Income Tax Calculations

Annual Income:

Total Amount of Income Tax:

Maximum Total

Maximum Amount Amount of Actual

Marginal Tax

Maximum

Amount of Actual

Maximum Total

Income for Each

of Income Within

Income Within

Rate per

Amount of Tax

Tax Within

Amount of Tax

Bracket

Each Bracket

Each Bracket

$100 earned

Within Each

Each Bracket

Within Each

Bracket

Bracket

more than

$518,400

$37 tax

more than

$153,225

$311,050

$35 tax

$105,857.50

no more than

$153,225

no more than

$518,400

$44,050

$32 tax

$14,096

no more than

$47,367.50

no more than

$207,350

$77,775

$24 tax

$18,666

no more than

$163,300

no more than

$33,271.50

no more than

$45,400

$22 tax

$9,988

no more than

$85,525

$14,605.50

$30,250

$12 tax

$3,630

no more than

$4,617.50

no more than

$40,125

no more than

$9,875

no more than

$987.50

$9,875

$10 tax

$987.50

Total Income

Total Tax

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Pfin (with Mindtap, 1 Term Printed Access Card) (…

Finance

ISBN:

9780357033609

Author:

Randall Billingsley, Lawrence J. Gitman, Michael D. Joehnk

Publisher:

Cengage Learning