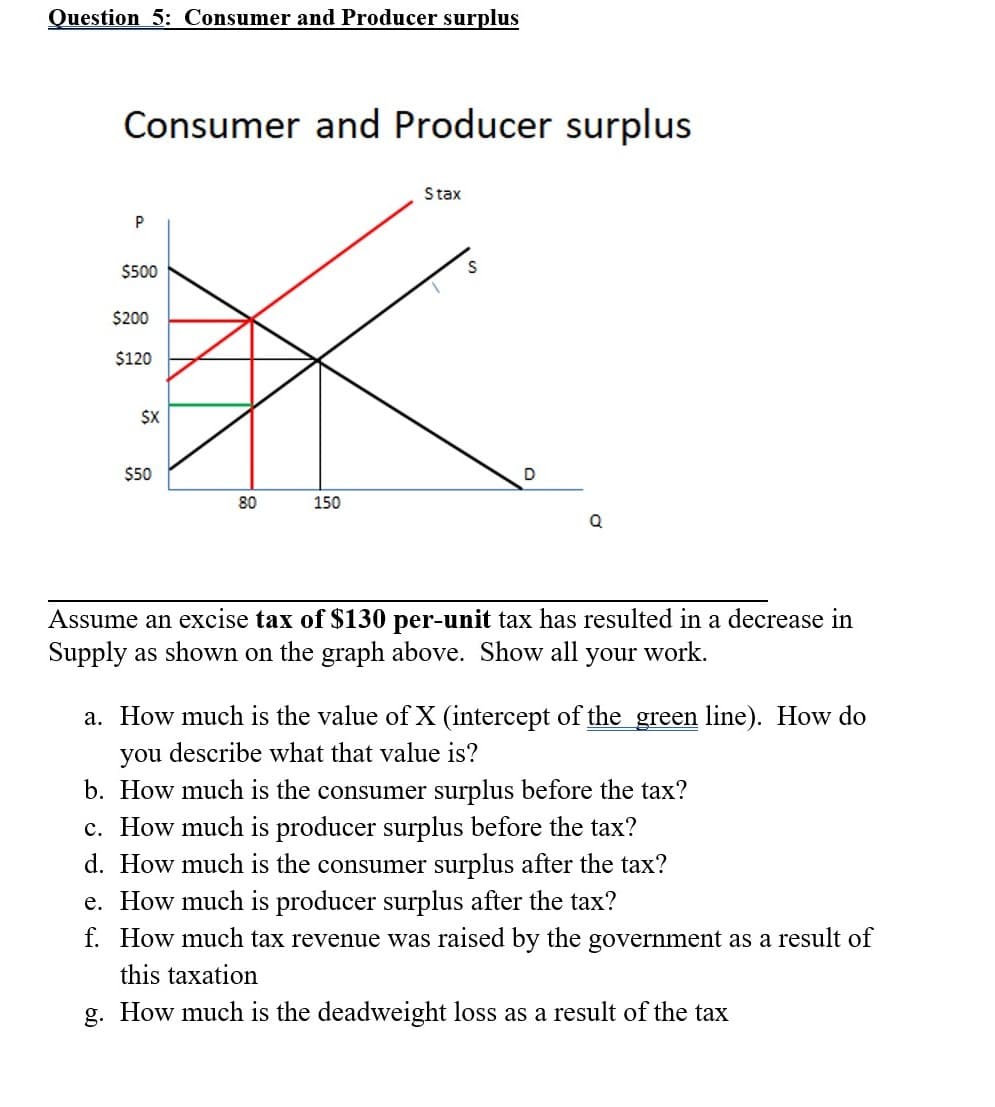

Question 5: Consumer and Producer surplus Consumer and Producer surplus Stax P $500 $200 $120 $X $50 80 150 Q Assume an excise tax of $130 per-unit tax has resulted in a decrease in Supply as shown on the graph above. Show all your work. a. How much is the value of X (intercept of the green line). How do you describe what that value is? b. How much is the consumer surplus before the tax? c. How much is producer surplus before the tax? d. How much is the consumer surplus after the tax? e. How much is producer surplus after the tax? f. How much tax revenue was raised by the government as a result of this taxation g. How much is the deadweight loss as a result of the tax

Question 5: Consumer and Producer surplus Consumer and Producer surplus Stax P $500 $200 $120 $X $50 80 150 Q Assume an excise tax of $130 per-unit tax has resulted in a decrease in Supply as shown on the graph above. Show all your work. a. How much is the value of X (intercept of the green line). How do you describe what that value is? b. How much is the consumer surplus before the tax? c. How much is producer surplus before the tax? d. How much is the consumer surplus after the tax? e. How much is producer surplus after the tax? f. How much tax revenue was raised by the government as a result of this taxation g. How much is the deadweight loss as a result of the tax

Managerial Economics: Applications, Strategies and Tactics (MindTap Course List)

14th Edition

ISBN:9781305506381

Author:James R. McGuigan, R. Charles Moyer, Frederick H.deB. Harris

Publisher:James R. McGuigan, R. Charles Moyer, Frederick H.deB. Harris

Chapter3: Demand Analysis

Section: Chapter Questions

Problem 11E: Federal excise taxes on gasoline vary widely across the developed world. The United States has the...

Related questions

Question

questions d,e,f,g

Transcribed Image Text:Question 5: Consumer and Producer surplus

Consumer and Producer surplus

Stax

P

$500

S

$200

$120

$X

$50

80

150

Q

Assume an excise tax of $130 per-unit tax has resulted in a decrease in

Supply as shown on the graph above. Show all

your

work.

a. How much is the value of X (intercept of the_green line). How do

you describe what that value is?

b. How much is the consumer surplus before the tax?

c. How much is producer surplus before the tax?

d. How much is the consumer surplus after the tax?

e. How much is producer surplus after the tax?

f. How much tax revenue was raised by the government as a result of

this taxation

g. How much is the deadweight loss as a result of the tax

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Recommended textbooks for you

Managerial Economics: Applications, Strategies an…

Economics

ISBN:

9781305506381

Author:

James R. McGuigan, R. Charles Moyer, Frederick H.deB. Harris

Publisher:

Cengage Learning

Principles of Economics (MindTap Course List)

Economics

ISBN:

9781305585126

Author:

N. Gregory Mankiw

Publisher:

Cengage Learning

Essentials of Economics (MindTap Course List)

Economics

ISBN:

9781337091992

Author:

N. Gregory Mankiw

Publisher:

Cengage Learning

Managerial Economics: Applications, Strategies an…

Economics

ISBN:

9781305506381

Author:

James R. McGuigan, R. Charles Moyer, Frederick H.deB. Harris

Publisher:

Cengage Learning

Principles of Economics (MindTap Course List)

Economics

ISBN:

9781305585126

Author:

N. Gregory Mankiw

Publisher:

Cengage Learning

Essentials of Economics (MindTap Course List)

Economics

ISBN:

9781337091992

Author:

N. Gregory Mankiw

Publisher:

Cengage Learning

Principles of Macroeconomics (MindTap Course List)

Economics

ISBN:

9781285165912

Author:

N. Gregory Mankiw

Publisher:

Cengage Learning

Principles of Economics, 7th Edition (MindTap Cou…

Economics

ISBN:

9781285165875

Author:

N. Gregory Mankiw

Publisher:

Cengage Learning

Principles of Microeconomics (MindTap Course List)

Economics

ISBN:

9781305971493

Author:

N. Gregory Mankiw

Publisher:

Cengage Learning