Fuppose the government implements a $5 dollar per unit sales tax. i. Calculate the new quantity and the price paid by the consumer. ii. Calculate the consumer surplus, producer surplus, tax revenue, and deadweight loss. ii. What share of the tax is passed on to the consumer and what share of the tax is passed on to the producer? iv. Graph the taxed equilibrium on a new graph.

Fuppose the government implements a $5 dollar per unit sales tax. i. Calculate the new quantity and the price paid by the consumer. ii. Calculate the consumer surplus, producer surplus, tax revenue, and deadweight loss. ii. What share of the tax is passed on to the consumer and what share of the tax is passed on to the producer? iv. Graph the taxed equilibrium on a new graph.

Microeconomics A Contemporary Intro

10th Edition

ISBN:9781285635101

Author:MCEACHERN

Publisher:MCEACHERN

Chapter16: Public Goods And Public Choice

Section: Chapter Questions

Problem 14PAE

Related questions

Question

Pls answer d,e,f

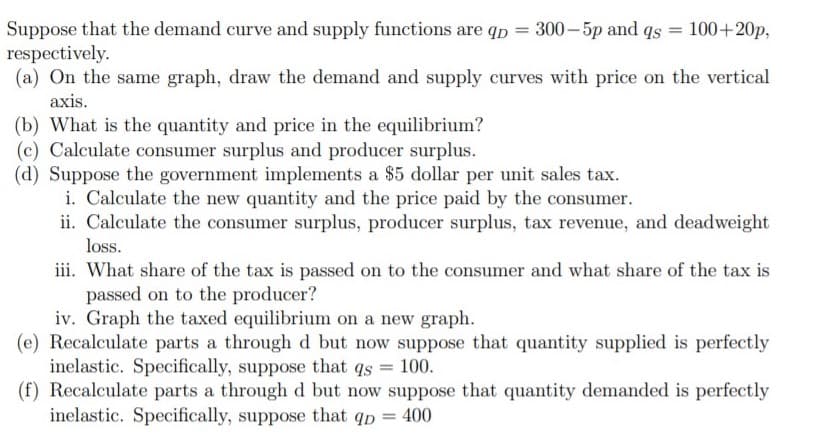

Transcribed Image Text:Suppose that the demand curve and supply functions are qp = 300– 5p and qs = 100+20p,

respectively.

(a) On the same graph, draw the demand and supply curves with price on the vertical

%3D

axis.

(b) What is the quantity and price in the equilibrium?

(c) Calculate consumer surplus and producer surplus.

(d) Suppose the government implements a $5 dollar per unit sales tax.

i. Calculate the new quantity and the price paid by the consumer.

ii. Calculate the consumer surplus, producer surplus, tax revenue, and deadweight

loss.

iii. What share of the tax is passed on to the consumer and what share of the tax is

passed on to the producer?

iv. Graph the taxed equilibrium on a new graph.

(e) Recalculate parts a through d but now suppose that quantity supplied is perfectly

inelastic. Specifically, suppose that qs = 100.

(f) Recalculate parts a through d but now suppose that quantity demanded is perfectly

inelastic. Specifically, suppose that qp = 400

%3D

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 5 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Recommended textbooks for you