QUESTION 6 A central bank that desires to reduce the quantity of money will: a. a. Reduce the reserve requirements, reduce the discount rate, and sell the treasury securities in open market. a. Increase the reserve requirements, increase the discount rate, and purchase the treasury securities in open market. b. a. Increase the reserve requirements, reduce the discount rate, and sell the treasury securities in open market. Oc. a. Increase the reserve requirements, increase the discount rate, and sell the treasury securities in open market. Od.

QUESTION 6 A central bank that desires to reduce the quantity of money will: a. a. Reduce the reserve requirements, reduce the discount rate, and sell the treasury securities in open market. a. Increase the reserve requirements, increase the discount rate, and purchase the treasury securities in open market. b. a. Increase the reserve requirements, reduce the discount rate, and sell the treasury securities in open market. Oc. a. Increase the reserve requirements, increase the discount rate, and sell the treasury securities in open market. Od.

Chapter14: Banking And The Money Supply

Section: Chapter Questions

Problem 3.4P

Related questions

Question

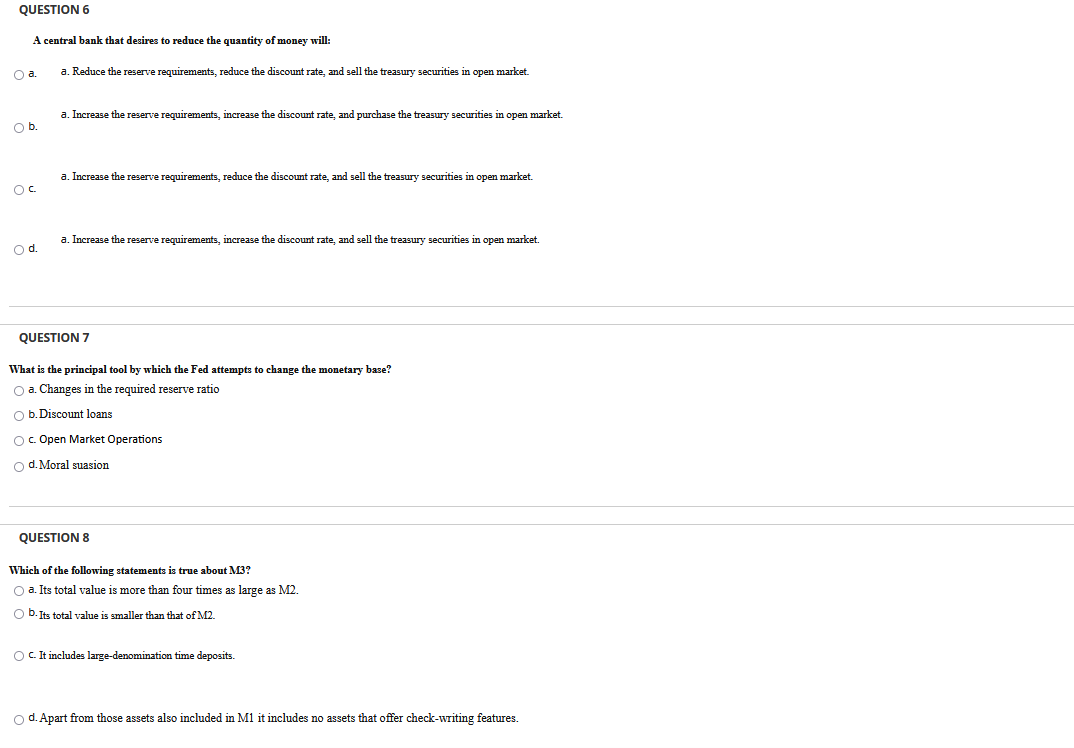

Transcribed Image Text:QUESTION 6

A central bank that desires to reduce the quantity of money will:

Oa.

a. Reduce the reserve requirements, reduce the discount rate, and sell the treasury securities in open market.

a. Increase the reserve requirements, increase the discount rate, and purchase the treasury securities in open market.

Ob.

a. Increase the reserve requirements, reduce the discount rate, and sell the treasury securities in open market.

Oc.

Increase the reserve requirements, increase the discount rate, and sell the treasury securities in open market.

Od.

QUESTION 7

What is the principal tool by which the Fed attempts to change the monetary base?

O a. Changes in the required reserve ratio

O b.Discount loans

O. Open Market Operations

o d. Moral suasion

QUESTION 8

Which of the following statements is true about M3?

O a. Its total value

more than four times as large as M2.

O b. Its total value is smaller than that of M2.

O C. It includes large-denomination time deposits.

o d. Apart from those assets also included in M1 it includes no assets that offer check-writing features.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Recommended textbooks for you

Brief Principles of Macroeconomics (MindTap Cours…

Economics

ISBN:

9781337091985

Author:

N. Gregory Mankiw

Publisher:

Cengage Learning

Principles of Economics (MindTap Course List)

Economics

ISBN:

9781305585126

Author:

N. Gregory Mankiw

Publisher:

Cengage Learning

Brief Principles of Macroeconomics (MindTap Cours…

Economics

ISBN:

9781337091985

Author:

N. Gregory Mankiw

Publisher:

Cengage Learning

Principles of Economics (MindTap Course List)

Economics

ISBN:

9781305585126

Author:

N. Gregory Mankiw

Publisher:

Cengage Learning

Principles of Macroeconomics (MindTap Course List)

Economics

ISBN:

9781305971509

Author:

N. Gregory Mankiw

Publisher:

Cengage Learning

Essentials of Economics (MindTap Course List)

Economics

ISBN:

9781337091992

Author:

N. Gregory Mankiw

Publisher:

Cengage Learning

Principles of Economics 2e

Economics

ISBN:

9781947172364

Author:

Steven A. Greenlaw; David Shapiro

Publisher:

OpenStax