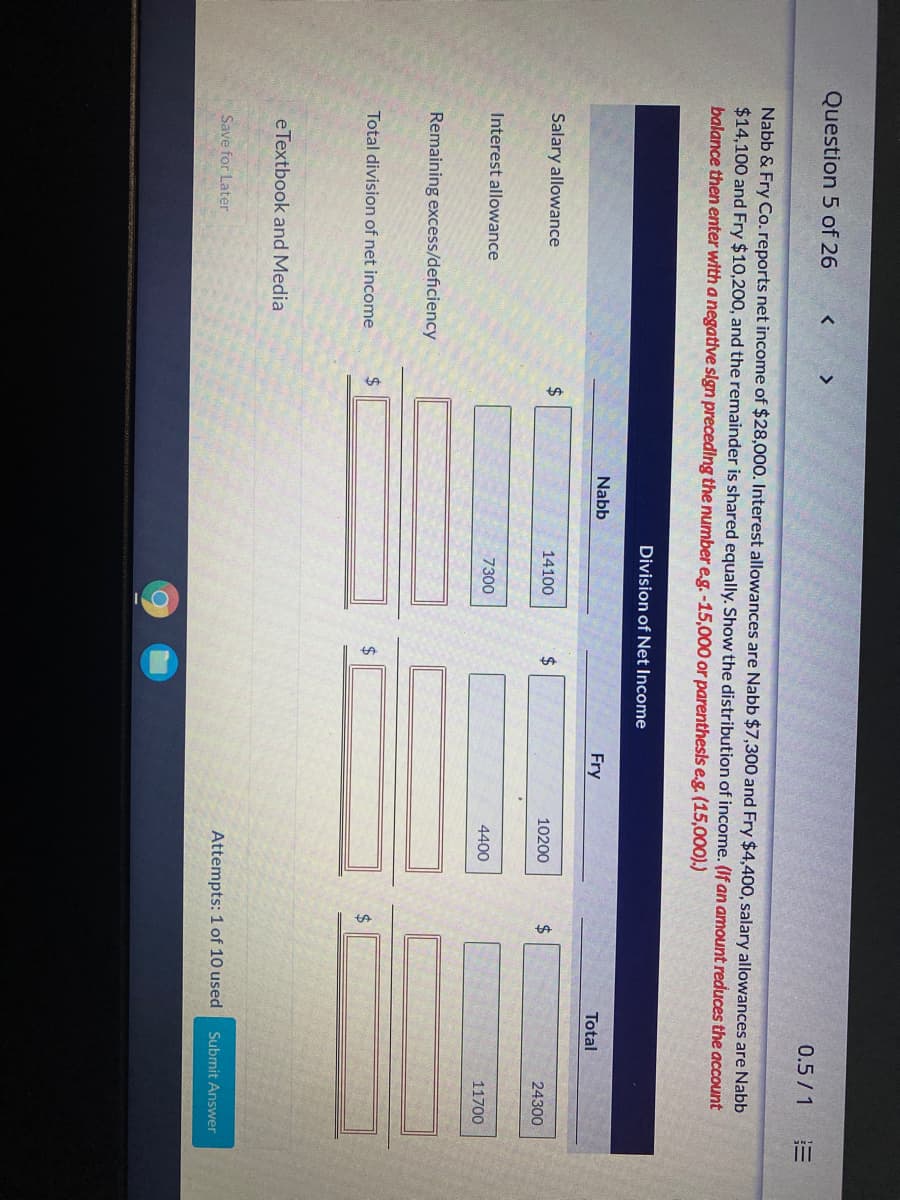

Question 5 of 26 0.5/1 Nabb & Fry Co. reports net income of $28,000. Interest allowances are Nabb $7,300 and Fry $4,400, salary allowances are Nabb $14,100 and Fry $10,200, and the remainder is shared equally. Show the distribution of income. (If an amount reduces the account balance then enter with a negative slgn preceding the number eg. -15,000 or parenthesls e.g. (15,000).) Division of Net Income Nabb Fry Total Salary allowance 24 14100 2$ 10200 $4 24300 Interest allowance 7300 4400 11700 Remaining excess/deficiency Total division of net income %24 %24 24 eTextbook and Media

Question 5 of 26 0.5/1 Nabb & Fry Co. reports net income of $28,000. Interest allowances are Nabb $7,300 and Fry $4,400, salary allowances are Nabb $14,100 and Fry $10,200, and the remainder is shared equally. Show the distribution of income. (If an amount reduces the account balance then enter with a negative slgn preceding the number eg. -15,000 or parenthesls e.g. (15,000).) Division of Net Income Nabb Fry Total Salary allowance 24 14100 2$ 10200 $4 24300 Interest allowance 7300 4400 11700 Remaining excess/deficiency Total division of net income %24 %24 24 eTextbook and Media

Corporate Financial Accounting

14th Edition

ISBN:9781305653535

Author:Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:Carl Warren, James M. Reeve, Jonathan Duchac

Chapter14: Financial Statement Analysis

Section: Chapter Questions

Problem 14.9BE

Related questions

Question

Transcribed Image Text:Question 5 of 26

0.5/ 1

Nabb & Fry Co. reports net income of $28,000. Interest allowances are Nabb $7,300 and Fry $4,400, salary allowances are Nabb

$14,100 and Fry $10,200, and the remainder is shared equally. Show the distribution of income. (If an amount reduces the account

balance then enter with a negative sign preceding the number e.g. -15,000 or parenthesls e.g. (15,000).)

Division of Net Income

Nabb

Fry

Total

Salary allowance

24

14100

2$

10200

2$

24300

Interest allowance

7300

4400

11700

Remaining excess/deficiency

Total division of net income

24

2$

2$

eTextbook and Media

Save for Later

Attempts: 1 of 10 used

Submit Answer

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Corporate Financial Accounting

Accounting

ISBN:

9781305653535

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

Corporate Financial Accounting

Accounting

ISBN:

9781305653535

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,