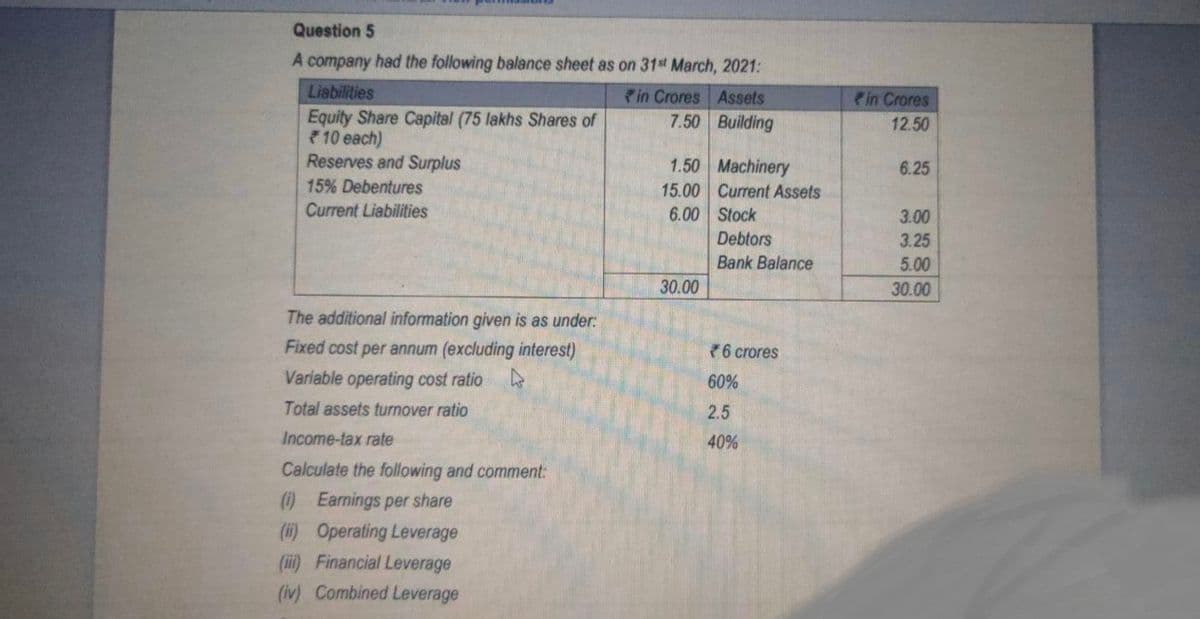

Question 5 A company had the following balance sheet as on 31 March, 2021: Lisbilities Pin Crores Assets 7.50 Building ein Crores Equity Share Capital (75 lakhs Shares of 10 each) Reserves and Surplus 15% Debentures Current Liabilities 12.50 1.50 Machinery 15.00 Current Assets 6.25 6.00 Stock 3.00 Debtors Bank Balance 3.25 5.00 30.00 30.00 The additional information given is as under: Fixed cost per annum (excluding interest) 76 crores Variable operating cost ratio 60% Total assets turnover ratio 2.5 Income-tax rate 40% Calculate the following and comment: ) Earnings per share (#) Operating Leverage (ii) Financial Leverage (iv) Combined Leverage

Question 5 A company had the following balance sheet as on 31 March, 2021: Lisbilities Pin Crores Assets 7.50 Building ein Crores Equity Share Capital (75 lakhs Shares of 10 each) Reserves and Surplus 15% Debentures Current Liabilities 12.50 1.50 Machinery 15.00 Current Assets 6.25 6.00 Stock 3.00 Debtors Bank Balance 3.25 5.00 30.00 30.00 The additional information given is as under: Fixed cost per annum (excluding interest) 76 crores Variable operating cost ratio 60% Total assets turnover ratio 2.5 Income-tax rate 40% Calculate the following and comment: ) Earnings per share (#) Operating Leverage (ii) Financial Leverage (iv) Combined Leverage

Cornerstones of Financial Accounting

4th Edition

ISBN:9781337690881

Author:Jay Rich, Jeff Jones

Publisher:Jay Rich, Jeff Jones

Chapter9: Long-term Liabilities

Section: Chapter Questions

Problem 103.2C

Related questions

Question

Calculate last two sub parts

Transcribed Image Text:Question 5

A company had the following balance sheet as on 31t March, 2021:

Liebilities

in Crores Assets

7.50 Building

in Crores

Equity Share Capital (75 lakhs Shares of

10 each)

Reserves and Surplus

12.50

1.50 Machinery

15.00 Current Assets

6.00 Stock

6.25

15% Debentures

Current Liabilities

3.00

Debtors

3.25

Bank Balance

5.00

30.00

30.00

The additional information given is as under:

Fixed cost per annum (excluding interest)

76 crores

Variable operating cost ratio

60%

Total assets turnover ratio

2.5

Income-tax rate

40%

Calculate the following and comment:

(1) Earnings per share

(i) Operating Leverage

(ii) Financial Leverage

(iv) Combined Leverage

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 3 steps with 3 images

Recommended textbooks for you

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning