QUESTION 5 Nicholas is a sole trader operating as a retailer. He maintains a periodic inventory system. Nicholas had $57,000 of trading stock on hand at 1 July 2021. This trading stock was valued at cost. During the 2022 income year, he purchased $120,000 of trading stock and his sales totalled $190,000. On 30 June 2022, he had $69,000 in trading stock on hand valued at cost. Assuming that Nicholas continues to value his trading stock at cost for tax purposes at the end of the 2022 income year, what is the TOTAL amount that he should include as assessable income for the 2022 income year? (a) $82,000; (b) $178,000; $190,000; $202,000.

QUESTION 5 Nicholas is a sole trader operating as a retailer. He maintains a periodic inventory system. Nicholas had $57,000 of trading stock on hand at 1 July 2021. This trading stock was valued at cost. During the 2022 income year, he purchased $120,000 of trading stock and his sales totalled $190,000. On 30 June 2022, he had $69,000 in trading stock on hand valued at cost. Assuming that Nicholas continues to value his trading stock at cost for tax purposes at the end of the 2022 income year, what is the TOTAL amount that he should include as assessable income for the 2022 income year? (a) $82,000; (b) $178,000; $190,000; $202,000.

Chapter13: Property Transactions: Determination Of Gain Or Loss, Basis Considerations, And Nonta Xable Exchanges

Section: Chapter Questions

Problem 14DQ

Related questions

Question

C.22.

Hi there please help me solve my practice question on

Transcribed Image Text:QUESTION 5

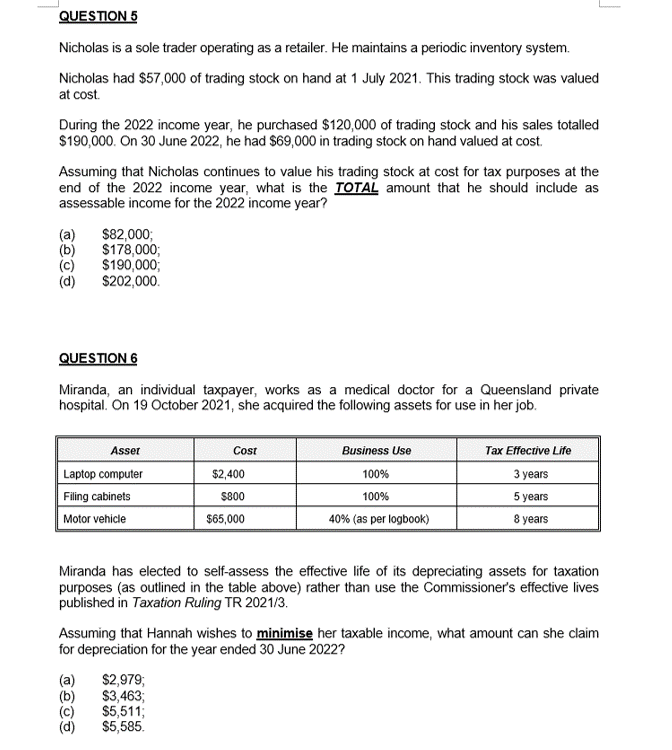

Nicholas is a sole trader operating as a retailer. He maintains a periodic inventory system.

Nicholas had $57,000 of trading stock on hand at 1 July 2021. This trading stock was valued

at cost.

During the 2022 income year, he purchased $120,000 of trading stock and his sales totalled

$190,000. On 30 June 2022, he had $69,000 in trading stock on hand valued at cost.

Assuming that Nicholas continues to value his trading stock at cost for tax purposes at the

end of the 2022 income year, what is the TOTAL amount that he should include as

assessable income for the 2022 income year?

(a) $82,000;

(b)

$178,000;

$190,000;

$202,000.

QUESTION 6

Miranda, an individual taxpayer, works as a medical doctor for a Queensland private

hospital. On 19 October 2021, she acquired the following assets for use in her job.

Asset

Laptop computer

Filing cabinets

Motor vehicle

Cost

$2,400

$800

$65,000

(a) $2,979;

(b)

$3,463;

$5,511;

$5,585.

Business Use

100%

100%

40% (as per logbook)

Tax Effective Life

3 years

5 years

8 years

Miranda has elected to self-assess the effective life of its depreciating assets for taxation

purposes (as outlined in the table above) rather than use the Commissioner's effective lives

published in Taxation Ruling TR 2021/3.

Assuming that Hannah wishes to minimise her taxable income, what amount can she claim

for depreciation for the year ended 30 June 2022?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning