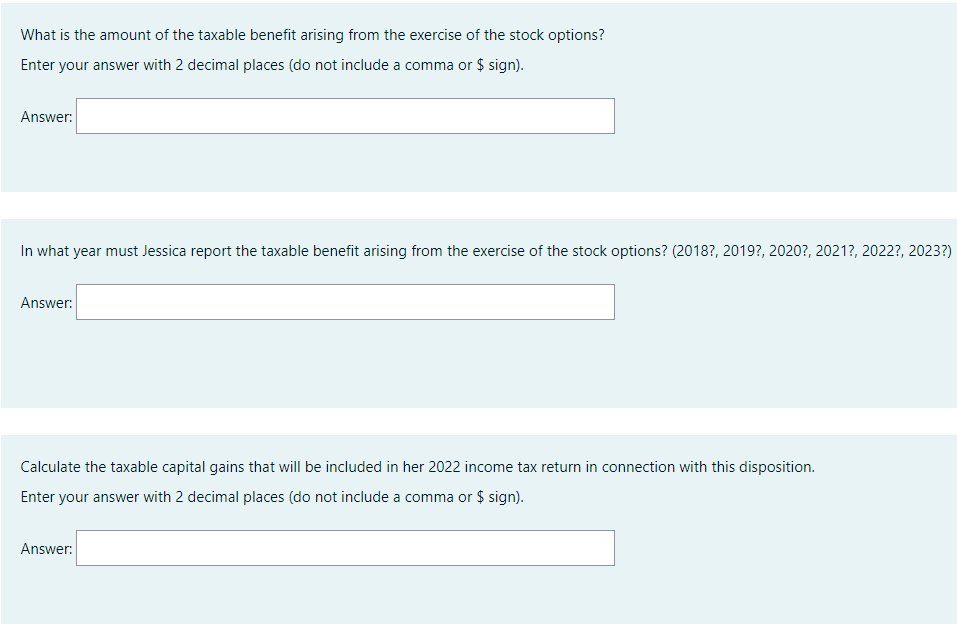

What is the amount of the taxable benefit arising from the exercise of the stock options? Enter your answer with 2 decimal places (do not include a comma or $ sign). Answer: In what year must Jessica report the taxable benefit arising from the exercise of the stock options? (2018?, 2019?, 2020?, 2021?, 2022?, 2023?) Answer: Calculate the taxable capital gains that will be included in her 2022 income tax return in connection with this disposition. Enter your answer with 2 decimal places (do not include a comma or $ sign). Answer:

What is the amount of the taxable benefit arising from the exercise of the stock options? Enter your answer with 2 decimal places (do not include a comma or $ sign). Answer: In what year must Jessica report the taxable benefit arising from the exercise of the stock options? (2018?, 2019?, 2020?, 2021?, 2022?, 2023?) Answer: Calculate the taxable capital gains that will be included in her 2022 income tax return in connection with this disposition. Enter your answer with 2 decimal places (do not include a comma or $ sign). Answer:

Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Chapter15: Contributed Capital

Section: Chapter Questions

Problem 8RE: On January 2, 2019, Brust Corporation grants its new CFO 2,000 restricted share units. Each of the...

Related questions

Question

B.20.

Use the information provided in Photo 1 to complete the 3 questions. I will upvote once all 3 questions are completed.

Transcribed Image Text:What is the amount of the taxable benefit arising from the exercise of the stock options?

Enter your answer with 2 decimal places (do not include a comma or $ sign).

Answer:

In what year must Jessica report the taxable benefit arising from the exercise of the stock options? (2018?, 2019?, 2020?, 2021?, 2022?, 2023?)

Answer:

Calculate the taxable capital gains that will be included in her 2022 income tax return in connection with this disposition.

Enter your answer with 2 decimal places (do not include a comma or $ sign).

Answer:

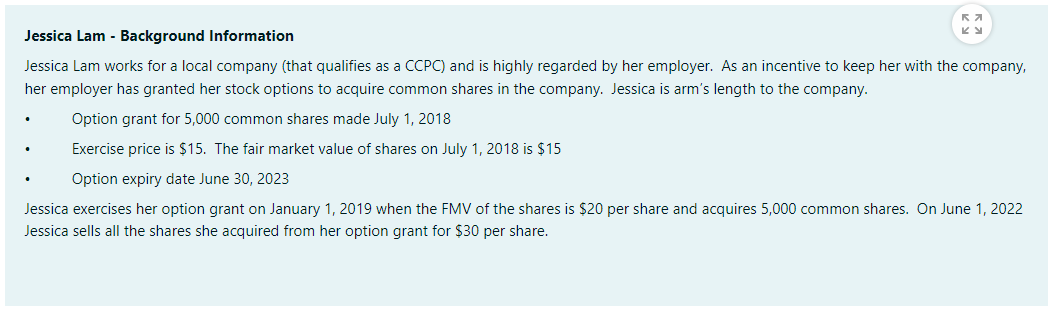

Transcribed Image Text:Jessica Lam - Background Information

Jessica Lam works for a local company (that qualifies as a CCPC) and is highly regarded by her employer. As an incentive to keep her with the company,

her employer has granted her stock options to acquire common shares in the company. Jessica is arm's length to the company.

Option grant for 5,000 common shares made July 1, 2018

Exercise price is $15. The fair market value of shares on July 1, 2018 is $15

Option expiry date June 30, 2023

Jessica exercises her option grant on January 1, 2019 when the FMV of the shares is $20 per share and acquires 5,000 common shares. On June 1, 2022

Jessica sells all the shares she acquired from her option grant for $30 per share.

.

KY

.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT