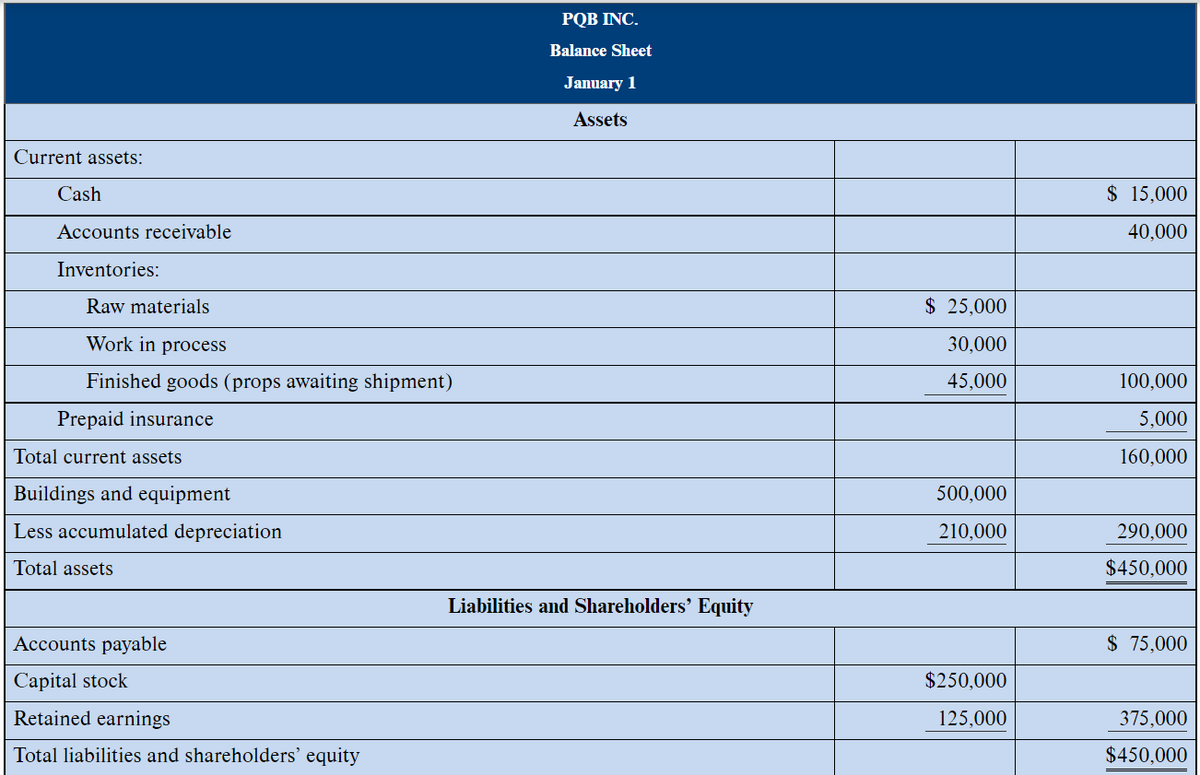

PQB Inc. designs and fabricates movie props such as mock-ups of star fighters and cybernetic robots. The company's balance sheet as of January 1, the beginning of the current year, appears below. Since each prop is a unique design and may require anything from a few hours to a month or more to complete, PQB uses a job-order costing system. Overhead in the fabrication shop is charged to props on the basis of direct labour cost. The company estimated that it would incur $80,000 in manufacturing overhead and $100,000 in direct labour cost during the year. The following transactions were recorded during the year: a. Raw materials, such as wood, paints, and metal sheeting, were purchased on account: $80,000. b. Raw materials were issued to production: $90,000 ($5,000 of this amount was for indirect materials). c. Payroll costs were incurred and paid: direct labour, $120,000; indirect labour, $30,000; and selling and administrative salaries, $75,000. d. Fabrication shop utilities costs were incurred: $12,000. e. Depreciation was recorded for the year: $30,000 ($5,000 on selling and administrative assets; $25,000 on fabrication shop assets). f. Prepaid insurance expired: $4,800 ($4,000 related to fabrication shop operations, and $800 related to selling and administrative activities). g. Shipping expenses were incurred: $40,000. h. Other manufacturing overhead costs were incurred: $17,000 (credit Accounts Payable). i. Manufacturing overhead was applied to production. Overhead is applied on the basis of direct labour cost. j. Movie props that cost $310,000 to produce according to their job cost sheets were completed. k. Sales for the year totalled $450,000 and were all on account. The total cost to produce these movie props was $300,000 according to their job cost sheets. 1. Collections on account from customers totalled $445,000. m. Payments on account to suppliers totalled $150,000.

Process Costing

Process costing is a sort of operation costing which is employed to determine the value of a product at each process or stage of producing process, applicable where goods produced from a series of continuous operations or procedure.

Job Costing

Job costing is adhesive costs of each and every job involved in the production processes. It is an accounting measure. It is a method which determines the cost of specific jobs, which are performed according to the consumer’s specifications. Job costing is possible only in businesses where the production is done as per the customer’s requirement. For example, some customers order to manufacture furniture as per their needs.

ABC Costing

Cost Accounting is a form of managerial accounting that helps the company in assessing the total variable cost so as to compute the cost of production. Cost accounting is generally used by the management so as to ensure better decision-making. In comparison to financial accounting, cost accounting has to follow a set standard ad can be used flexibly by the management as per their needs. The types of Cost Accounting include – Lean Accounting, Standard Costing, Marginal Costing and Activity Based Costing.

Prepare a T-account for each account on the company’s balance sheet, and enter the beginning balances.

Make entries directly into the T-accounts for the transactions given above. Create new T-accounts as needed. Determine an ending balance for each T-account.

Was manufacturing overhead underapplied or overapplied for the year? Assume that the company allocates any overhead balance among the Work in Process, Finished Goods, and Cost of Goods Sold accounts, using the overall balances in each account. Prepare a

Prepare an income statement for the year. (Do not prepare a schedule of cost of goods manufactured; all of the information needed for the income statement is available in the T-accounts.)

Step by step

Solved in 4 steps with 1 images